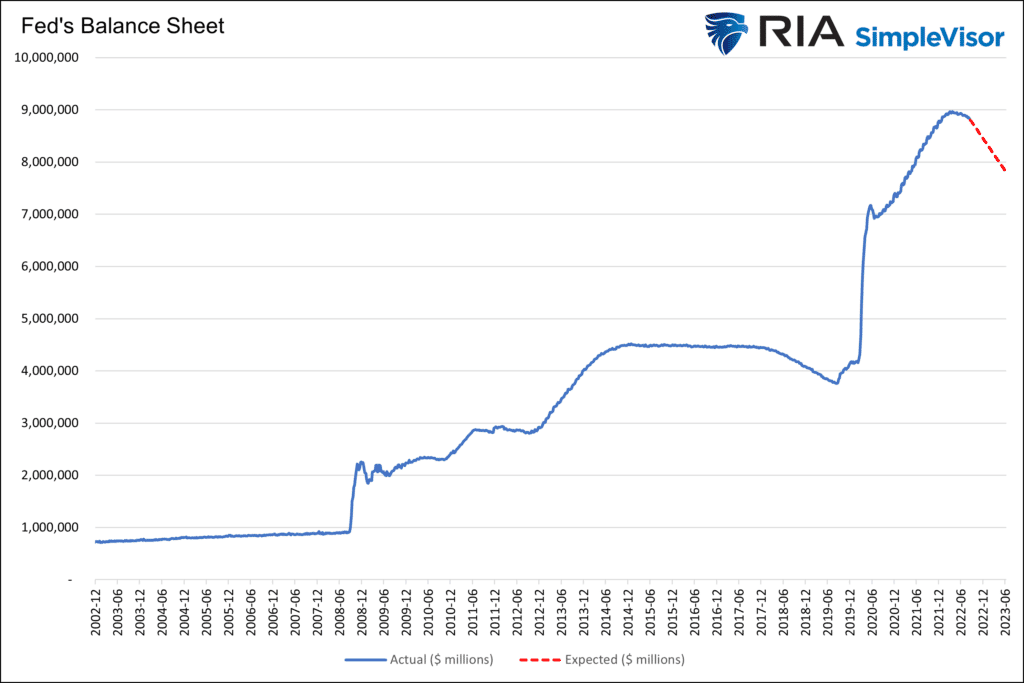

The Federal Reserve’s balance sheet unwind, aka Quantitative Tightening (QT), ramps up today to 95 billion a month. The plan is to allow 60 billion in U.S. Treasury bonds and 35 billion of mortgages to mature monthly. The Fed may let additional Treasury Bills mature to reach their 95 billion goal, if there are not enough mortgages maturing or paying down in a given month. With the step up in QT comes reduced liquidity for the banking system and financial markets.

The 2018 episode of QT taught us that liquidity dries up over time, and the effects take a while to be felt. The more illiquid markets and market participants that heavily rely on leverage will feel the impact first. Given the 95 billion monthly pace of QT is almost double the rate of 2018, the adverse liquidity effects may occur sooner this time. Below we provide a summary of an important white paper on QT presented at the Jackson Hole Conference.

What To Watch Today

Economy

- 7:00 a.m. ET: MBA Mortgage Applications, the week ended August 26 (-1.2% prior)

- 8:15 a.m. ET: ADP Employment Change, August (300,000 expected)

- 9:45 a.m. ET: MNI Chicago PMI, August (52.5 expected, 52.1 prior)

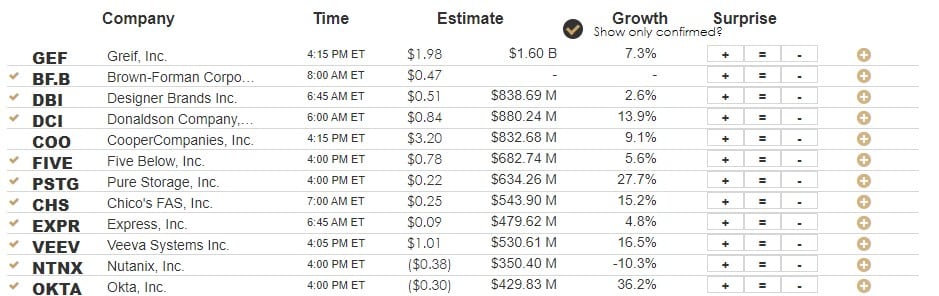

Earnings

Market Trading Update

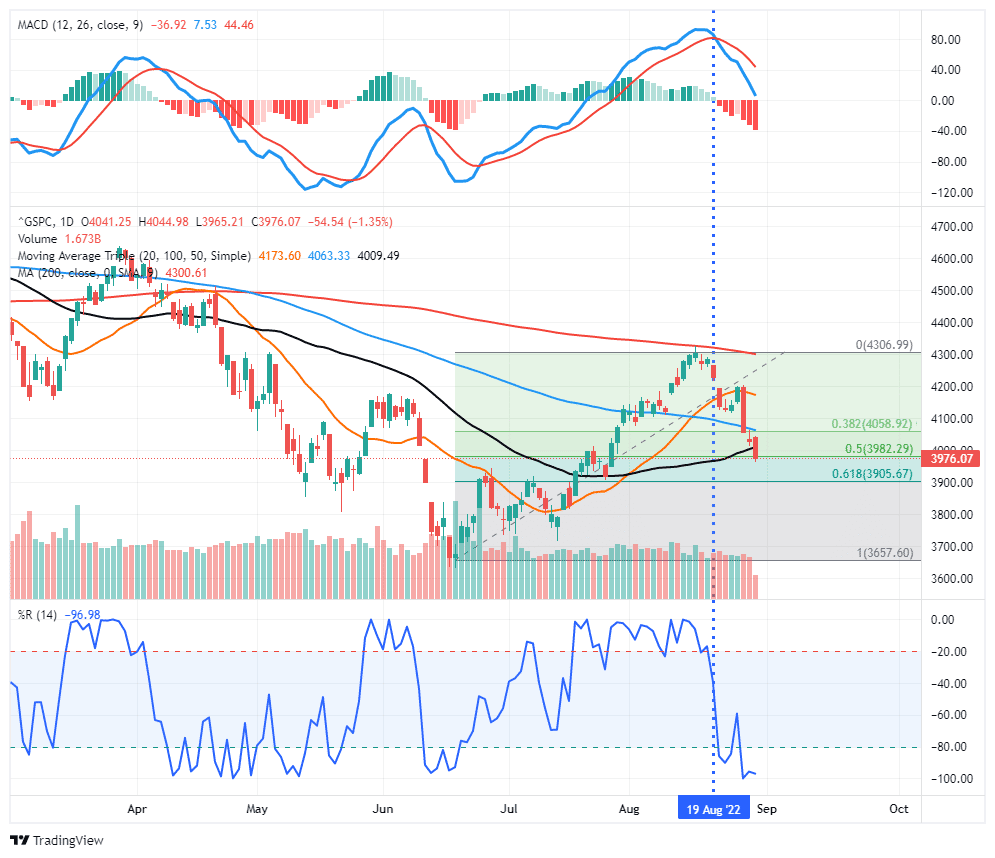

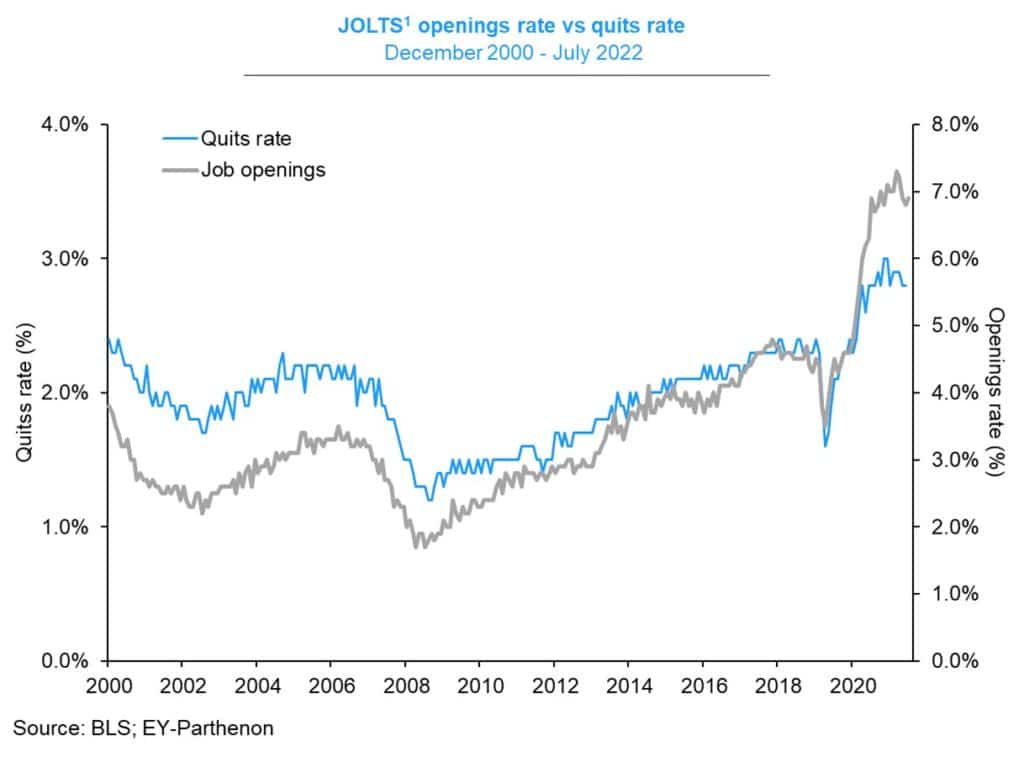

While the market tried to rally out of the gate yesterday morning, the JOLTS report sent sellers into panic mode as the strong report gives more room for the Federal Reserve to continue its aggressive rate hiking campaign. Unfortunately, as noted recently, the market needed to hold the 50-dma to avoid retesting the lows. Such was not to be with the market breaking that critical support.

With that break, the market completed a 50% retracement of the advance. However, with the MACD sell signal becoming more entrenched, it is unlikely that much will stop the market from retesting lows soon. Such doesn’t mean we won’t have some rally attempts. We will, and those rallies should be sold into and risk rebalanced in portfolios accordingly.

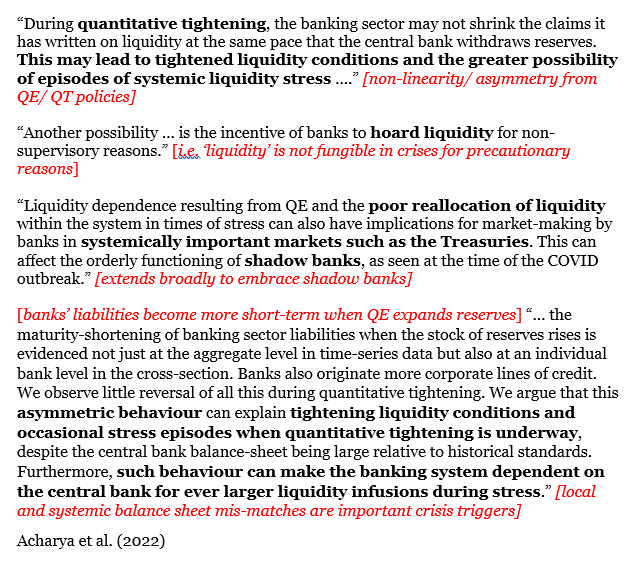

Getting Wonky on QT

As the Fed increases QT to 95 billion a month, it’s worth getting a little wonky, so we can better appreciate how QT can negatively impact liquidity. To help us, we share a 58-page Fed white paper by Viral V. Acharya on the topic of QT and liquidity presented at the recent Jackson Hole Conference. Cross Border Capital does a great job of highlighting a few of the paper’s key points. We summarize and simplify them below the graphic.

- Point 1– Banks may use the excess liquidity during QE to make loans, including those like margin debt used for speculative purposes. During QT, however, they may not reduce their loan book, thus effectively reducing net liquidity available to others.

- Point 2– Banks, understanding that liquidity is declining, may “hoard” excess liquidity. Such actions reduce system-wide liquidity.

- Point 3– Liquidity is allocated poorly during QE. When removed, it can have unequal stress on Treasury markets, where banks rely heavily on liquidity to maintain balanced two-way flows.

- Point 4– During QE, banks tend to loan money for shorter time periods. This can be for speculative purposes and short-term loans. In many cases, the short loans need to roll over once they mature. With QT draining liquidity, stress can occur as the borrowers may struggle to borrow to pay off the original loans. Such can result in the forced liquidation of assets to repay the original loan.

The “Rule of 20” Argues the Bear Is Not Yet Hibernating

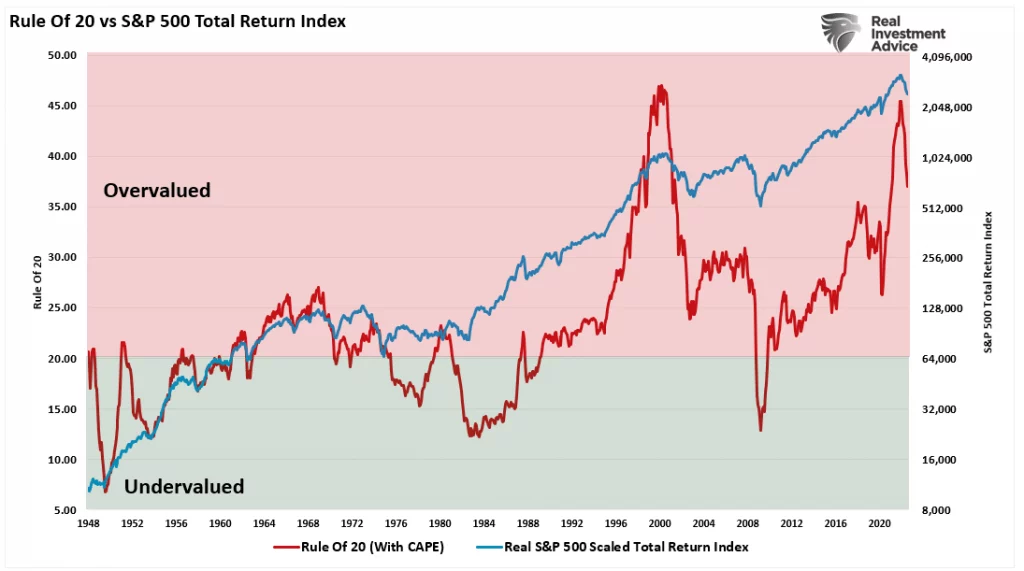

Lance Roberts wrote The Rule of 20 and Why the Bear Market Remains yesterday. In the article, he explains that one “fair value” measure for the S&P 500 is attained when the P/E ratio and inflation rate equal 20. The graph below shows this valuation tool currently sits around 35, or a 75% premium to “fair value.” The measure is still about 20% overvalued even if inflation drops to zero. Lance suggests the market is more than “fully priced.” To wit:

The rule peaked at the 2nd highest level in history earlier this year. Such levels suggest the market is more than “fully priced.” Regardless of what definition you choose to use.

JOLTS Points to Continued Tightness in the Labor Markets

The JOLTS index of job openings unexpectedly rose to 11.24 million from 11 million last month, and estimates of 10.4 million. The report suggests the labor market remains hot. Powell made it clear the Fed is concerned about a price-wage spiral. Strong labor markets will certainly encourage employees to ask for raises or quit their jobs to seek higher-paying jobs. The graph below shows job openings, and the quits rate remains well above historical norms.

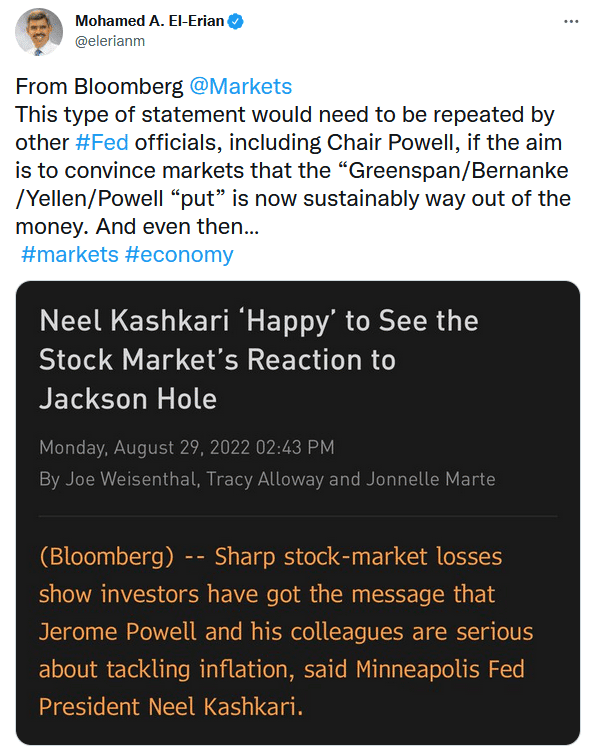

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.