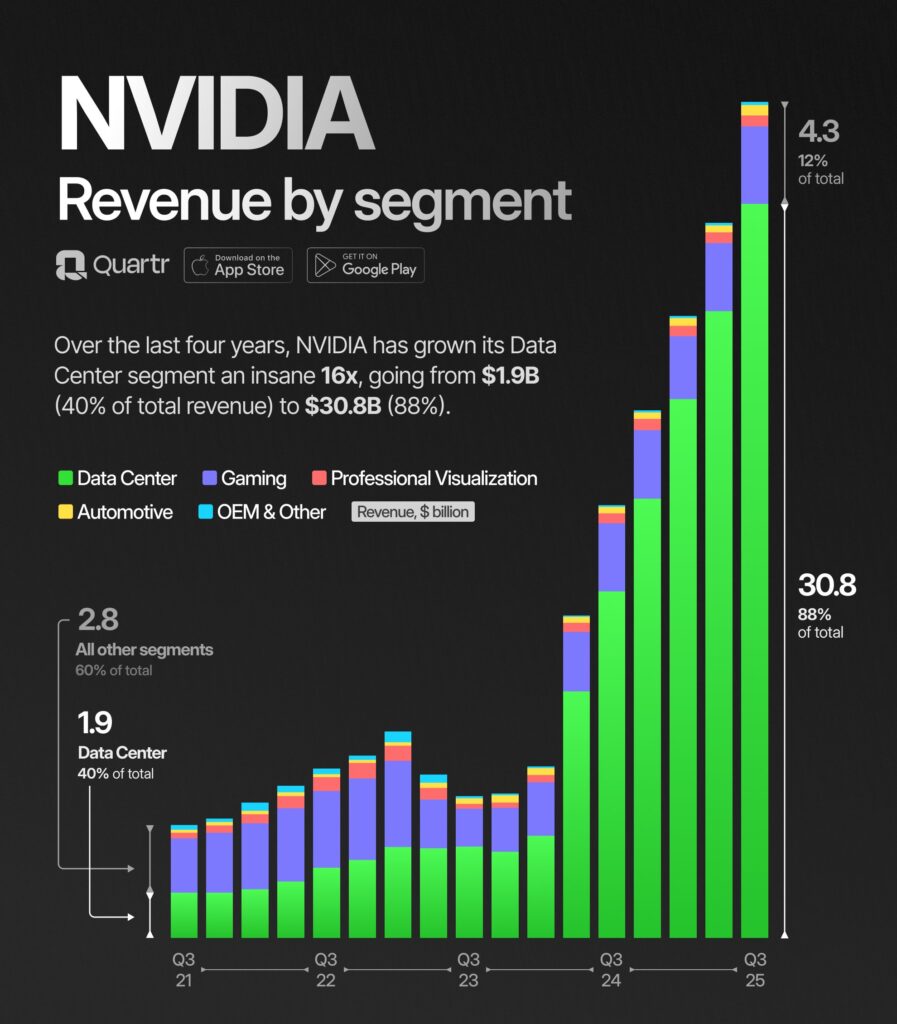

Wall Street’s poster child for AI is Nvidia. With an overwhelming market share in AI chip design, Nvidia is up over 200% year to date and a whopping 2680% over the last five years. Driving the price surge are incredible earnings, revenue growth, massive profit margins, and promising outlooks. Since 2020, Nvidia’s sales have increased 600%, and its earnings have grown tenfold. On Wednesday night, Nvidia reminded investors why it is Wall Street’s AI king. For example, its net income this past quarter is more than its revenue from the same quarter a year ago. Revenue has grown by about 100% over the last year, about five times the rate of META, AMD, MSFT, and GOOG. The graph below shows AI data center revenue is solely responsible for its monstrous growth.

Despite handily beating the market’s earnings expectations and guiding forecasts higher for next year, post-earnings trading in shares of Nvidia was lackluster. Nvidia appears to be fairly priced for analysts’ growth expectations. Its PEG ratio, normalizing P/E for expected growth, is 1.93, higher than the S&P 500 (1.55). For Nvidia shares to continue on their meteoric run, it must maintain its market share and high margins while the demand for its chips continues to beat expectations. That is a tall order, but thus far, Nvidia has delivered.

What To Watch Today

Earnings

- No notable earnings reports today

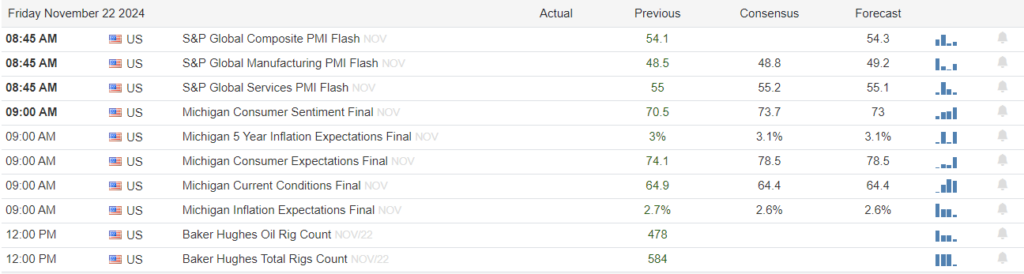

Economy

Market Trading Update

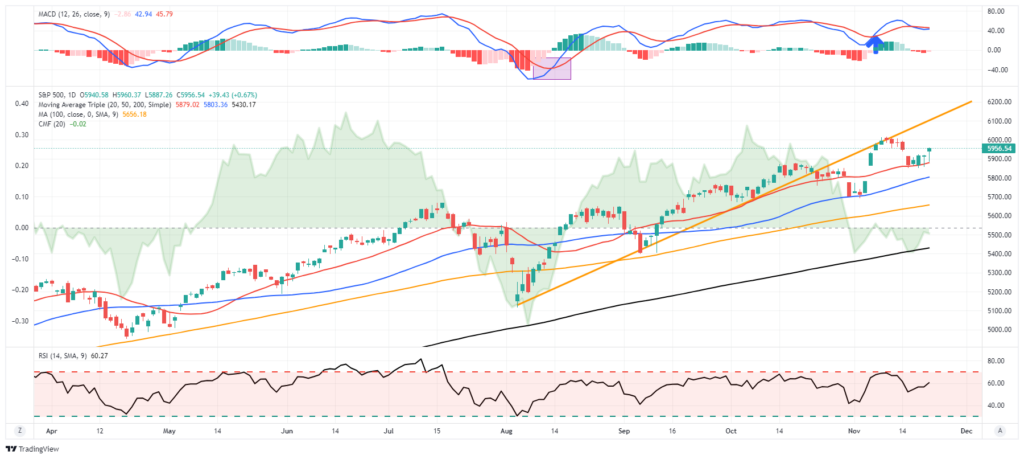

Yesterday, we touched on the Nasdaq, which has been trading weak as of late, along with the S&P 500. As we wrap up the trading week, we look forward to a holiday-shorted week with the market closed on Thursday for Thanksgiving, and open a half-day on Friday. As such, trading volume with lighten up considerably next week, leaving the “inmates to run the asylum.”

As we discussed with the Nasdaq, the S&P 500 has done a good job of holding support at the 20-DMA and has rallied off of that level several times. If the market can string together some positive gains and get momentum moving again a rally to the broken trend line from August is likely.

The good news is that we just past the normal “weak” period for the market in November. While not lalways the case, on average, the market trends to trade better the week before and after the Thanksgiving holiday. If that turns out to be the case again this year, a retest of recent highs at 6000 seems likely.

While remain bullishly biased to the market currently, as trading action remains promising with intra-day selloffs being met with buyers, we remain aware of the risk of a market downturn. As such, investors may want to consider several strategies:

- Use Stop-Loss Orders: To manage downside risk, consider using stop-loss orders.

- Increase Equity Exposure: Large-cap stocks historically perform well during this period. You could consider increasing exposure to diversified index funds or sector ETFs that align with historical trends.

- Review Portfolio Risk: While the MACD buy signal is a positive indicator, you should assess your portfolio’s risk tolerance and ensure it aligns with your long-term goals.

- Rebalance Allocations: Now may be a good time to rebalance by reducing positions in riskier assets or diversifying across asset classes.

If you are underweight equities, consider minor pullbacks and consolidations to add exposure as needed to bring portfolios to target weights. Pullbacks will likely be shallow, but being ready to deploy capital will be beneficial. Once we pass the inauguration, we can assess what policies will likely be enacted and adjust portfolios accordingly.

While there is no reason to be bearish, this does not mean you should abandon risk management..

Oil Is Standing On Thin Ice

In trading, the more times a support or resistance level is tested, the stronger that level becomes. This is because each time the price reaches that level and is rejected, it becomes more difficult for the price to break through that level. The more times a level is tested, the stronger it becomes. -Quora

With that technical trading rule in mind, let’s look at the graph of crude oil below. The price of crude oil has bounced off the horizontal line ($66) six times in the last three years. Before the line provided support, it acted as resistance. Furthermore, since peaking in 2022, oil prices have formed a downward trending resistance line that has been hit five times, as shown with the yellow circles. The wedge pattern forming is often bearish, so a decided break of $66 could foretell a decent decline in oil prices. Contrarily, an increase above the downward trending line could be very bullish.

Oil is a critical macroeconomic indicator. For starters, our economy runs on oil, so oil prices tell us a lot about the economy’s health. Moreover, the economy relies heavily on debt, so one can also say the economy runs on interest rates. Inflation and oil prices often correlate strongly. Therefore, oil and interest rates have a strong relationship. Considering the importance of oil prices, the graph should be followed closely by all investors for a break higher or lower.

Is Bitcoin Also On Thin Ice

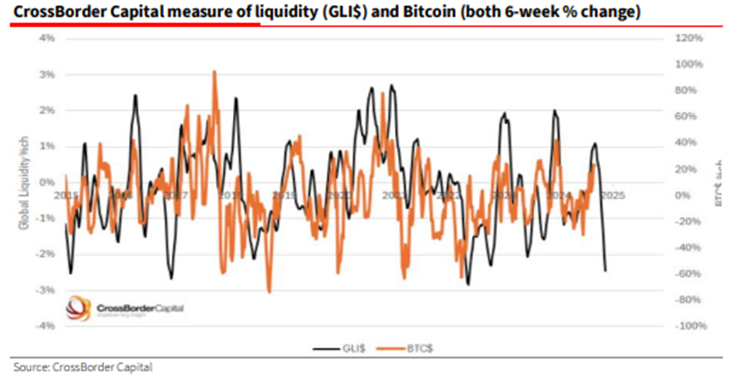

Liquidity drives asset prices. Notably, the correlation between liquidity and the most speculative assets tends to be the highest. The graph below, courtesy of CrossBorder Capital, shows that the six-week change in liquidity and Bitcoin tend to be well correlated.

Liquidity has fallen sharply over the last six weeks, which helps explain some recent weakness in stocks and gold prices. However, bitcoin has continued higher. With bitcoin prices technically extended and liquidity dropping, bitcoin investors should be mindful that, like oil, bitcoin’s price may be on thin ice.

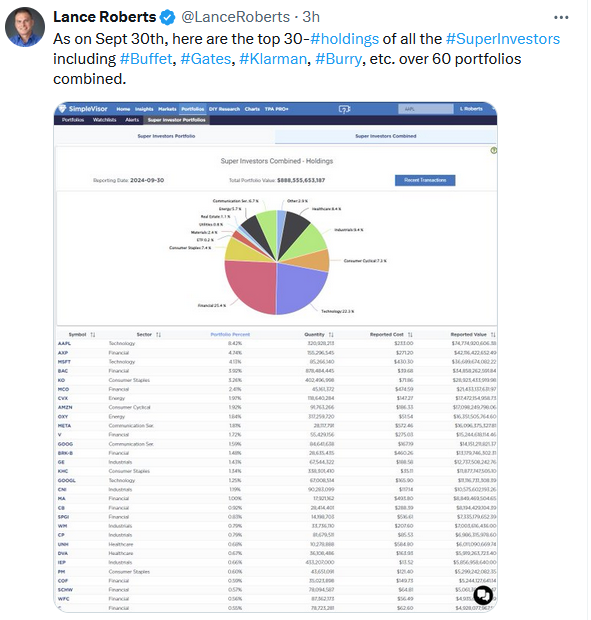

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.