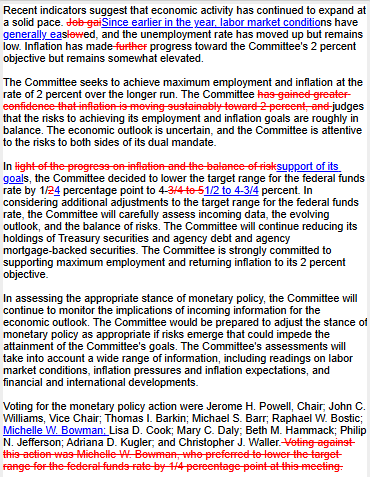

As expected yesterday, the Fed cut the Fed Funds rate. With the expected 25bps rate cut, the new range for Fed Funds is 4.50-4.75%. The redlined second paragraph below, regarding inflation, is the only meaningful change to the FOMC statement. We think the Fed made the change to present a more hawkish stance. Furthermore, it may help combat the skittish bond market and stress its vigilance in fighting inflation. Also of note, this decision was unanimous, unlike the 50bps cut in September, which had one dissenting voter.

The following points are from Jerome Powell’s press conference:

- He believes the recent rate increase has less to do with inflation and more with increased expected economic growth under Donald Trump.

- “We remain on a path to a more neutral stance.” Powell believes the Fed will continue to reduce rates, but the pace and terminal rate will be data-dependent. He reiterated that thought multiple times. We believe he is leaving the door open for anything from no rate cut to 50bps at the December meeting.

- Powell said the statement about inflation highlighted in the first paragraph is meant to show that the Fed remains flexible in bringing inflation to target. Again, it appears Powell doesn’t want the market to think the Fed is on a predictable set course to get rates back to neutral.

- “We don’t comment on fiscal policy.” But, Powell said the Fed thinks a lot about how fiscal policy and deficits affect the economy and inflation.

- The Fed is not overly concerned by the recent increase in rates. They focus more on “persistent changes to financial conditions.”

As an aside, Donald Trump has said he will allow Jerome Powell to finish his term, which expires in May 2026.

What To Watch Today

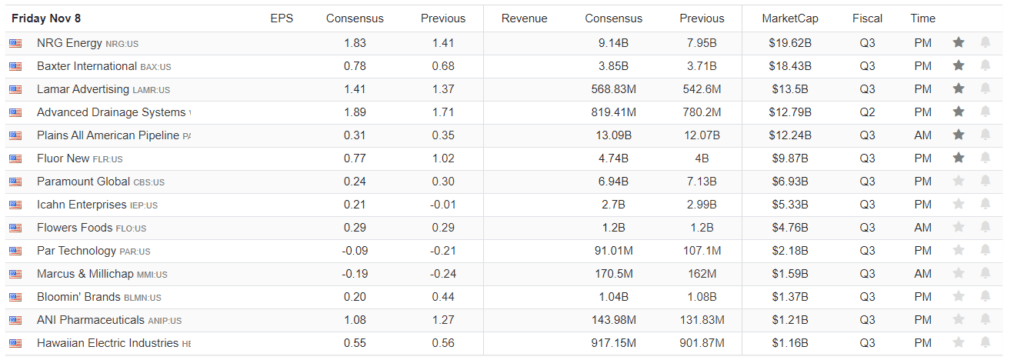

Earnings

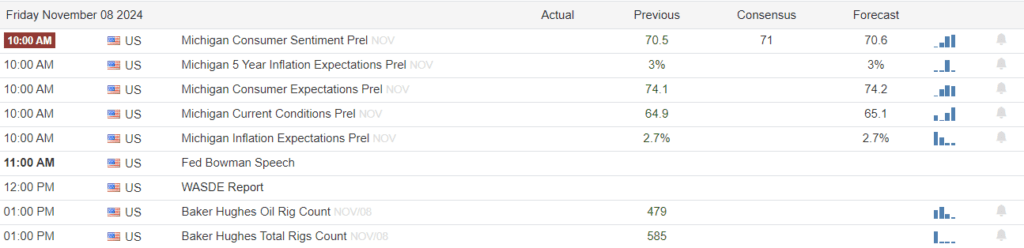

Economy

Market Trading Update

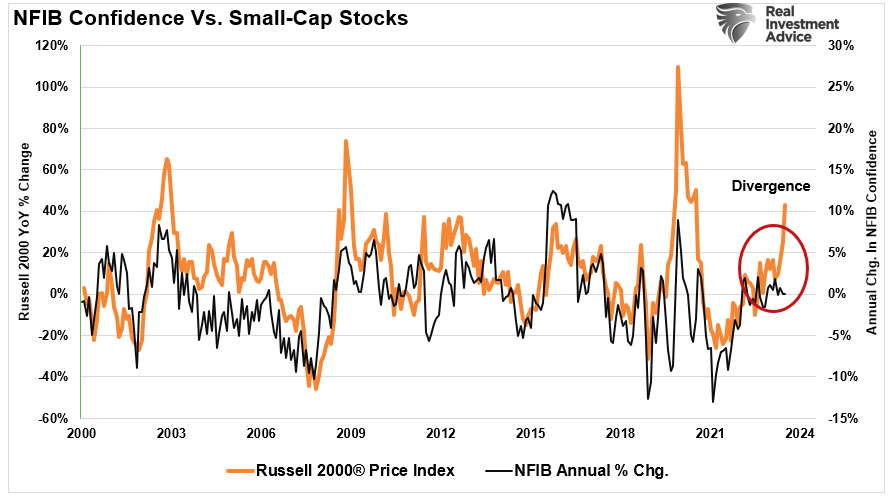

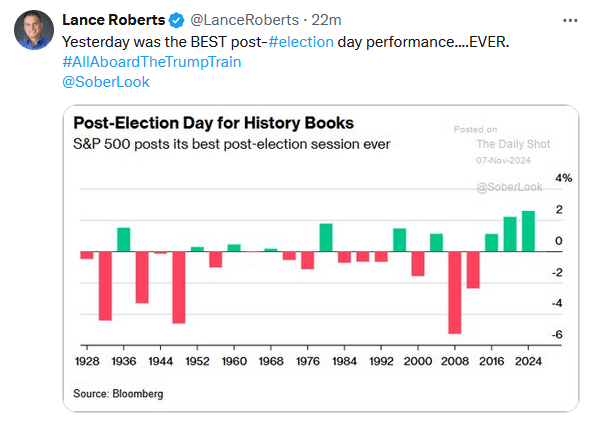

Yesterday, we discussed the massive surge in the markets following the election of President Trump. Notably, the massive surge in small/mid-cap stocks was the most compelling. As shown in the chart below, there is a very high correlation between small/mid-cap stocks’ annual rate of change and the NFIB small business confidence index. Given that business owners typically lean conservative, favoring policies that promote economic growth, reduced regulations, and tax cuts, the election yesterday is supportive of business owners.

We suspect that the next iteration of the NFIB index will be a catchup move, fueled by an explosion of business owners’ confidence. This should lead to increases in CapEx spending, employment, and wage growth.

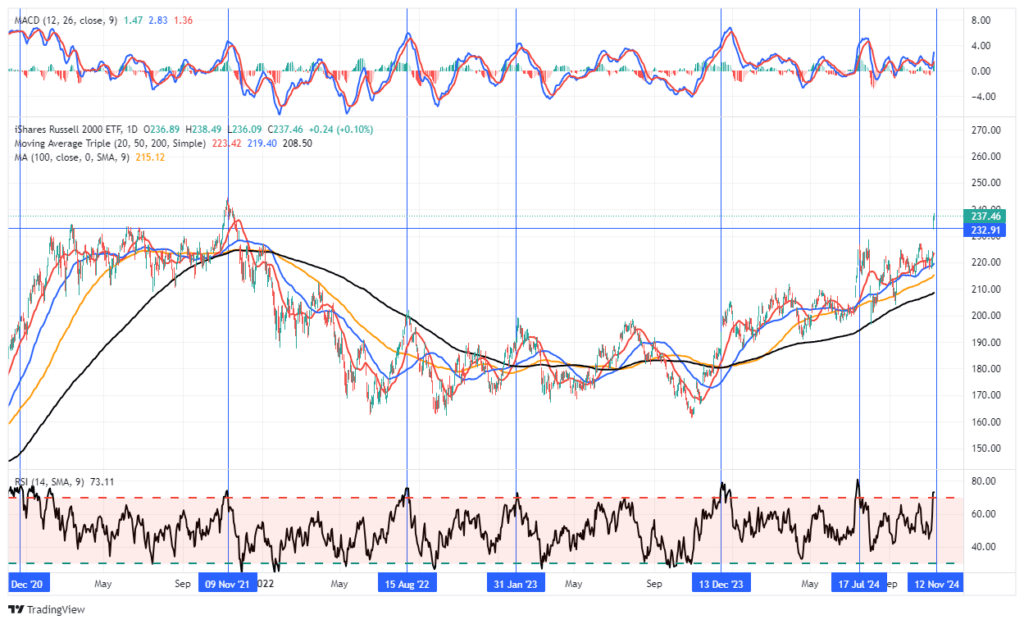

Given that pro-business policies should benefit small and mid-cap stocks, we began building a position in those stocks using the Russell 2000 Index ETF (IWM). The chart below shows that yesterday’s breakout above the previous consolidation. However, the index is very overbought and extended, which has previously preceded short-term corrections. Accordingly, we started with a small position in portfolios and are looking for pullbacks and consolidations to add to the position over the next several months.

Of course, there is always risk that we need to be mindful of. But if Trump is able to pass “business friendly” policies, we should see that continue to benefit the small and mid-cap space.

Small Cap Stocks Hit Record Highs- Can It Continue Higher?

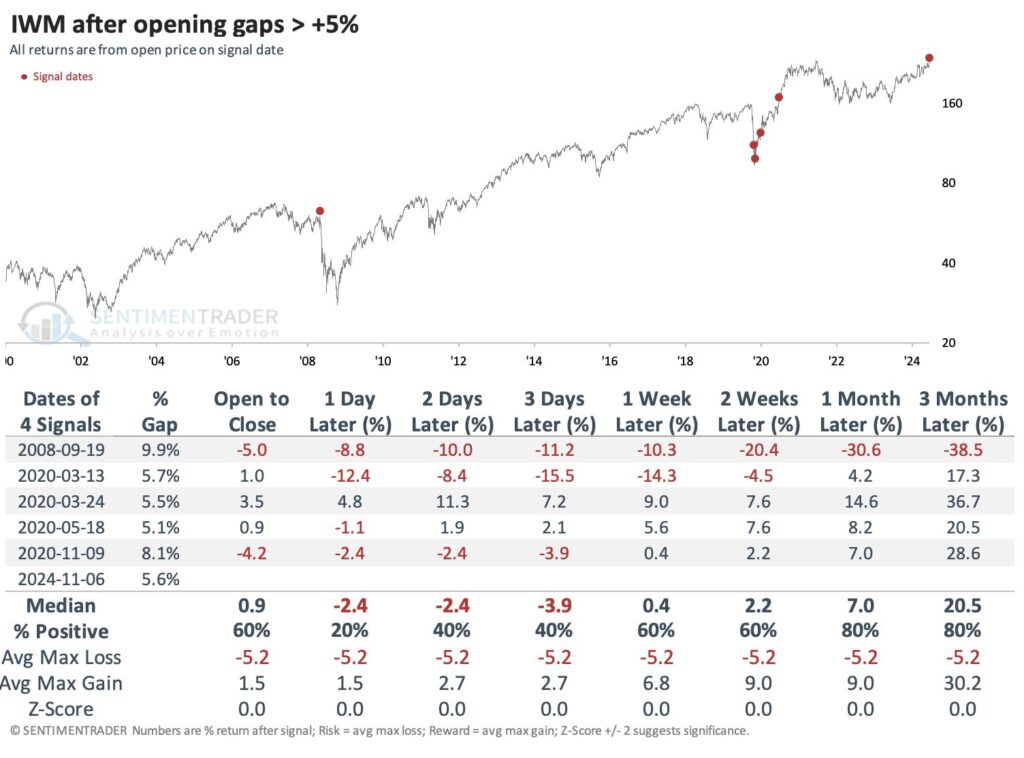

The Russell 2000 small-cap stock index hit a record high yesterday after rising 5%. Accordingly, the index is now up 18% year to date and making up ground against the S&P 500, which is up approximately 25%. In post-election trading on Wednesday, the small-cap index outshone all of the other key market indexes. With the large gap higher, can we expect a continuation?

To help answer that, we lean on a graphic provided by Sentimentrader, shown below. It shows the six times, including yesterday, when the Russell 2000 (IWM) opened 5% higher on the day. The first time was in September 2008. At that time, IWM opened up nearly 10% and gave up those gains and more over the coming days, weeks, and months. The other experiences, which occurred in 2020, were much better, especially over longer periods.

Our takeaway from the table is that Wednesday’s gap open will likely produce gains if the market remains firm. The first two instances in the table were in bear markets. As a result, the gap higher faded as prices continued lower. The remaining instances were in bull markets. Thus, the 5% opening gap initially gave up some of the gains but was on its way higher within a week or two.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 0

2024/11/08