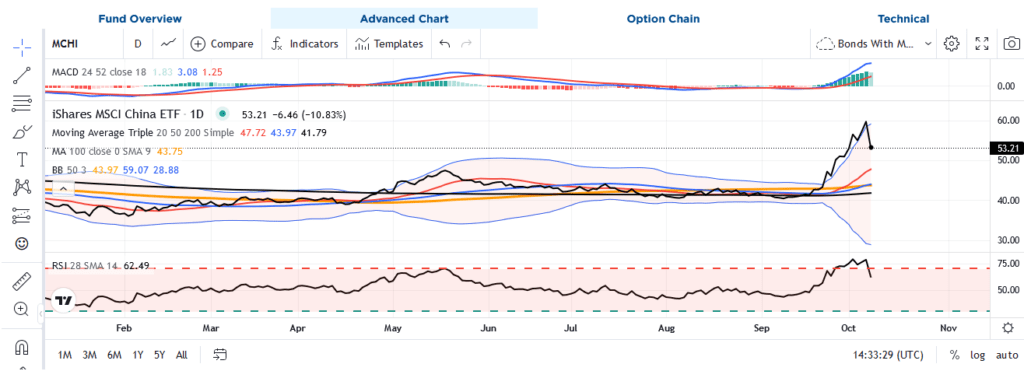

Chinese stocks (CSI 300) opened Tuesday morning following their week-long Golden Week holiday, with a massive 11% pop higher. However, shortly after opening, the index gave up half of the surge as China’s economic planning agency did not offer additional economic, monetary, or financial stimulus. As shown below, Chinese stocks have been soaring since mid-September due to lower interest rates, new QE, economic stimulus, and measures allowing banks to buy equities more easily. Before Tuesday’s trading, the CSI 300 was up nearly 50% on the stimulus measures in just a few weeks. But the index gave up a third of its recent gains without new stimulus. (The ETF in the graph traded all week despite the holiday; therefore, its daily performance is slightly different than the CSI Index.)

As we also see in the U.S. and other developed markets, volatility ensues when stimulus is repeatedly used to soothe markets and jump-start economic activity. Investors, like Paavolov’s dogs, develop a taste for stimulus. Any shortfall versus their expectation, even if minimal, can rapidly erase gains on prior stimulus. Consequently, when used repeatedly and for non-crisis reasons, stimulus adds market volatility. As we have seen with Chinese equities, volatility can often accompany strong returns, but as we learned on Tuesday, failing to provide enough of what the market wants can push markets lower violently.

As the Fed embarks on a series of rate cuts, the U.S. and global market will build in expectations. Failure to meet said expectations can result in sharp downdrafts. Conversely, meeting or bettering expectations can cause markets to soar. Stimulus-driven markets detract investors from fundamentals and instead force their focus on government actions. While the government and investors benefit from the short-term effects, the long-term result is weaker economic growth, rich stock valuations, and unproductive low bond yields.

What To Watch Today

Earnings

- No notable earnings releases today.

Economy

Market Trading Update

In yesterday’s commentary, we discussed how bonds are approaching a more deeply oversold basis as we head into the upcoming auctions. I have been getting a lot of emails on TLT in particular, so read that commentary if you have any questions.

Today, I want to return our focus to the market’s ongoing consolidation. As discussed in “Technical Takes On The Market,” the market continues to act bullishly. To wit:

“An ascending triangle is forming on the daily charts, another bullish pattern that typically signals further upward movement. In this case, we’ve seen a series of higher lows in recent weeks, indicating buyers are stepping in earlier during each pullback. The flatter upper trendline from the previous to the recent all-time high indicates an ongoing increase in buying pressure.”

The market continues to trade off support, retesting the 20-DMA yesterday but failing to make any progress higher. The market’s “consolidation” above support is bullish, as the previous overbought condition is reversed. However, the one concern that both Michael Lebowitz and I have discussed recently is the consolidation of the market, which is occurring with volatility rising. As shown, when such an environment has occurred, it has either been coincident with or a precursor to a correction. Could this time be different? Sure. However, history is an important guide to outcomes, and the current setup suggests there is a higher degree of risk than not.

Trade accordingly.

Hurricane Milton And The Broken Window Theory

With hurricane Helene causing massive destruction and Milton likely to do the same, many pundits will declare these catastrophes as beneficial to the economy. Their simple logic is that significant spending is needed to rebuild. They are not wrong from a short-term point of view. Inevitably, both hurricanes will boost GDP. However, as nineteenth-century economist Frederic Bastiat pointed out, there is also an unseen negative effect. Consider Bastiat’s logic when seeing inflated economic activity in the next few quarters. The following summary of his theory comes from our article, Tales of Cobras, Windows, and Economic Promise.

Nineteenth-century French economist Frederic Bastiat has a well-known theory about unintended consequences. He uses a parable to explain that which is seen and what is not seen. His lesson starts with a stone that shatters a shopkeeper’s window. Most noticeable to the town’s people is the economic benefit of the broken window. In their minds, the shopkeeper must buy a window and employ a glazier to install it. As an aside, many economists peddle similar logic in the aftermath of natural disasters.

Bastiat’s brilliance is pointing out the not so obvious opportunity cost of the broken window. In this case, after paying to fix the window, the shopkeeper has less money to spend elsewhere. The shopkeeper could have bought new equipment making his shop more productive and profitable. The benefits of which would have had a positive impact on the shopkeeper’s wealth but also the economy and the populace.

Instead, replacing the window is at best a neutral economic event. There is undoubtedly no net economic gain, but there is an opportunity cost. Financial and material resources were used in a non-productive manner.

How Howard Marks Thinks About Risk… And You Should Too

One of the biggest takeaways from Marks’ series is the idea that risk and volatility aren’t the same thing. For years, many investors (and academics) have been taught that volatility—the ups and downs of stock prices—equals risk. However, Marks argues that this is a big misunderstanding.

Volatility is one part of the picture, but risk is the probability of losing money. Just because prices bounce around doesn’t mean you’re at risk of a big loss. Investors should focus on managing their downside, not just trying to avoid every little price swing.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 6

2024/10/09