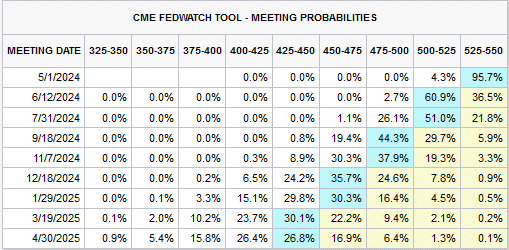

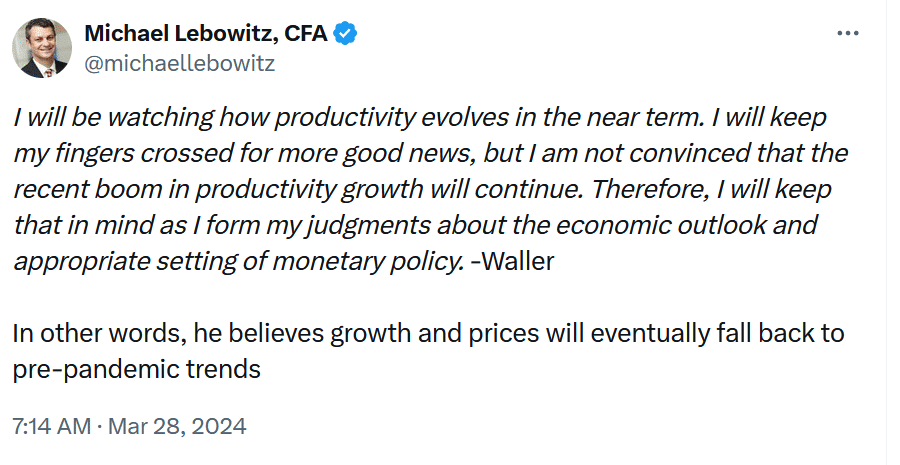

In a speech last Thursday, Fed Governor Christopher Waller showed how even the most hawkish Fed members are turning dovish. The transformation from a hawkish to a dovish Fed began last October. In late summer and early fall of 2023, the Fed talked about rate increases and was steadfast about beating inflation. At the November and December meetings, the “hawkish” Fed backed off of further rate increases. More importantly, their December policy projections forecasted their rate cuts. This has occurred despite signs inflation is not falling as it was, and the economy continues to fire on all cylinders. To appreciate the Fed’s change in stance, let’s consider the dovish comments from the Fed’s most hawkish member, Christopher Waller.

In a speech at the Economic Club of New York, Christopher Waller acknowledges inflation is too high. To wit, “various inflation measures have continued to come in hot.” Yet, instead of taking a hawkish tone, he is just delaying the timing of rate cuts. He states: “I continue to believe that further progress will make it appropriate for the FOMC to begin reducing the target range for the federal funds rate this year.” As comments from Christopher Waller and other Fed members show, the Fed is worried about something. Otherwise, rate increases would be in their discussions. Might they foresee the lag effect of prior rate hikes catching up with the economy or a liquidity problem this summer or fall? Time will tell, but Waller and his colleagues’ shift toward a dovish tone is surprising, given robust economic growth and sticky inflation data alongside very easy financial conditions.

What To Watch Today

Earnings

- No notable earnings releases

Economy

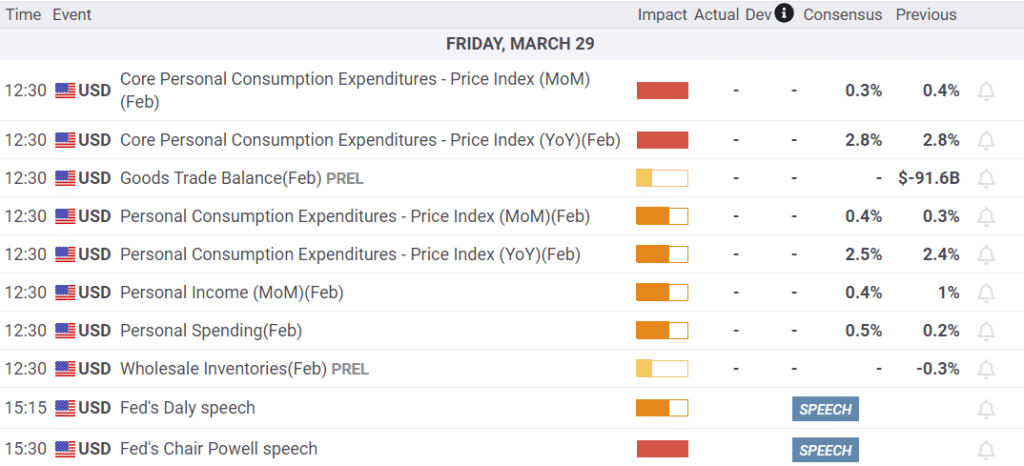

Market Trading Update

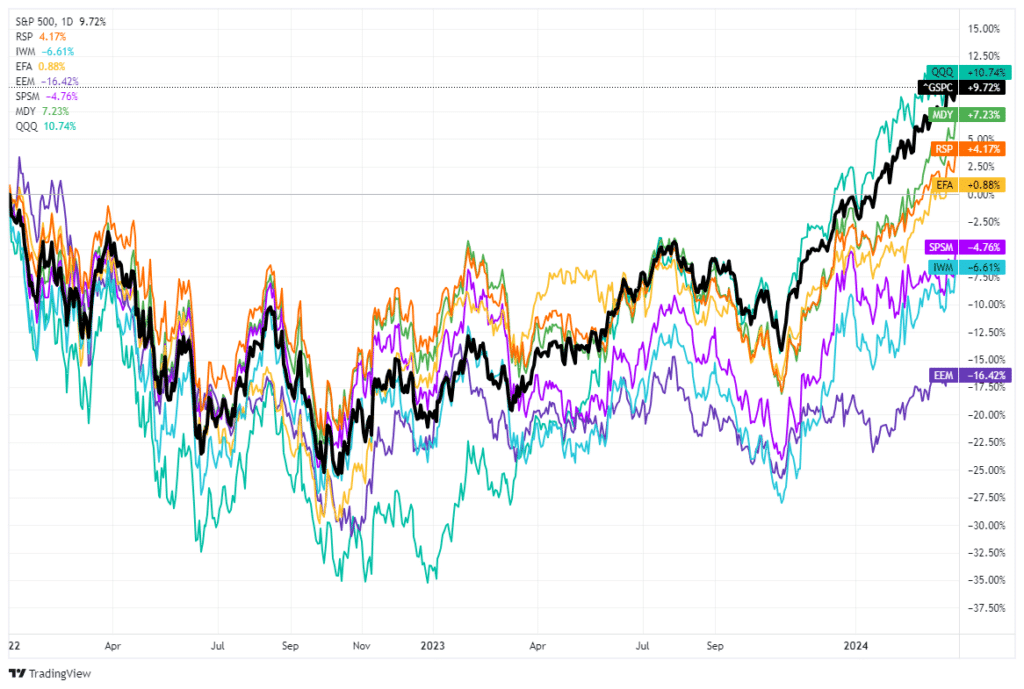

The market is closed today for the Easter holiday. However, that spate of economic reports will be looked at closely by the markets for signs of stronger inflation that may curtail the Fed from cutting rates in June. With the market finishing March in the green, the S&P 500 index is now up 5-straight months in a row, a decently long stretch of uninterrupted gains. As shown below, the S&P 500 and the Nasdaq are the clear winners over other major markets year-to-date. Notable, Midcaps have performed better as of late, with Small Caps, Russell 2000, and Emerging Markets trailing furthest behind.

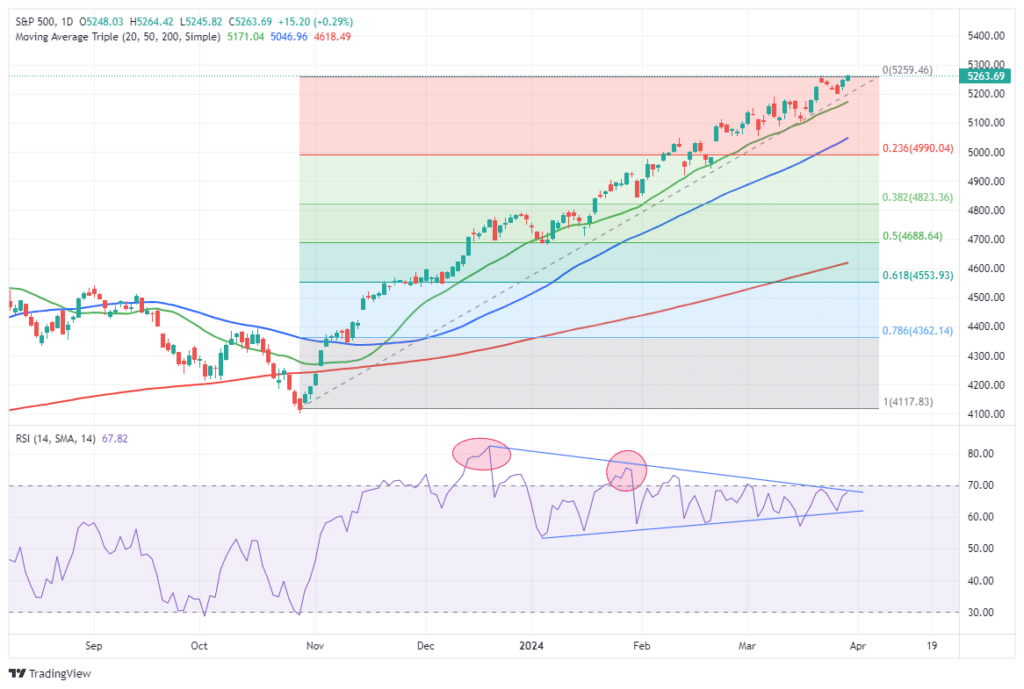

The extension of the S&P 500 index above its respective 200-DMA remains a significant risk to a short-term correction. As we have noted previously, between the very compressed volatility index, very bullish sentiment, and long-positioning by investors, only a catalyst is needed to spark a reversal. Currently, 4990 remains first support, but 4650 is a very likely probability at some point. While such would provide a much better entry point to add exposure, such a decline will “feel” much worse than it actually is.

However, such was also the case last summer.

The Week Ahead

A new cycle of economic data kicks off this week with an update on the employment situation. The BLS jobs report is expected to show that the economy gained 200k jobs and that the unemployment rate remained steady at 3.9%. JOLTs on Tuesday and ADP on Wednesday will also tell us more about the labor markets. The ISM manufacturing and services index reports come out on Monday and Wednesday, respectively. The labor and price components of these indices will be closely watched.

Earnings season kicks off this week, but the larger, more followed companies will not report until the end of next week, when many banks and airlines will report their earnings.

Is Another Round Of QE Closer Than We Think?

In our article, QE By A Different Name Is Still QE, we discussed how large deficits and significant amounts of outstanding force the Fed to help the Treasury’s funding pressures. Specifically, the article discusses a rumor about how the Fed might meet this task. To wit:

Rumor has it that the regulators could eliminate leverage requirements for the GSIBs. Doing so would infinitely expand their capacity to own Treasury securities.

Once banks have the ability to buy unlimited amounts of Treasury securities, the Fed must resurrect some version of the BTFP program to help the banks fund the purchases. While we haven’t heard anything about the BTFP or some other method to fund the banks, the calls for unlimited leverage are growing. The International Swaps and Derivatives Association has asked banking regulators to exempt banks from holding capital against Treasury holdings. Keep in mind this is not unprecedented. From April 2020 to March 2021, U.S. Treasury securities were exempted from banks supplementary leverage ratio (SLR). This time, the move could become permanent and the first step to what may amount to unlimited Treasury funding ultimately sponsored by the Fed. Or as we call it, version 2.0 of QE.

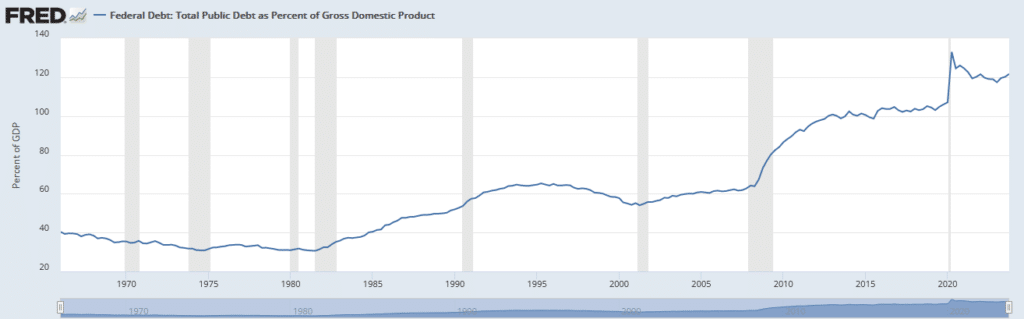

If the trend in the graph below of federal debt to GDP continues, the Fed and banks must find a new way to accommodate the extra debt. Version 2.0 is a good answer.

A Tribute To Daniel Kahneman, The Master Of Behavioral Economics

Daniel Kahneman, a Nobel Prize winner for his work in behavioral economics, passed away last week. He devoted significant time and effort toward studying human judgment and decision-making. His work helps us appreciate our biases and those of the market pundits, Fed officials, and corporate leaders we tend to rely upon.

Given his expertise, the importance of decision-making, and biases in our investment performance, we share a few of his quotes.

- We’re blind to our blindness. We have very little idea of how little we know. We’re not designed to know how little we know.

- If owning stocks is a long-term project for you, following their changes constantly is a very, very bad idea. It’s the worst possible thing you can do because people are so sensitive to short-term losses. If you count your money every day, you’ll be miserable.

- We’re generally overconfident in our opinions and our impressions and judgments.

- All of us would be better investors if we just made fewer decisions.

- Economists think about what people ought to do. Psychologists watch what they actually do.

- Frequent repetition is a reliable way of making people believe in falsehoods because familiarity is not easily distinguished from truth.

Tweet of the Day

“Want to have better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 4

2024/03/29