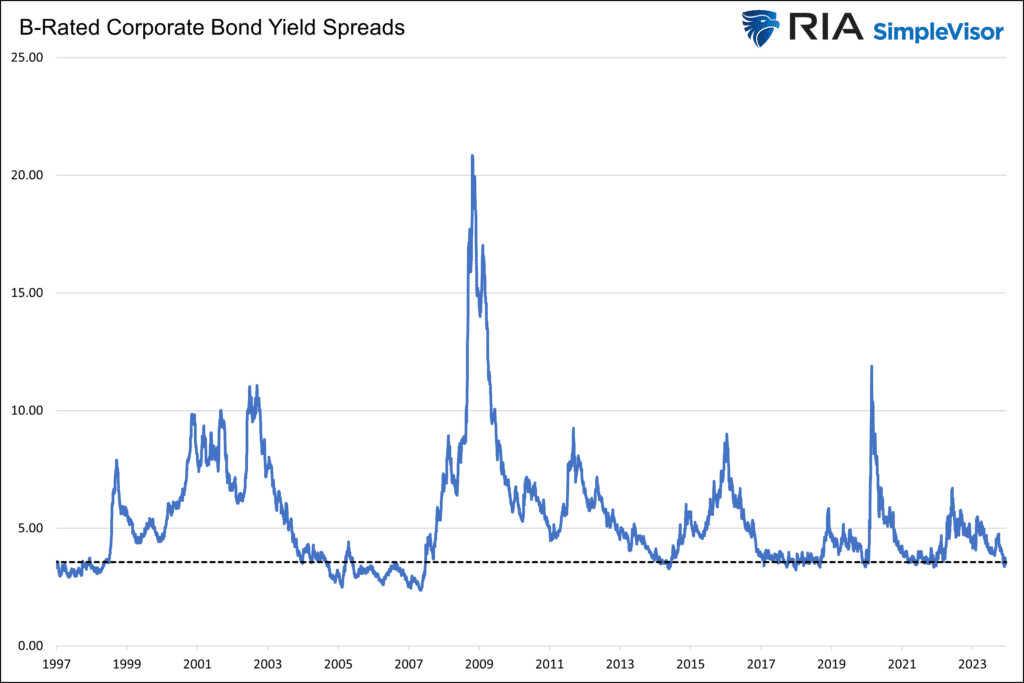

We have noted numerous times that corporate bond spreads, the yield premium versus U.S. Treasuries, are not aligned with default risks. As evidence, the graph below illustrates the yield premium on B-rated junk, which is near the lowest in 15 years. Therefore, the spread should be higher, given the high-interest rates and the fact that most junk-rated companies are highly indebted. Said differently, it should be better reflective of the fundamentals. Add in the possibility of a recession, and the yield spreads make even less sense. S&P Global seems to agree with us in their 2023 credit review and outlook for 2024.

In S&P Globals’ recently published credit review and outlook, they note that corporate defaults jumped 80% in 2023 to 153. Additionally, 63% of said defaults were in the U.S. Companies like Silicon Valley Bank, AMC, Lending Tree, and Bed Bath and Beyond were among the more well-known names. Regarding their 2024 credit outlook: “Expect further credit deterioration globally, predominantly at the lower end of the rating scale (rated ‘B-‘ or below), where close to 40% of issuers are at risk of downgrades. We expect financing costs to remain elevated despite the prospect of rate cuts. We think slower economic growth and higher financing costs will contribute to increasing default rates.” Further in the report, they expect default rates to reach 5% by September. Throw in a recession, and the default rate would be higher and likely to cause corporate yield spreads to rise significantly.

The simple takeaway from their credit outlook is that fundamentals do not support current yield spreads.

What To Watch Today

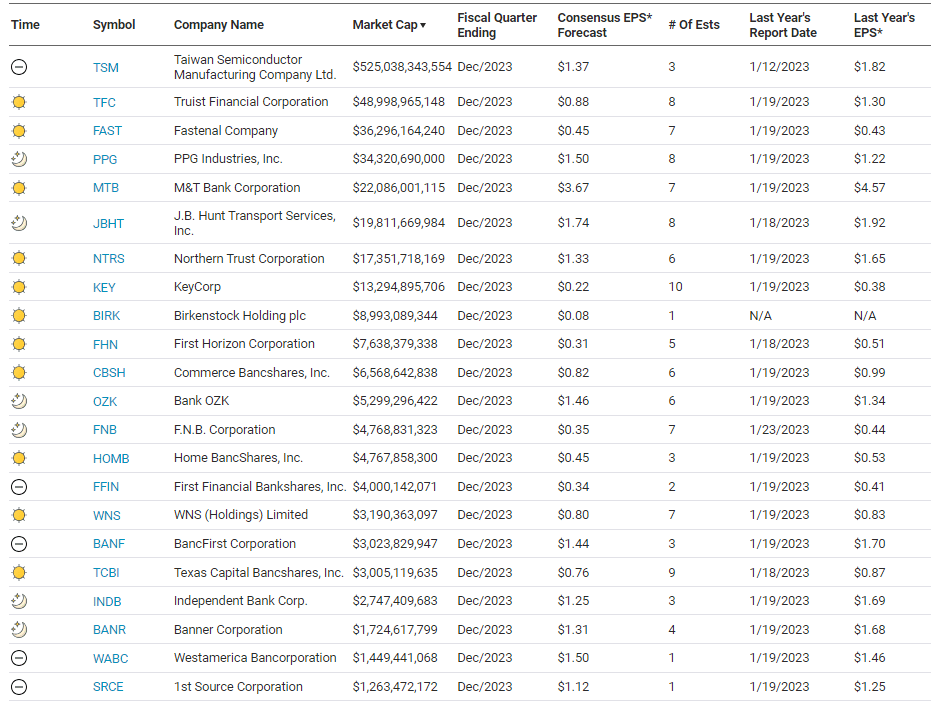

Earnings

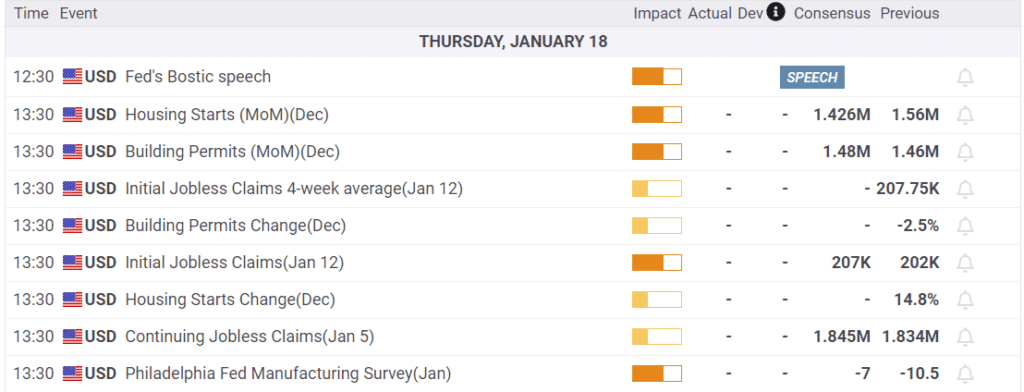

Economy

Investing Summit: Early Bird Registration Available Now

January 27th, we are hosting a live event featuring Greg Valliere to discuss investing in the 2024 presidential election. What will a new president mean for the markets, the risks, and where to invest through it all? Greg will be joined by Lance Roberts, Michael Lebowitz, and Adam Taggart for morning presentations covering everything you need to know for the New Year.

Register now, as there are only 150 seats. The session is a LIVE EVENT, and no recordings will be provided.

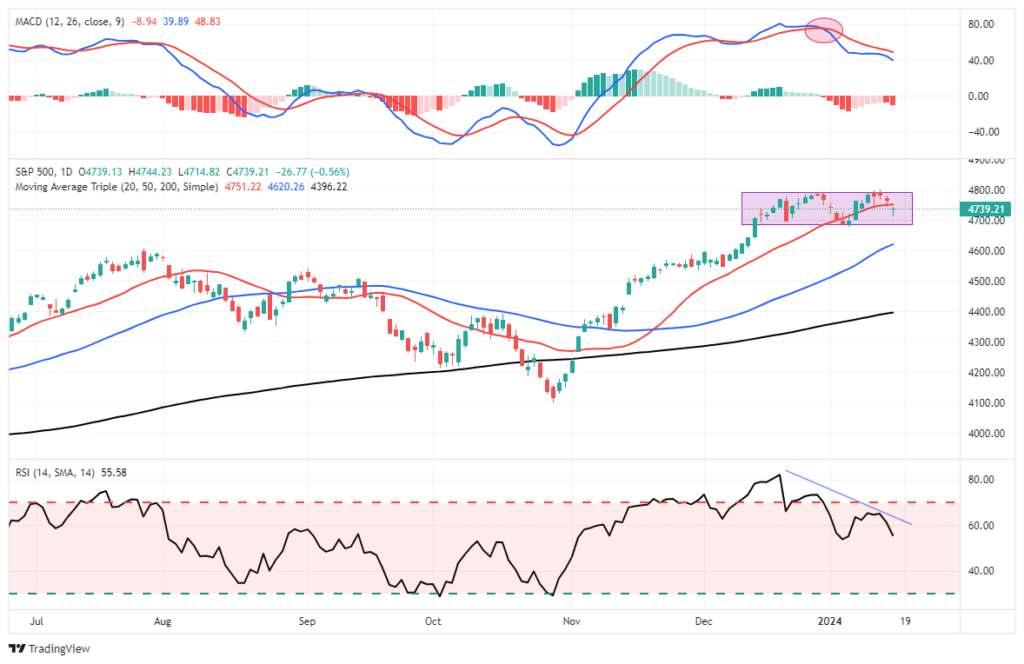

Market Trading Update

The “sell signal,” as discussed in yesterday’s commentary and over the last few weeks, keeps prices within the current consolidation range. We are about halfway through the corrective action of both the MACD and RSI indicators, which suggests another week or so of sloppy trading action. The market continues to see buying in the afternoons, which remains bullish. Also, the number of stocks above their respective 50- and 200-DMA is constructive, suggesting that a deeper correction remains unlikely. Of course, all of that is subject to change given an exogenous event that spooks the market, but otherwise, there is no reason to be overly concerned momentarily.

We have had several Fed speakers over the last few days and more today, all suggesting that the market’s expectations of 6-rate cuts this year are likely overly optimistic. That is, unless the economy slips into a recession or a financial event of some sort manifests itself. For now, continue to maintain exposure and accumulate cash as needed by rebalancing risk. We will likely get an opportunity to increase equity exposure at a better level soon.

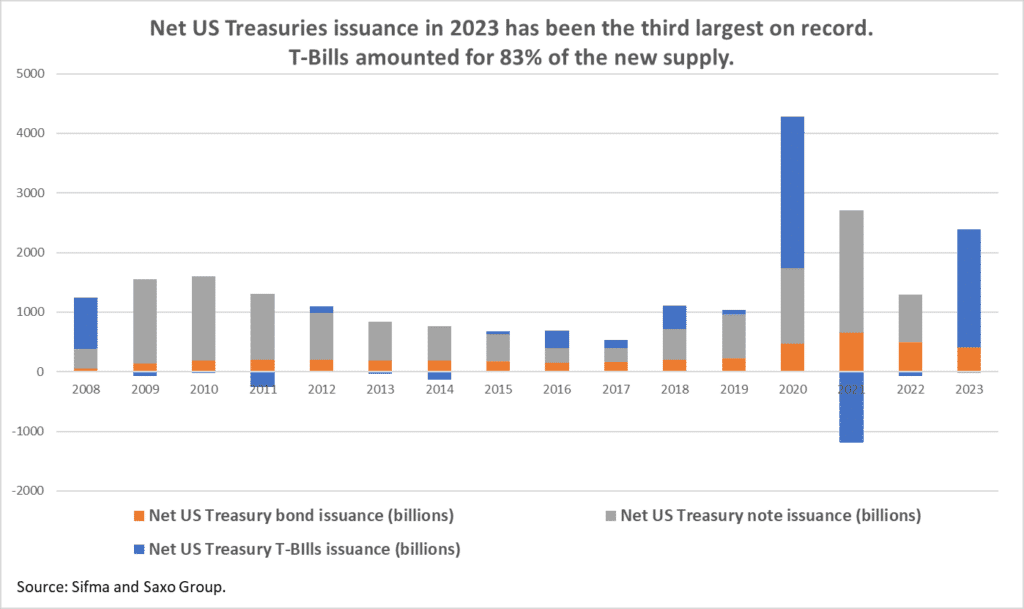

Treasury Bill Issuance Dwarfs Notes and Bonds

In 2023, Janet Yellen and the U.S. Treasury primarily issued Treasury bills versus notes and bonds to fund the government’s $2+ trillion deficit. Such was the second largest amount of Treasury bill issuance, behind 2020. The Treasury was clearly betting that high-interest rates would be temporary. Accordingly, they are trying to minimize the amount of longer-term notes and bonds with higher interest rates.

The strategy primarily worked well because the financial system had plenty of liquidity. However, as the Fed’s reverse repurchase program continues to drain, said excess liquidity is rapidly leaving the system. Unfortunately, for the Treasury, continued reliance on Treasury Bills will drain liquidity from the money markets and is likely to result in stress in the financial markets. Any wonder why the Fed is starting to talk about liquidity-generating operations such as lower interest rates and tapering QT?

Retail Sales Remain Strong In December

Retail Sales were better than expected, rising 0.6% versus expectations of +0.4%. The retail sales control group, which feeds the GDP calculation, grew by 0.8%, well above expectations of +0.2%. The data represents spending in December. Therefore, we shouldn’t read too much into the data. We know credit usage and buy-now-pay-later loans were heavily relied upon for holiday spending. The truer test of the strength of the consumer will come over the next few months. Despite the solid data and higher CPI last week, the market continues to expect the Fed will cut rates sooner rather than later. In fact, after the retail sales data was released, came from the following headline:

CITIGROUP EXPECTS U.S. FEDERAL RESERVE TO START CUTTING INTEREST RATES IN JUNE VS EARLIER FORECAST OF JULY

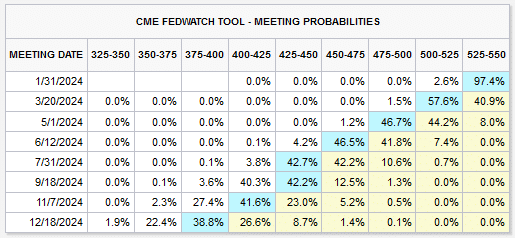

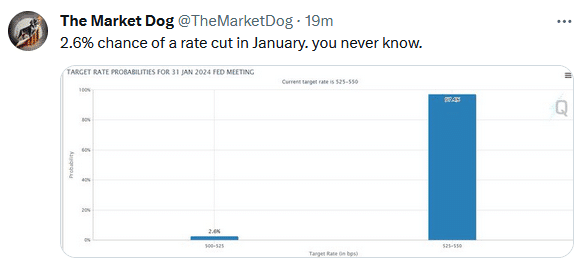

The table below shows the market implies that there is a good chance the Fed will cut rates in March and then at each meeting afterward. As we share in the Tweet of the Day and in the table below, there is a 2.6% implied chance the Fed will cut rates this month.

Tweet of the Day

“Want to have better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 4

2024/01/18