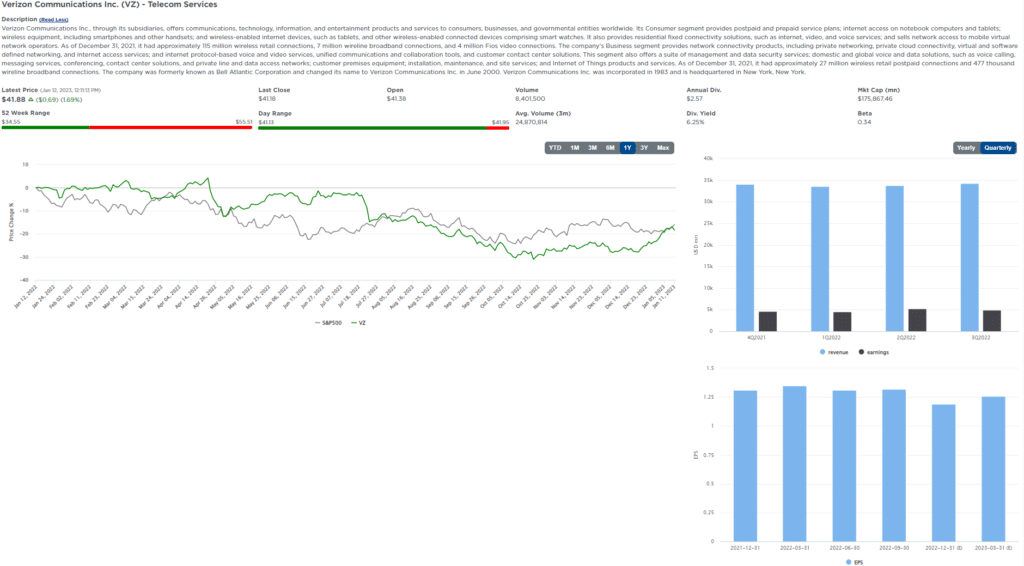

A theme we have been focusing on for 2023 revolves around high-dividend stocks trading at attractive valuations. This theme outperformed the broad market last year as investors sought safety to ride out the volatility spurred by the Fed’s fight against inflation. We expect the outperformance to continue into 2023 as the lag effect of prior rate hikes catches up with the economy.

In an environment ripe for an economic slowdown and where raising funds in capital markets is costly, cash flows become a critical investment factor. Earnings (EPS) reported by companies typically differ from actual cash flows due to accrual-based accounting standards. Most investors tend to focus on earnings; however, cash flows determine the amount of capital available to be reinvested or returned to investors. Such is why we screen on Free Cash Flow Yield in this screen in lieu of more typical valuation ratios.

Screening Criteria

We considered the following factors when screening:

- Exclude Financials Sector

- Market Cap > $10b

- Dividend Yield > 3%

- 5yr Annualized Dividend Growth >2%

- Free Cash Flow Yield in the Top 30% of the Universe

- 3-5yr Annualized EPS Growth Est. >3%

- Times Interest Earned (TIE) Ratio >2

Company Summaries

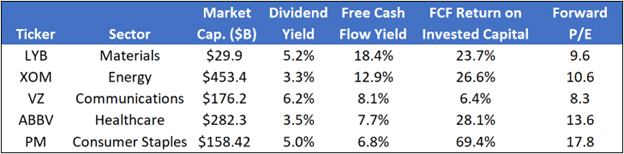

LyondellBasell Industries N.V. (LYB) – Specialty Chemicals

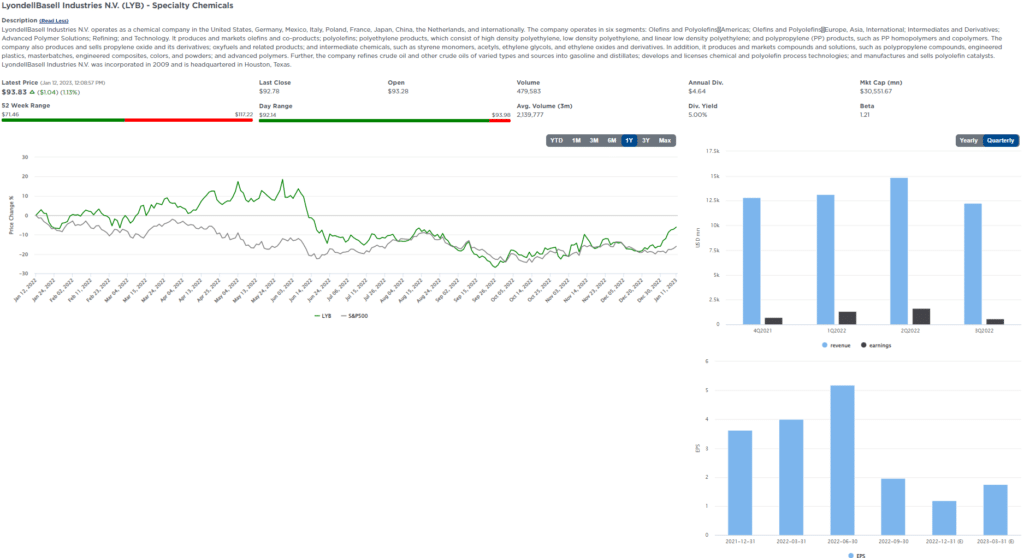

Exxon Mobil Corporation (XOM) – Oil & Gas Integrated

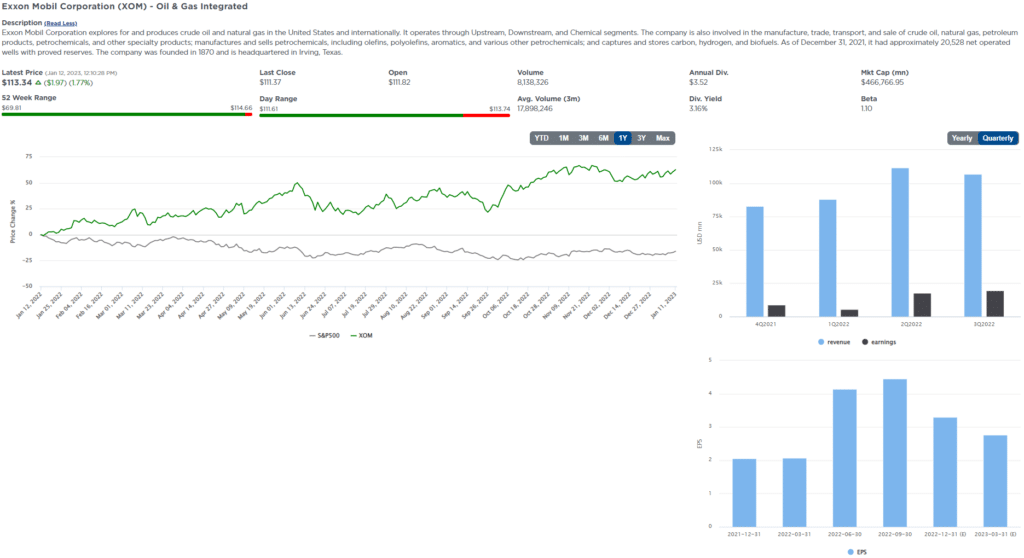

Verizon Communications Inc. (VZ) – Telecom Services

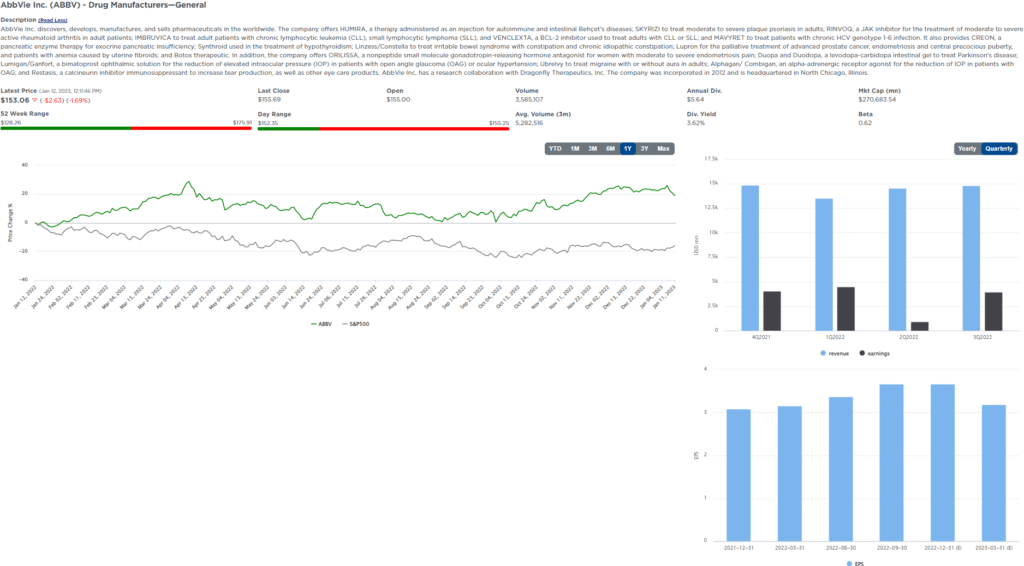

AbbVie Inc. (ABBV) – Drug Manufacturers—General

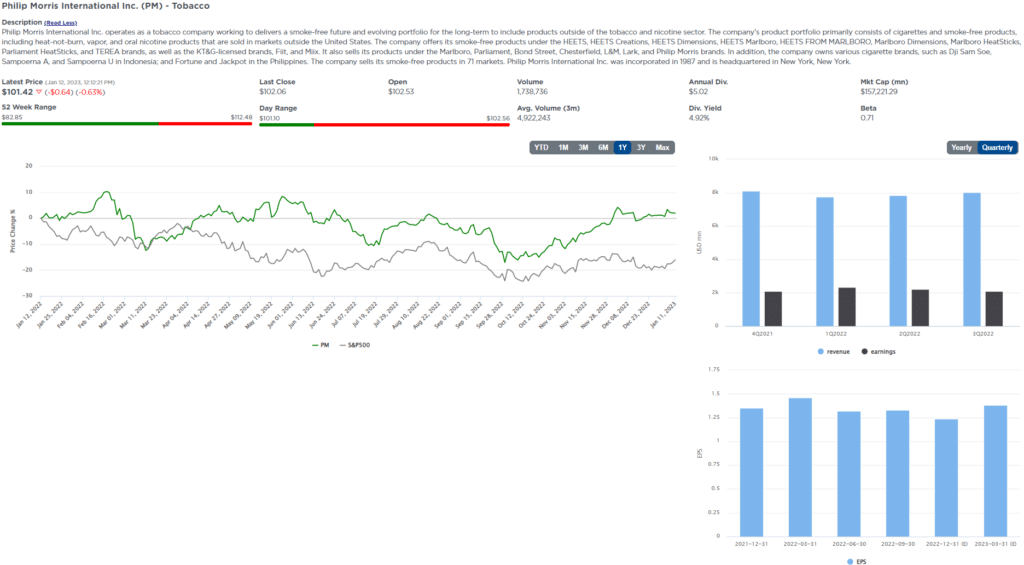

Philip Morris International Inc. (PM) – Tobacco

Five for Friday

Five for Friday uses stock screens to produce five stocks that we expect will outperform if a particular investment theme plays out in the future. Investment themes may be relevant to the current or expected market, industry and/or economic trends. Investment themes may not always represent our current forecast.

Disclosure

This report is not a recommendation to buy or sell the named securities. We intend to elicit ideas about stocks meeting specific criteria and investment themes. Please read our disclosures carefully and do your own research before investing.

Michael Lebowitz, CFA is an Investment Analyst and Portfolio Manager for RIA Advisors. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. CFA is an Investment Analyst and Portfolio Manager; Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Customer Relationship Summary (Form CRS)