This week we put our twist on a MarketWatch stock screen offering quality earnings with a high dividend yield. The screen looks at companies in the S&P 500 with relatively lower betas, higher dividend yields, and good prospects for 2024 sales and earnings growth. We take MarketWatch’s top 22 screen results and further refine the criteria for value to arrive at our five stocks.

As we have noted previously, using our factor tracker, high dividend yield stocks are the best-performing factor YTD. After the recent bounce from new bear market lows, it may be time to start thinking about shelter in case of another leg lower.

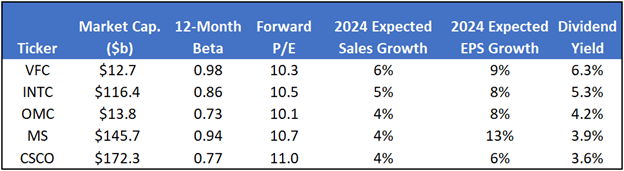

Screen Criteria

- 12-Month Beta < 1

- Dividend yield > 3.5%

- 2024 EPS Growth > 4%

- 2024 Sales Growth > 4%

- Forward P/E < 12

Screen Results

The stocks we chose are all trading in value territory on a forward P/E basis. The outsized dividend yields on VFC and INTC are partly the product of poor performance YTD relative to the other companies on the list. OMC, however, is down less than 10% YTD and still carries a 4.2% dividend yield. While a high dividend yield can be attractive, it’s not guaranteed. Evaluating the relative safety of the dividend is important in most cases.

Company Summaries (all descriptions courtesy SimpleVisor)

V.F. Corp. (VFC)

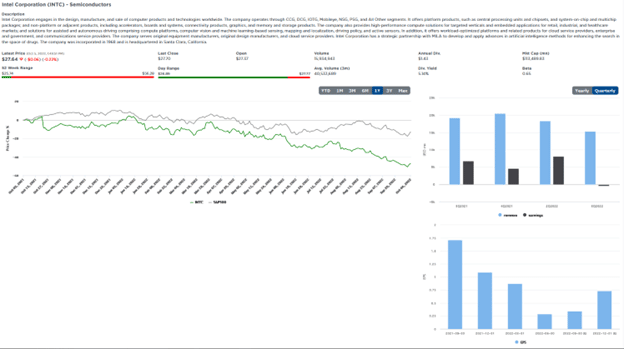

Intel (INTC)

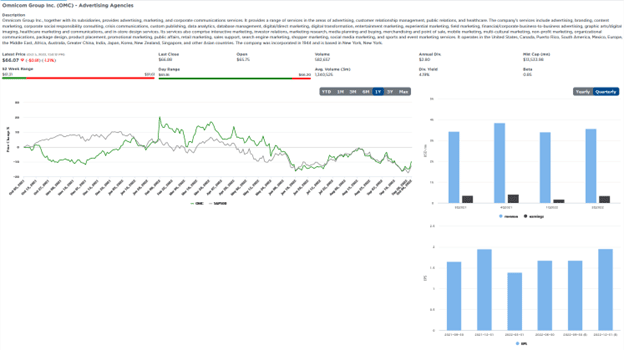

Omnicom Group Inc. (OMC)

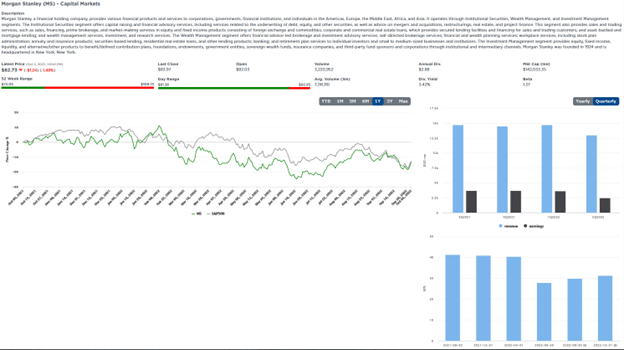

Morgan Stanley (MS)

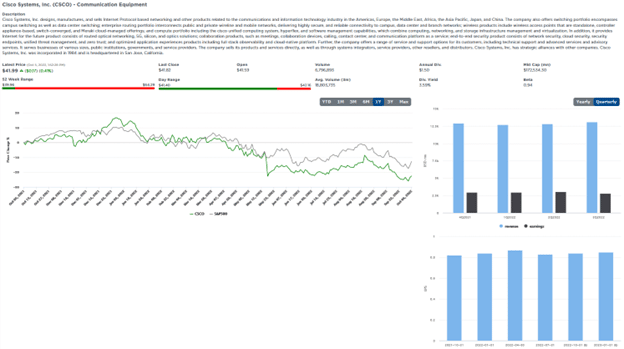

Cisco Systems (CSCO)

Disclosure

This report is not a recommendation to buy or sell the named securities. We intend to elicit ideas about stocks meeting specific criteria and investment themes. Please read our disclosures carefully and do your own research before investing.

Michael Lebowitz, CFA is an Investment Analyst and Portfolio Manager for RIA Advisors. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. CFA is an Investment Analyst and Portfolio Manager; Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Customer Relationship Summary (Form CRS)