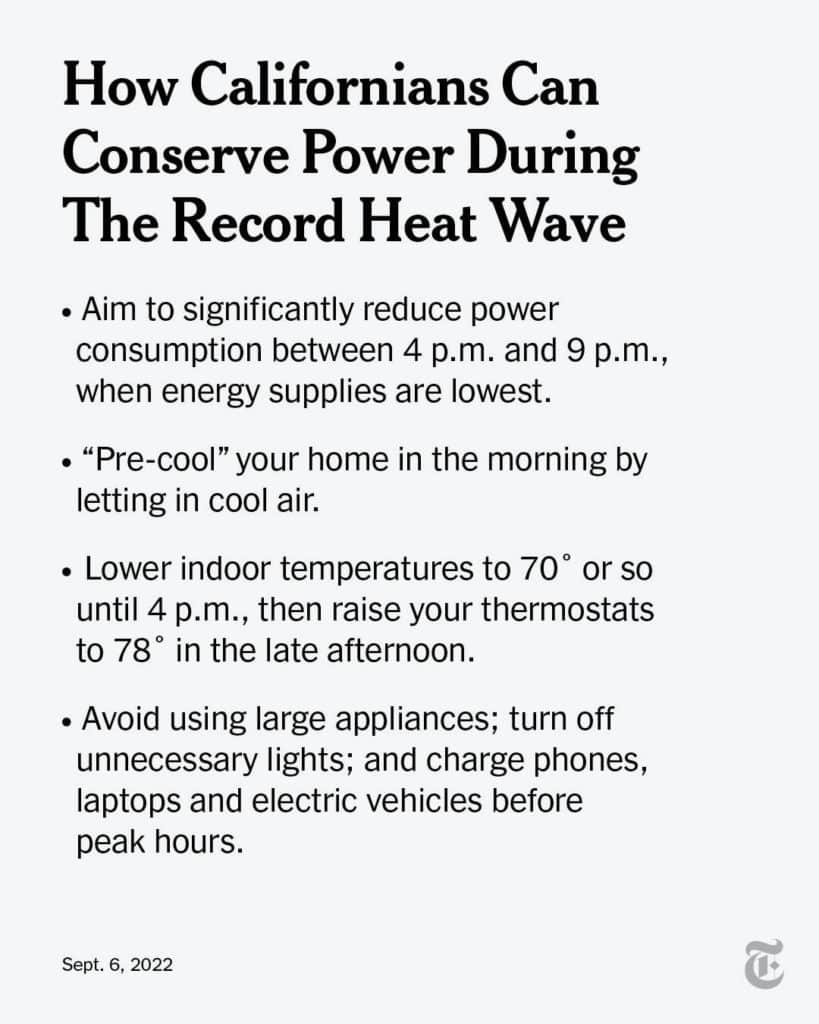

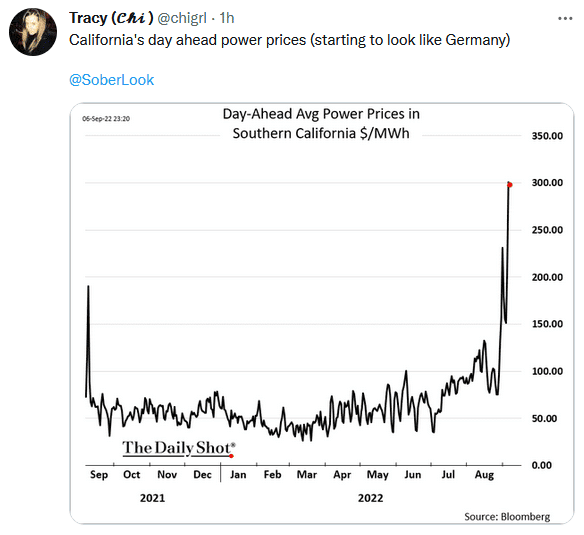

A year or two ago, politicians were demanding we need to flatten the curve. At the time, they were referring to limiting the spread of covid. Once again, we hear the same “flatten the curve” demands from politicians. This time, however, it’s about electricity. A European Union representative states: “So what we have to do is flatten the curve and avoid the peak demands…We will promise a mandatory target for reducing electricity use at peak hours.”

From Europe to California, scorching temperatures and high energy prices cause politicians to beg individuals and corporations to limit energy usage, especially at peak electricity usage hours. At times, as we are now seeing in California, rolling blackouts are employed to reduce strains on the electric grid. High energy prices and limitations on electricity usage will raise production costs for goods produced in affected areas. Flattening the curve may help the electrical grid, but it will steepen the inflation curve!

What To Watch Today

Economy

- 8:30 a.m. ET: Initial Jobless Claims, the week ended September 3 (240,00 expected)

- 8:30 a.m. ET: Continuing Claims, the week ended May 21 (1.435 expected, 1.438 previously)

- 3:00 p.m. ET: Consumer Credit, July ($33.0 billion expected, $40.15 previously)

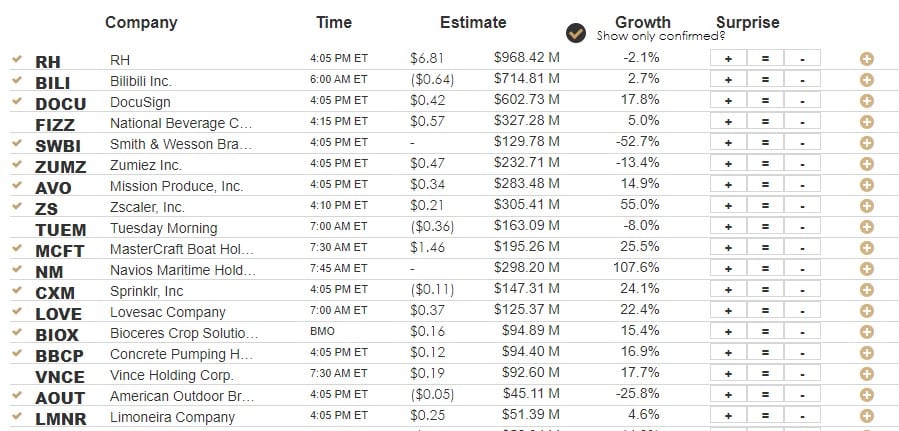

Earnings

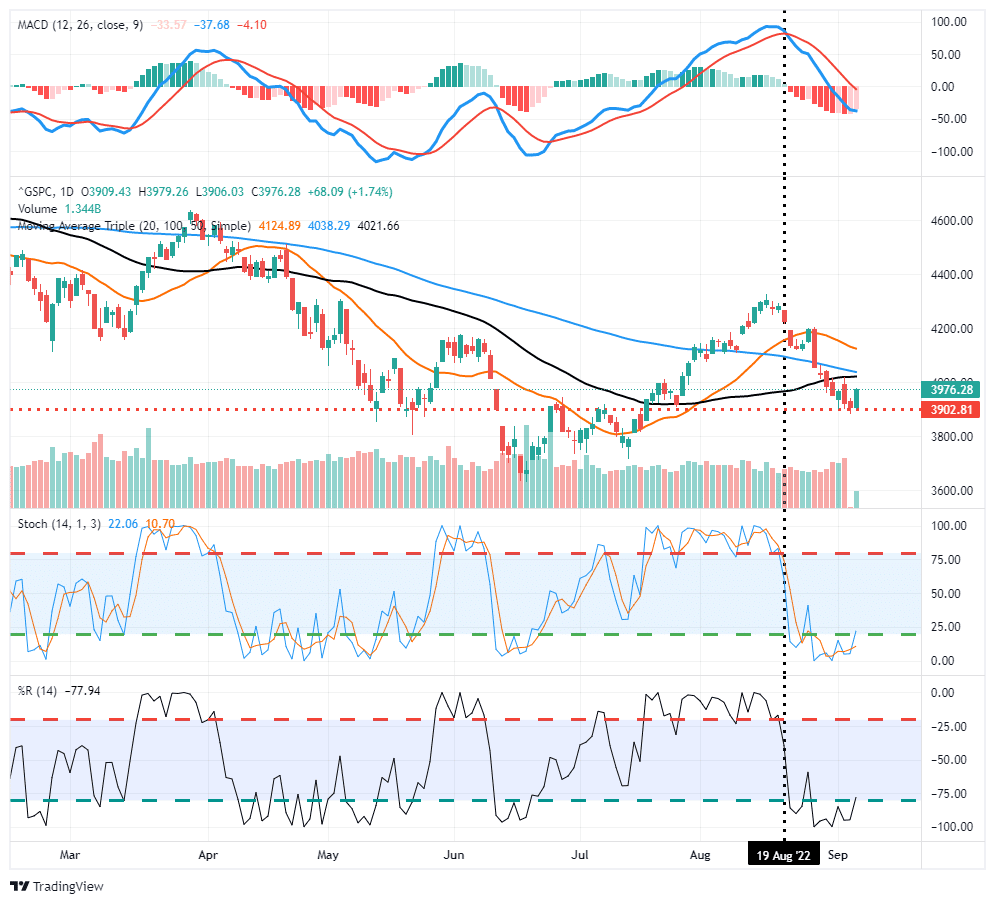

Market Trading Update

The market finally rallied from oversold conditions and, importantly, held important support, as shown in our chart yesterday. With the 100-dma very close to crossing below the 50-dma, there is a good bit of resistance at the 4000 level on the S&P 500 index. That level is likely a good place to take profits and rebalance portfolios in the near term as the Fed continues to hike rates and tighten monetary policies.

The MACD sell signal did show some bullish action by narrowing the spread, but the sell signal is still in place, keeping downward pressure on prices. As shown at the bottom, the two oversold indicators did turn up, suggesting we might see some follow-through over the next couple of days. Don’t forget to sell into the rally.

Why We Bought Euros

Yesterday we added euros (FXE) to our portfolios. SimpleVisor subscribers were provided details of the trade and a lengthy explanation of what drove us to make the trade. We provide a few snippets of the summary below. For a full write-up and trade details, give SimpleVisor a try with a 30-day free trial.

- Given the soaring rate of inflation, especially energy prices, this instance of a stronger dollar is wreaking havoc on Europe and Japan. Making matters worse, many foreign borrowers borrow in dollars. If they do not hedge the currency risk, as many do not, a strong dollar results in higher interest and principal payments. Therefore, they must acquire more expensive dollars to pay interest and principal. Further, a strong dollar is a de facto global monetary policy tightening.

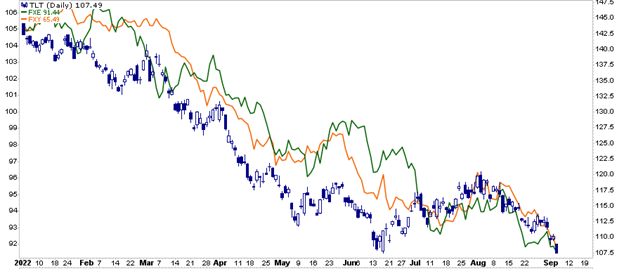

- We suspect that the ECB and BOJ have been selling dollar assets, predominately Treasury bonds, to prop up their currencies. Supporting this theory, the graph below shows the strong correlation between 20-year UST bonds (TLT) and the Euro (FXE) and Yen (FXY).

- Essentially reopening FX swap lines kill two birds with one stone. Swap lines should cap U.S. yields and help limit inflationary pressures in Europe and Japan. Equally important, it helps defuse what is slowly becoming a financial crisis in those countries.

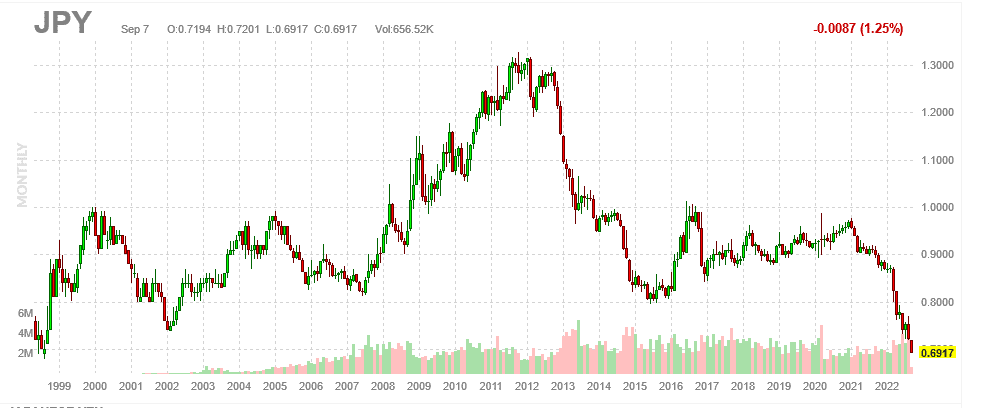

Daunting Head and Shoulder Pattern in the Yen

The graph below shows the yen versus the dollar is making 20+ year lows. More concerning, the pattern over the period appears to be a giant head and shoulders pattern. According to the pattern, a breaking of the shoulder should result in a decline equal to the distance between the top of the head and the shoulder. In this case, that does not seem feasible as it would bring the price to near zero.

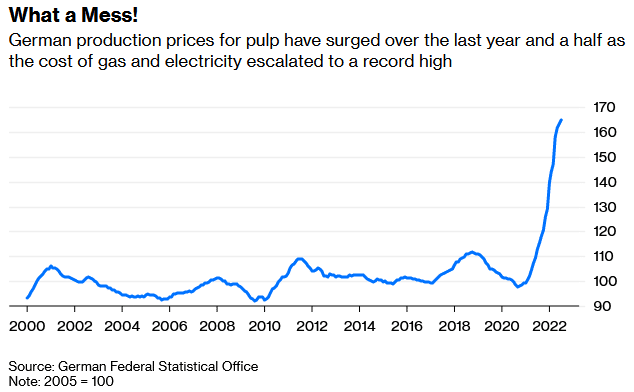

Got Toilet Paper?

Not again!! In his latest article, Can You Afford to Hoard?, Javiar Blas warns that toilet paper prices are rising. Accordingly, we may once again see stockpiling of toilet paper. Unfortunately, it’s not just about toilet paper. Blas says the higher cost of producing toilet paper is “a microcosm of the much larger, energy-intensive manufacturing sector, where production costs are continuing to skyrocket in line with soaring wholesale energy prices. It’s the same issue across European industrial commodities — from glass, ceramics, and synthetic fibers to aluminum, cement, fertilizer, and dozens of other daily-life goods.”

European gas prices are soaring. With it comes higher costs of production. These must be largely passed on to consumers if the producers are to survive. To wit:

Lorenzo Poli, the head of Italian paper maker Cartiere Saci SpA, recently shared his company’s monthly energy bill on television: It had gone from a little more than 385,000 euros in 2021 to almost 2 million euros in 2022. In another sign of the stress, Hakle GbmH, a large German toilet-paper maker with a century-long history, filed for insolvency on Monday. The company said that “massive” price increases for energy and other commodities drove it into “a corner.”

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.