Gold and Silver

Following our review of bonds, a subscriber asked us if we would do a similar analysis for the price of gold. We figured that with the Olympics starting soon, we would add silver.

Gold and Silver Fundamentals

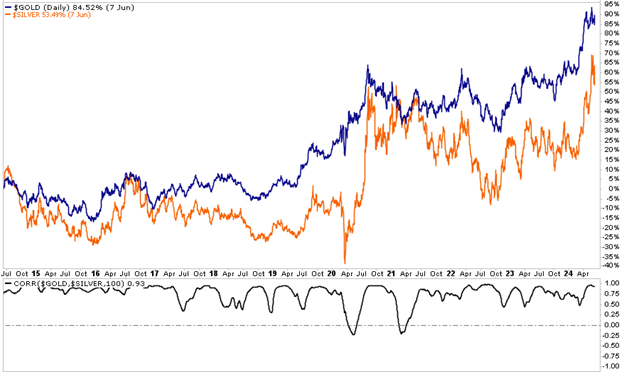

Gold and silver tend to trade in a similar fashion, as the graph below shows. Silver is often the more volatile of the two. The lower chart shows a robust statistical correlation.

The price of gold is up about 50% in the last year and a half, while silver has almost doubled over the same period. The narrative behind the surge in precious metals is that soaring fiscal deficits will bankrupt the nation. Furthermore, gold buying by countries like China and Russia as they try to distance themselves from the U.S. dollar, will further bolster the price increases.

Our last article on gold, Is Gold Warning Us Or Running With The Markets? was published in April. At the time we debunked many of the narratives driving gold prices higher. Per the article:

The previous few sections share some typical rationales to justify higher gold prices. While they sound like legitimate reasons for Gold to soar, when taken into context, they are not that different from other periods in the last twenty years when Gold was flat or trending lower in price.

The price of Gold can provide valuable insights at times. But other times, Gold can give false signals warped by irrational market behaviors. We think Gold is getting caught up in a speculative bubble, and its price is not presenting us with a warning of fiscal, monetary, or geopolitical crisis.

Gold has a strong correlation with real yields when real yields are low. Currently they are at a 15-year high.

We will be more optimistic about gold prices when the Fed starts cutting rates and real yields decline. Until then, we think gold is following the path of many other assets and rising on speculative narratives.

Technicals

The next graph shows gold has recently broken from a multiyear wedge pattern and a sloppy inverse head and shoulders pattern. Both are very bullish. However, we would not be surprised to see its price retest the breakout (about 2100) before continuing higher. It could be such a retest coincides with rate cuts by the Fed.

Silver prices, like gold, broke out from a long-term wedge pattern. Similarly, we suspect it will retest the breakout (about 25) before continuing higher.

Disclosure

This report is not a recommendation to buy or sell the named securities. We intend to elicit ideas about stocks meeting specific criteria and investment themes. Please read our disclosures carefully and do your own research before investing.

Michael Lebowitz, CFA is an Investment Analyst and Portfolio Manager for RIA Advisors. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. CFA is an Investment Analyst and Portfolio Manager; Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Customer Relationship Summary (Form CRS)