Next Wednesday, we will be publishing an article contemplating Tesla’s valuation. To help us in this endeavor, we compare it to Toyota, the world’s largest automaker. Unbeknownst to many, Toyota, which produces the fewest number of electric vehicles (EV), is at the forefront of the green revolution in automobiles.

Unlike Tesla, which solely relies on electric vehicles (EV), Toyota has the largest market share of hybrid cars and, maybe more importantly, is at the forefront of tomorrow’s potential leading automotive technology, solid-state batteries.

Our coming article starts with an industry review of how sales of EV and hybrid models fit in with traditional gas-powered engines and how they all may be replaced with solid-state batteries in the future. We then use this macro review and outlook and compare the fundamentals and valuations for Toyota and Tesla.

The analysis sheds light on whether Tesla and or Toyota are good investment options.

We thought it might be helpful to provide a sneak peek of the fundamental and valuation summaries in this edition of Friday’s Favorites.

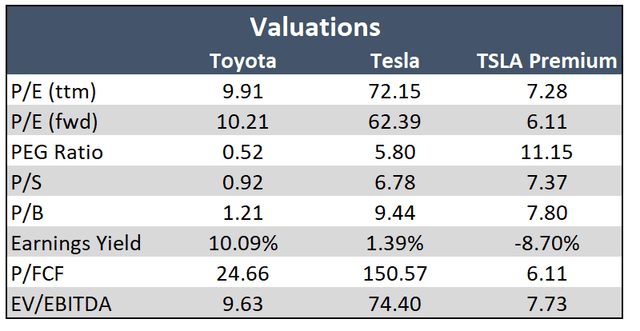

Valuations

The table below compares valuations for the two companies. Before looking at the data below, consider that Tesla is a high-growth company while Toyota is mature. Toyota is the world’s largest automaker, while Tesla is ranked 15th. Given its smaller size, it is much easier for Tesla to gain global market share. This potential for outsized growth is reflected in the valuations. Tesla generally trades at valuations that are 6-8 times that of Toyota, implying 6-8x of excess growth for Tesla over Toyota in the long run.

The PEG ratio, however, tells a different story. The PEG ratio takes each company’s P/E ratio and divides it by its 3-5yr expected earnings growth. Therefore, the ratio helps normalize the P/E ratio for companies with different growth rates.

Based on the P/E and the PEG ratio, the market implies earnings growth of 19.05% for Toyota and 12.44% for Tesla.

Tesla investors are willing to pay much higher valuations versus Toyota for what they believe will be much more significant revenue and earnings growth beyond the next 5 years, alongside significant gains in market share.

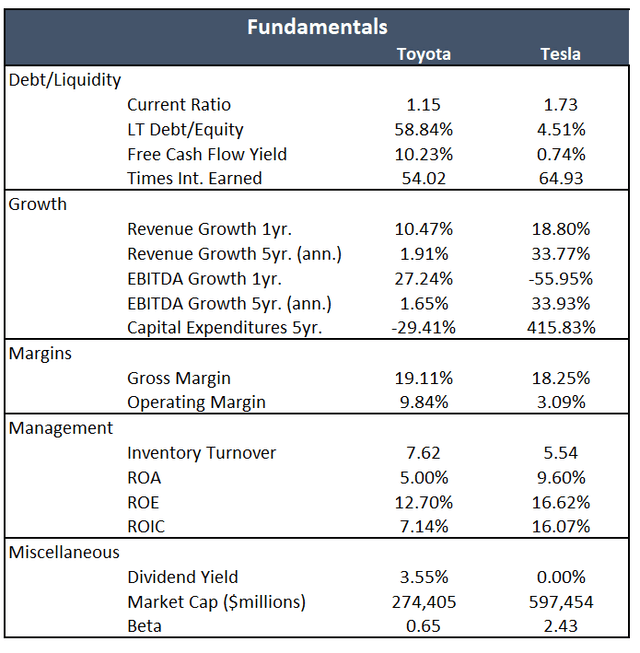

Fundamentals

The data below shows that Tesla is generally more efficient than Toyota and growing much more rapidly. Note that EV cars have much fewer parts, making assembly quicker and cheaper. Further, Tesla’s revenue and earnings benefit from EV credits. These are being phased out, which may weigh on margins and profitability going forward. Lastly, Tesla also generates revenue from other sources. While not large, they skew the data above.

Toyota’s revenue has been relatively stagnant over the last five years, while Tesla has grown by 33% a year on average. Tesla’s cash flow growth is tough to gauge as they are heavily reinvesting back into production and innovation, as shown by the tremendous growth in capital expenditures. Another indication that the companies are in different stages of the lifecycle is Tesla’s lack of dividend compared to Toyota’s healthy 3.55% yield.

Tesla has much less long-term debt than Toyota. However, we suspect that if they are to continue growing, debt will grow accordingly.

Disclosure

This report is not a recommendation to buy or sell the named securities. We intend to elicit ideas about stocks meeting specific criteria and investment themes. Please read our disclosures carefully and do your own research before investing.

Michael Lebowitz, CFA is an Investment Analyst and Portfolio Manager for RIA Advisors. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. CFA is an Investment Analyst and Portfolio Manager; Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Customer Relationship Summary (Form CRS)