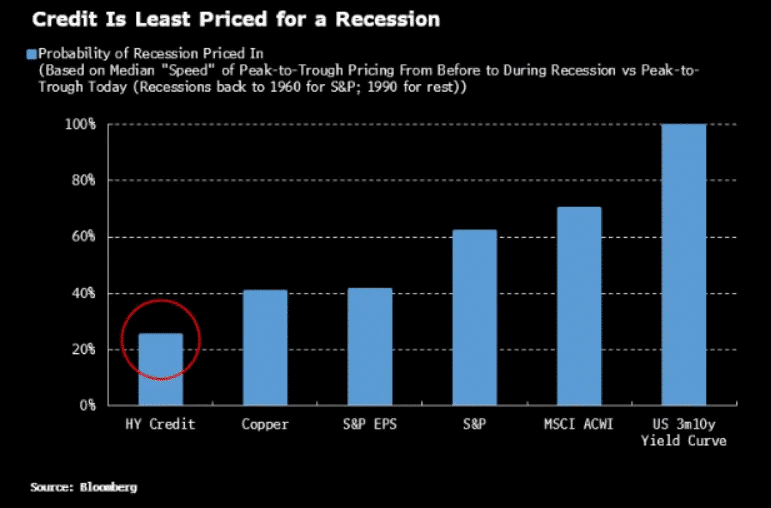

The graph below from Bloomberg provides an interesting analysis of what odds, so to speak, various markets assign to a recession. To help explain the logic, the S&P is pricing in a 60% chance of recession. From the market peak in January 2022 to the trough in October, the market fell 27%. The graph shows that the decline was about 60% of what transpires on average during recessions since 1960. The MSCI ACWI, representing foreign developed markets, is pricing in a slightly higher chance of a recession, while the EPS drawdown thus far is only about 40%, a little bit less. All three are in the same 50%-ish ballpark. The yield curve all but guarantees a recession, while high yield credit, aka junk bonds, are not pricing in much.

As the circled bar shows, high yield credit spreads are pricing in a relatively small 25% of a recession. We have recently discussed the minimal additional yield that high yield investors earn versus U.S. Treasuries. To wit, in a recent commentary, we wrote: “Despite recession concerns, corporate bond spreads, which tend to widen before and during recessions, send no such signal.” One potential reason is that high yield investors are not as concerned about the consequences of a recession. This may be due to the historically low rate of defaults over the last decade. Further tempering yields, high yield debt issuance has been light this year. Backward-looking optimism and little supply may keep spreads down for now, but the high yield bond sector may be most ripe for pain if a recession occurs.

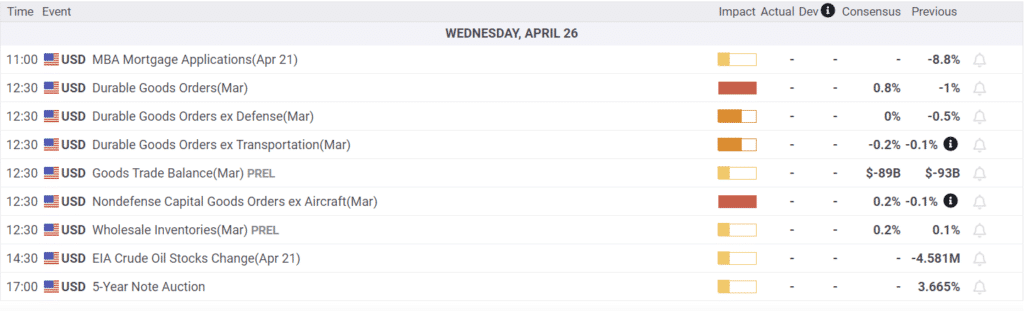

What To Watch Today

Economy

Earnings

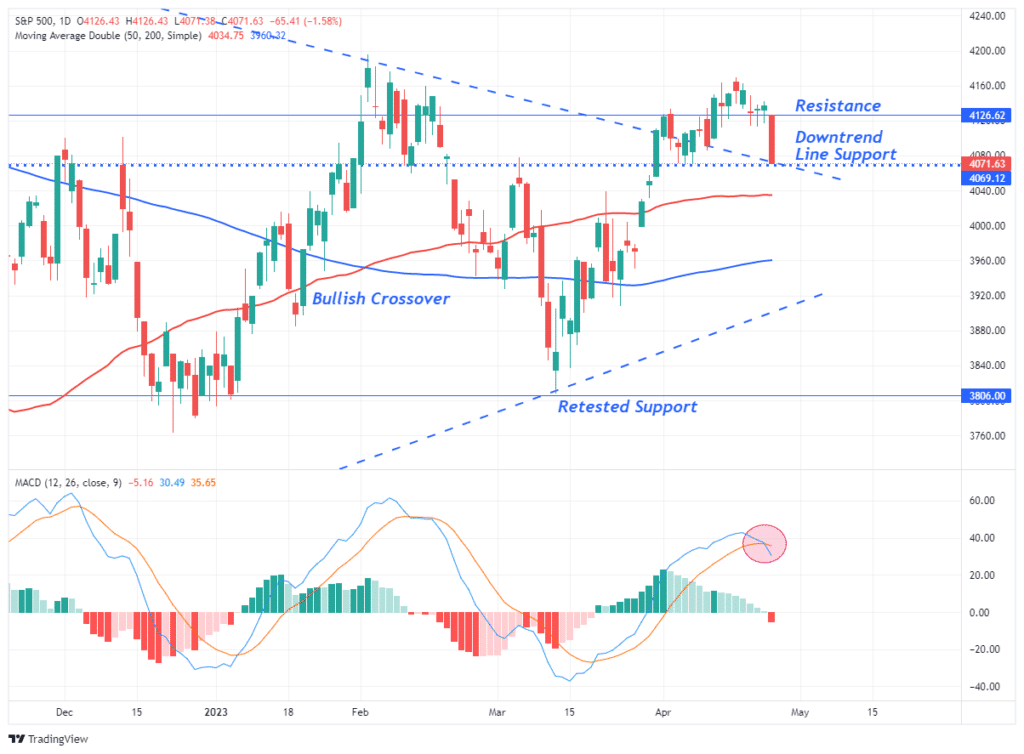

Market Trading Update

Just yesterday, I published “Sell May In April” with the expectation that our “sell signals” would kick in and the recent bull rally would reverse a bit. I didn’t expect it to happen all in one day. Nonetheless, that selloff was needed to work off the recent excess and provide a decent entry point to add exposure later.

For now, the bullish trend line from last April provides immediate support, but a failure will bring the 50-DMA, then the 200-DMA, and finally, the rising trendline from the October lows as the next major support levels. This summer, there is room for decent correction as the market adjusts for slower economic growth. However, that will likely be the correction to buy for the next market advance, provided nothing has “broken” systemically, financially, or economically.

Take some profits on any bounce tomorrow and raise cash levels for now.

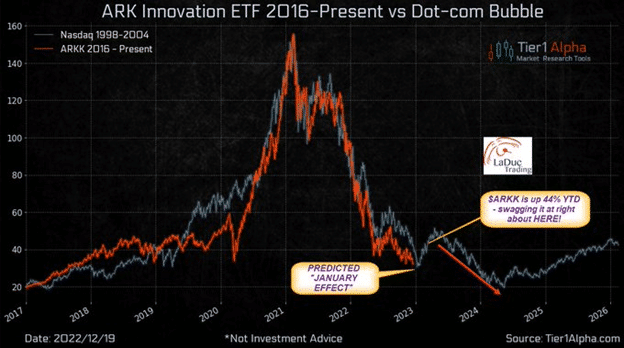

More on Cathie Wood and ARKK

In Monday’s Commentary, we shared Cathie Wood’s forecast that Tesla could become a $5 trillion company. We gave a disclaimer to her outlandish projection as follows:

It’s worth disclosing that Wood’s ARKK fund has a 10% weighting toward Tesla. ARKK is down 5% over the last five years and 75% from 2021 highs.

We share a couple of graphs to provide more context to the bubble pattern her fund has formed over the last couple of years.

The first graph below, courtesy of Tier1Alpha, shows the amazing correlation between the current ARKK bubble, which peaked in early 2021, and the dot-com bubble of the early 2000s. Assuming the striking correlation holds, ARKK investors may get a decent bounce soon, but the pain is not over. The second graph comparing Goldman Sach’s index of non-profitable tech companies and ARKK are virtually mirror images of each other. Many of the companies that ARKK holds are still in their early growth phases, bleeding cash, and consequently not producing profits. We presume ARKK and the Goldman index contain many of the same companies.

First Republic Bank (FRC)

On Monday, FRC rose about 15% as investors were optimistic its earnings report, due after the close, would show the bank’s problems are stabilizing. Unfortunately, it is still hemorrhaging deposits and may likely be taken over by the FDIC if it continues to lose deposits. The stock was down nearly 50% on Tuesday. FRC reports total deposits of $104.5 billion, well below expectations of $136.7 billion. Its deposits are now down about 40% Since early March. First Republic also announced that about a quarter of its workforce would be laid off. The Wall Street Journal sums up their situation well:

First Republic shares are down 28% this morning. The good news: It isn’t dead. The bad news? It is dead in the water for now.

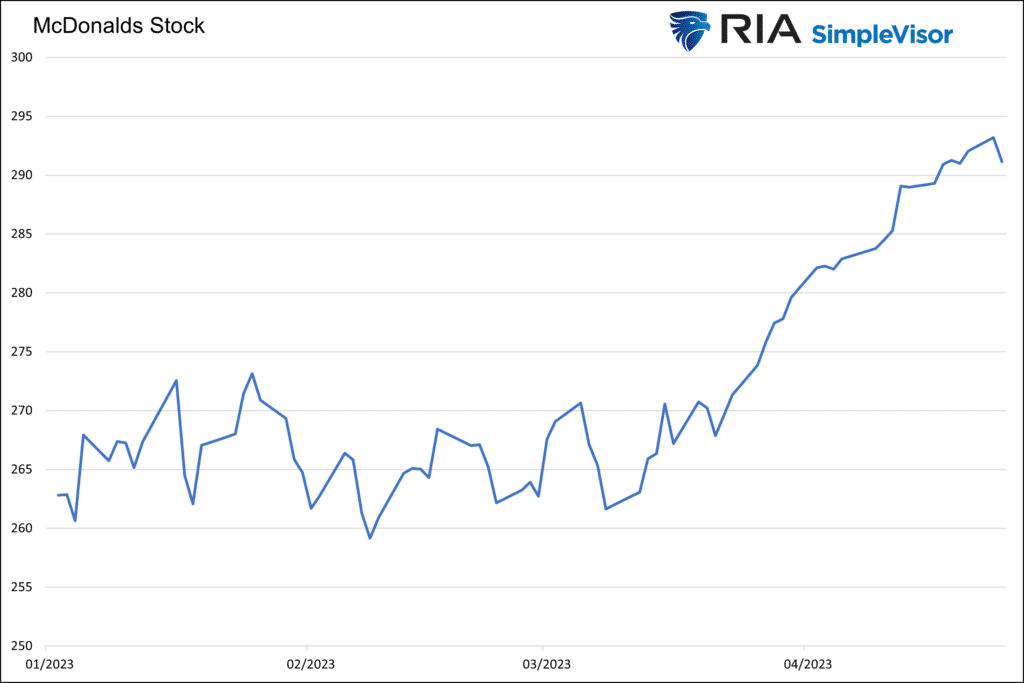

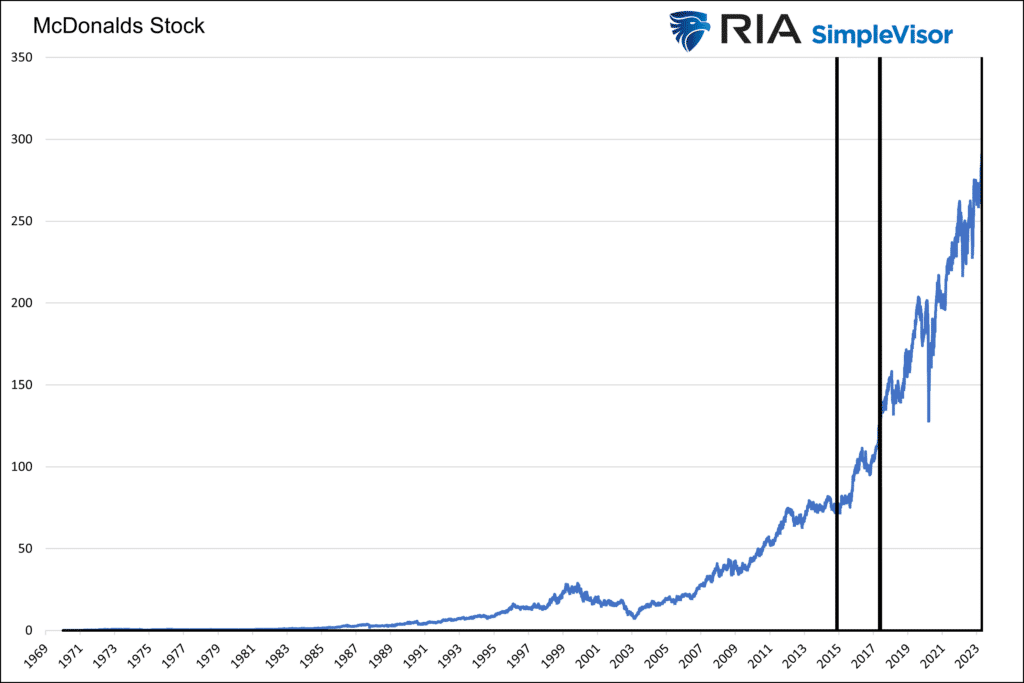

McDonald’s Maybe on a Tear, But Beware

As the graph below shows, McDonald’s (MCD) has been on a tear before Tuesday’s decline, rising in 19 of the last 22 trading days. The second graph shows that such a streak has only happened on two other occasions (black vertical lines) since 1980. Some investors are buying the stock because it is a strong company and relatively recession-proof. Further, food costs have been coming down for the most part, which should help them better manage profits. Automating their staff with robots is also helping. While the company is well-run, possibly recession-proof, and able to manage expenses, it is not a value stock.

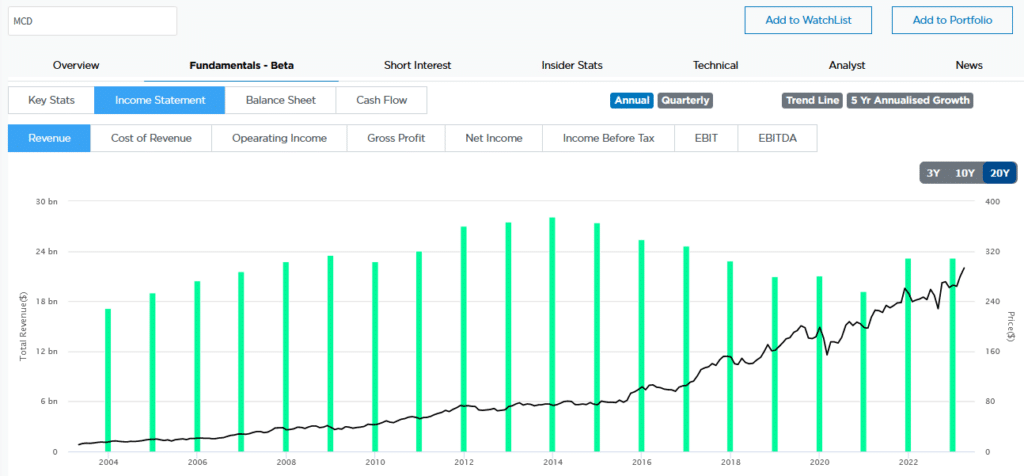

The third graph below, courtesy of SimpleVisor, shows that McDonald’s revenues (green) peaked around 2014 and have declined since. Its earnings have been flat over the same period. Despite falling revenue and no earnings growth, the stock has risen nearly 4x since 2014. Buying back about 25% of its shares since 2014 explains some of the price gains. A more significant chunk of the gains can be attributed to valuation expansion. In other words, despite no growth, investors have been willing to pay more for the same dollar of earnings. Since 2014 MCD’s P/E has risen from 17 to 29. Its price to sales (P/S) is 9.3, three times its level in 2014. A price to sales of such a high level is often associated with high-growth potential companies, not low to no-growth firms.

To understand the risk of buying MCD at such valuations, we share a quote from Scott McNeely. CEO of Sun Microsystems:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. It assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are?” -Scott McNeely 1999

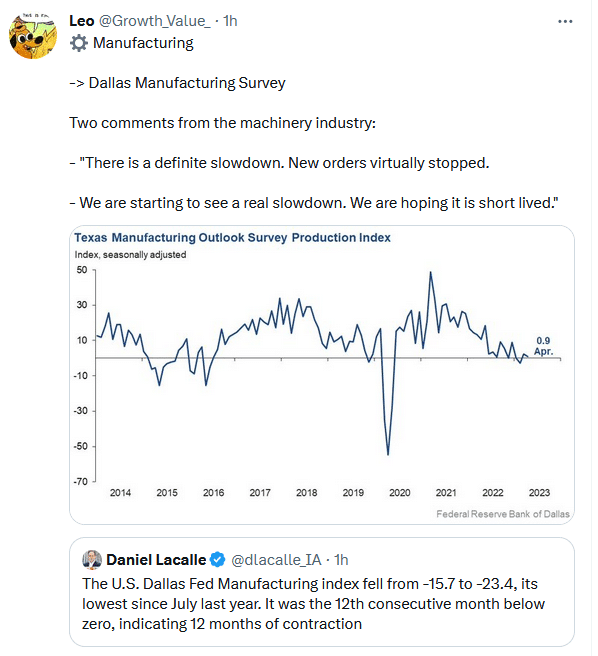

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 1

2023/04/26