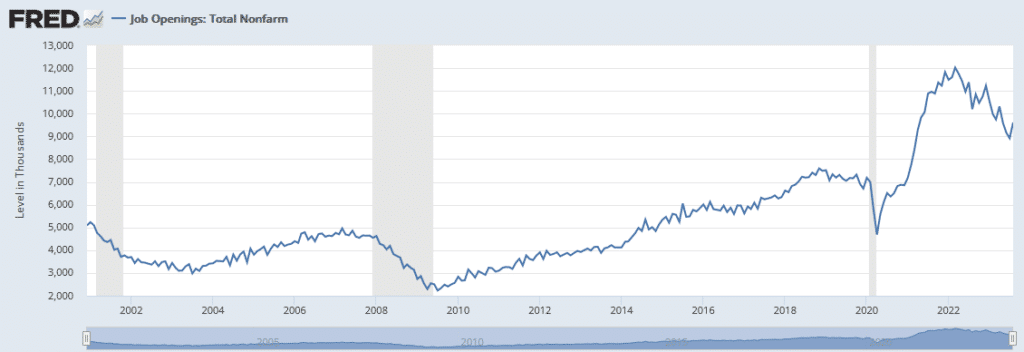

JOLTS reported a substantial increase in the number of job openings. Per the BLS, job openings rose from 8.9 million to 9.61 million. As we share below, it is common for the number of job openings to trend in a zig-zag-like pattern. Note that in all periods except for the surge higher in 2020 and 2021, the data trended in one direction, but monthly changes often vacillated between increases and declines. Statistically, two-thirds of the monthly readings over the last twenty years rose or fell in a different direction than the prior month. While the increase is concerning, the lower trend remains intact.

The stock and bond markets reacted poorly to more job openings. Many investors believe the more robust labor market feeds inflationary pressures. Assuming this to be accurate, they fear data like JOLTS makes the Fed’s “higher for longer” stance more likely. Investors will put much more weight on Friday’s monthly employment report. The market expects the number of jobs to increase by 160k. Such is lower than the prior print and continues the recent downward trend. 160k new jobs are also less than the pre-pandemic average (2012-2019) of just under 200k

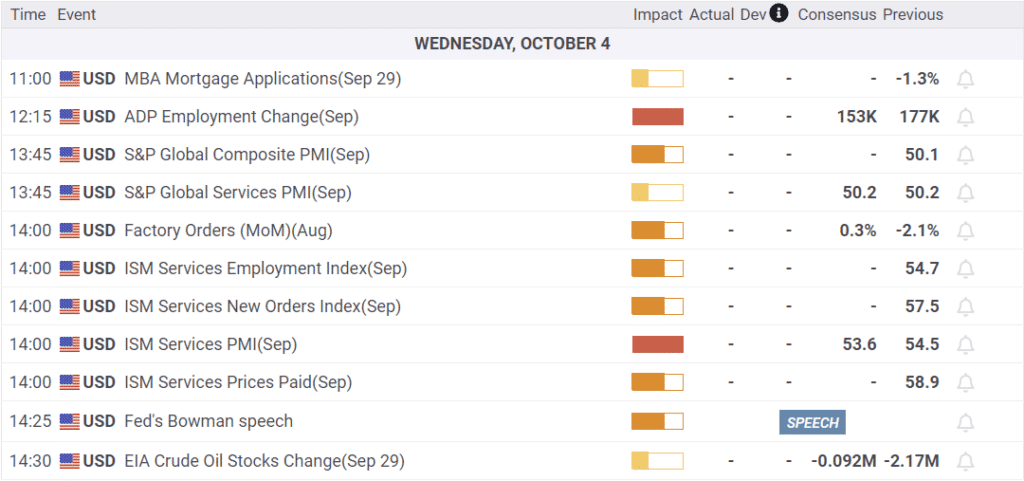

What To Watch Today

Economy

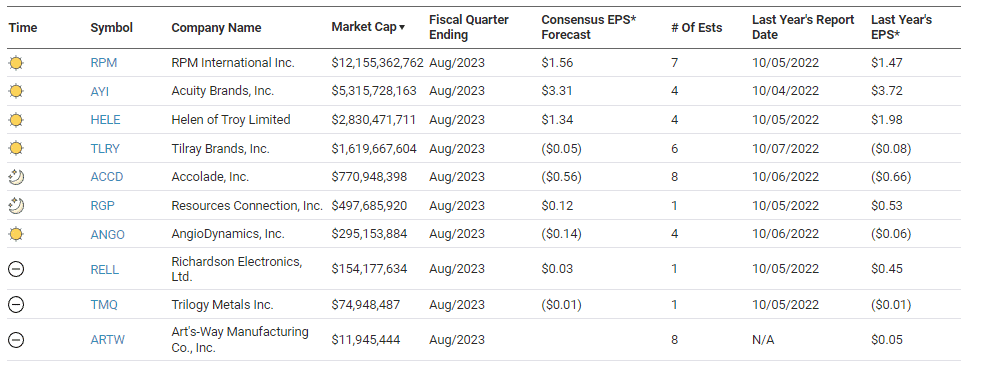

Earnings

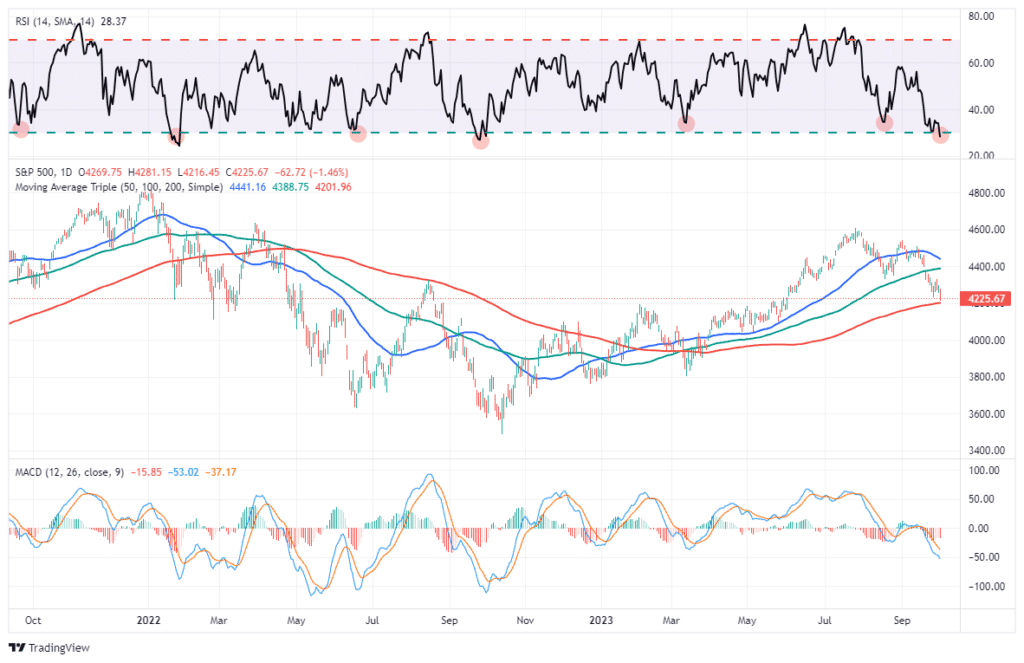

Market Trading Update

Rough day in the markets yesterday. With the break of support at the 150-DMA, the 200-DMA is now the last line of defense for the short-term market. The push higher in rates yesterday weighed on long-duration assets like bonds and Technology stocks, but interestingly, Utilities rallied. This sell-off is getting rather extended, so some relief is likely coming soon. The rally could be challenging with multiple levels of resistance now above the market heading into year-end.

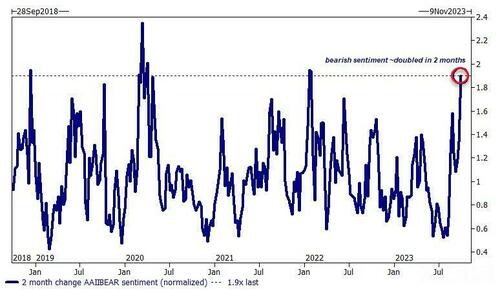

One of Goldman’s top traders, Brian Garrett, confirms much the same via Zerohedge, which is a follow-up to his observations from last week, which found “bearish sentiment was everywhere“…

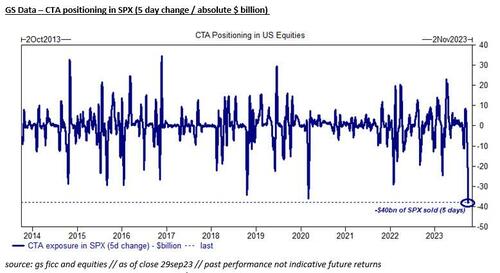

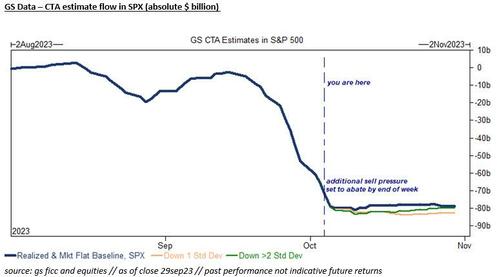

He noted that bearish sentiment “has gone from survey data to systematic reality (chart below) with ~$40bn of SPX futures sold in the last week“, which is a subset of the $100 billion or so in total global equity sales by the CTA community.

As Garrett explains by confirming what we first said two weeks ago that “We Are On The Verge Of Triggering Billions In Forced Selling,” he noted that “the pace of CTA unwinds in ES1 futures (magnitude + speed) have been the largest on record … by GS strat calculation, almost $40bn of SPX was sold over the last five sessions.”

“That’s the bad news. Meanwhile, the good news – as we also first said yesterday – is that much of this unwind has been realized, and we are closer to the end of this sell pressure than not. By the end of this week (flat tape or down tape), there is very little convexity to additional unwind.” – Zerohedge

This is the point of the market cycle where it is toughest. Be patient and let the technicals work for you.

Bad Market Breadth Returns

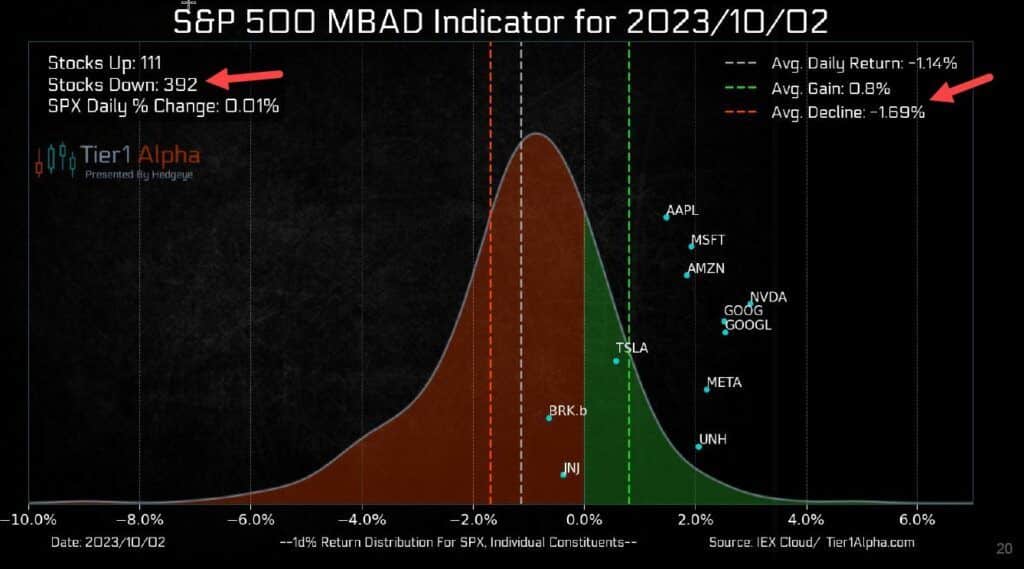

The S&P 500 rose slightly on Monday, but most stocks traded poorly. The NASDAQ and the largest market cap companies led the way, while most other stocks withered. Such bad breadth was reminiscent of trading earlier in the year. It’s worth looking at some details of Monday’s breadth.

78% or 392 of the 503 S&P 500 stocks were lower despite the market rising slightly. More telling, of those stocks falling, the average decline was -1.69%. The average change for all stocks was -1.14%. The graph below, courtesy of Tier1 Alpha, shows the distribution of stocks. Note that seven of the ten largest stocks, as shown, were up 2% or more.

We will pay close attention to the market’s breadth over the coming week. Was the poor breadth on Monday just a function of the reversal of window dressing trades from last week’s quarter end? Or, will the trend of the largest stocks leading persist through year-end?

Government Shut Down Averted For 45 Days- Good or Bad?

The headlines seem to conclude that the recent stop-gap agreement to fund the government for 45 days and avoid a shutdown is good. Is it? To help answer the question, we share a few quotes from our recent article- Government Shutdown Averted. But Is That A Good Thing?

The first quote below explains how the government has funded itself in recent years.

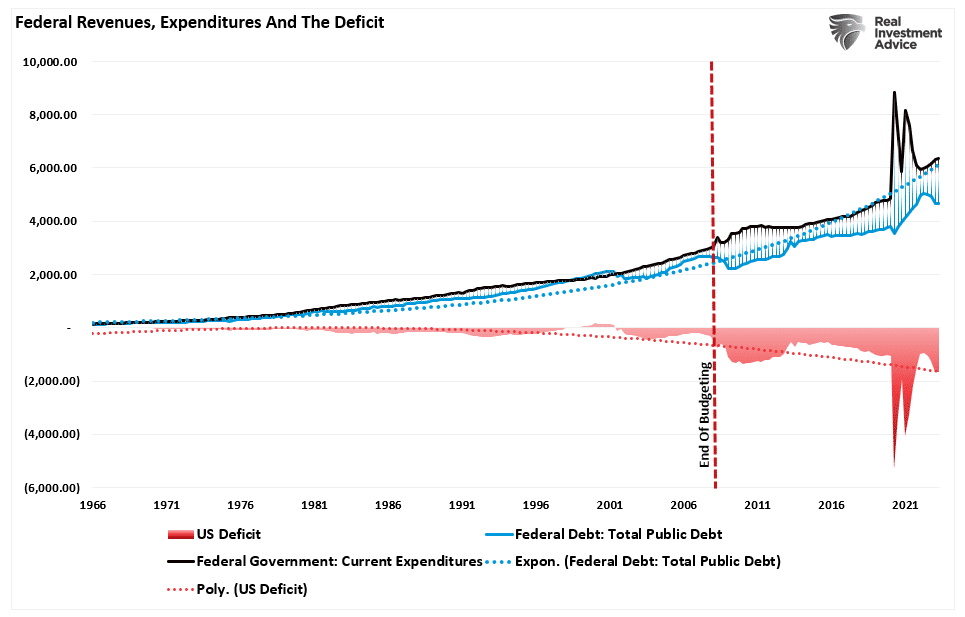

However, since 2008, the Government has continued to operate without a budget. Rather than passing a budget each year, a “Continuing Resolution” is passed to fund spending. The problem with using “Continuing Resolutions” is that it uses the previous spending levels and increases that spending by 8%. Such is why, since 2008, the debt has exploded as spending is compounding annually.

Avoiding the shutdown will result in more spending than otherwise had it shut down, but not to a meaningful degree. A large percentage of government spending is mandatory, and therefore, a shutdown would not have affected most payments.

That impact would be relatively minor, and based on past shutdowns, Goldman Sachs estimated a reduction of annualized growth by around 0.2% for each week it lasted after accounting for modest private-sector effects.

What’s of much more importance is what happens in mid-November when the stop-gap deal concludes. The result should be concerning if the 45-day delay ultimately ends in another continuing resolution. If so, debt will continue to grow much quicker than GDP and tax revenue. Therefore, the nation’s debt-to-GDP ratio will continue to climb, and with it, the nation’s financial stability and expected economic growth will weaken.

If our leaders can tighten the nation’s fiscal belt and agree to some restraint, the economy will be more stable in the long run. But, the cost of spending less will likely cause a short-term period of economic weakness. That is an important consideration given the upcoming elections. Political battle lines are fierce between Democrats and Republicans. Further, there are vastly different fiscal views within the parties. Given the elections and the hostile political climate, we presume little will be done to restrain spending. Looking toward November, we may want to consider how long the government may be shut down when the 45-day period ends and what effect that may have on the economy and markets.

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 6

2023/10/04