Trade Alert – Equity & ETF Models

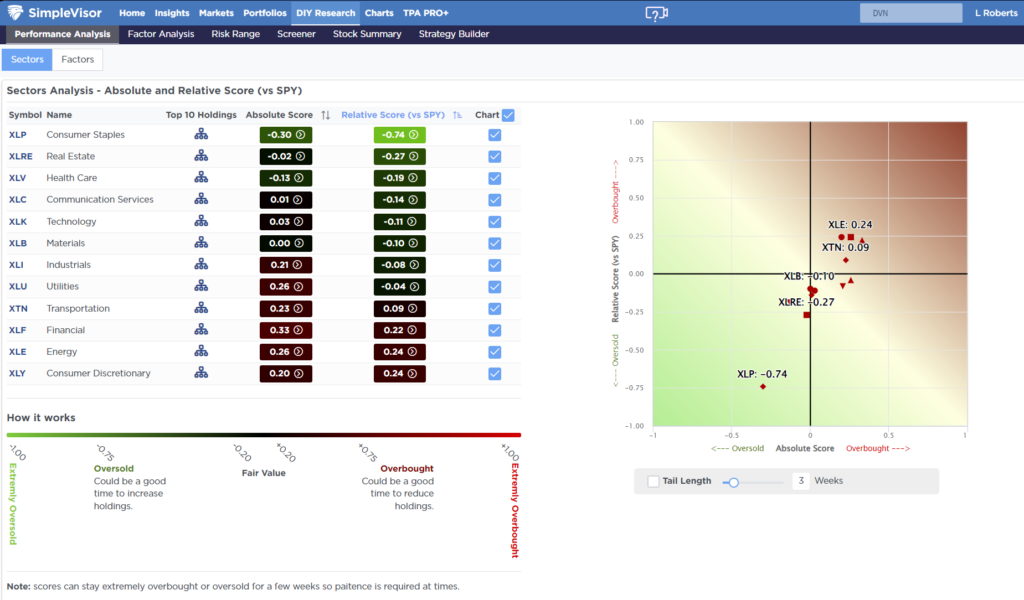

In our latest analysis of relative performance, staples have become extremely oversold relative to the rest of the market, while energy, which we trimmed earlier this week, is now more overbought. This is shown in the relative analysis section of SimpleVisor.

Of the Staples sector, Proctor and Gamble (PG) is the most oversold on a relative basis. Therefore, this morning, we added .5% to PG and 1% to XLP. With staples turning on to strong buy signals, we could well see a rotation to this sector which has some of the strongest fundamentals. Notably, this addition is also a defensive move and will likely accompany further portfolio shifts in the coming weeks and months.

Equity Model

- Increase PG to 3.5% of the portfolio.

ETF Model

- Increase the iShares Staples ETF (XLP) to 7% of the portfolio

Want These Alerts Via TEXT?

To receive trade information via text, click on your user name in the upper right corner of the website. Then click My Account and the title SMS Notification Preferences.

NOTE: You must add your country code in front of your number. The U.S. code is 1.

Please let us know if you have any problems.

Lance Roberts is a Chief Portfolio Strategist/Economist for RIA Advisors. He is also the host of “The Lance Roberts Podcast” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter, Linked-In and YouTube

Customer Relationship Summary (Form CRS)