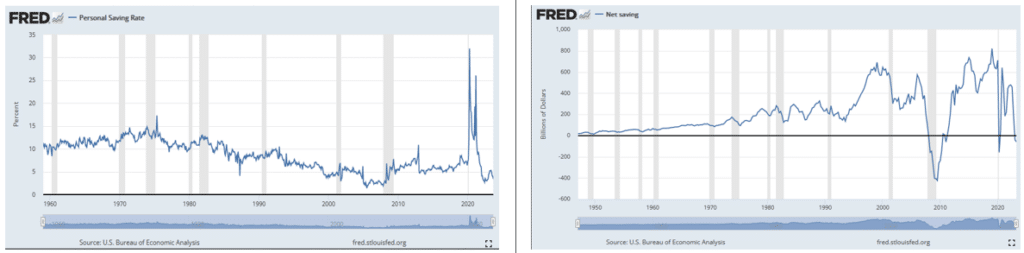

In early August, we wrote: “The bottom line is that consumers saved less and have largely drawn down the stimulus-related excess savings. It appears that savings drawdowns in aggregate will no longer contribute to above-trend consumption.” The article, Stimulus and Consumption Are Fueling Economic Resilience, describes factors driving outsized economic growth. Such helps us appreciate when the inevitable lags of higher interest rates will dampen economic activity. At that time, we projected that the excess savings from the stimulus had been largely depleted in the aggregate. On the heels of the strong Q3 GDP print, let’s revisit savings, the driver of the economy for the last few years.

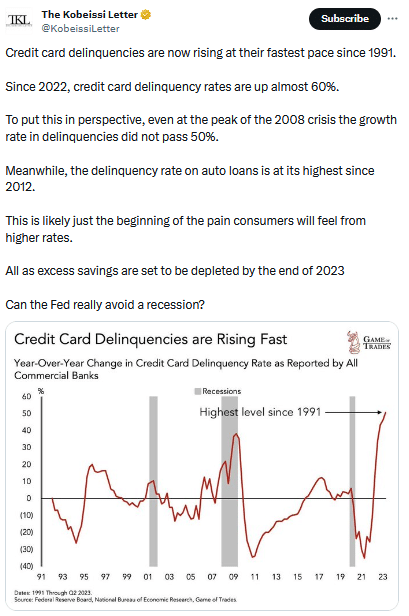

The graph on the left shows the personal savings rate fell to 3.4% in September and is hovering around the lowest levels of the last sixty years. Net Savings on the right side is negative for only the third time since 1947. This measure aggregates consumer savings with corporations and the government. Can consumption remain strong without adequate savings? Organically, the answer is not likely. However, with credit, all three sectors can continue to spend. The Tweet of the Day, courtesy of the Kobeissi Letter, shows that the percentage increase in credit card payment delinquencies is at 30-year highs. We have compared the spurt of stimulus-driven economic activity to a python swallowing a pig. Based on the data below and other information, the pig is nearing the end of its journey.

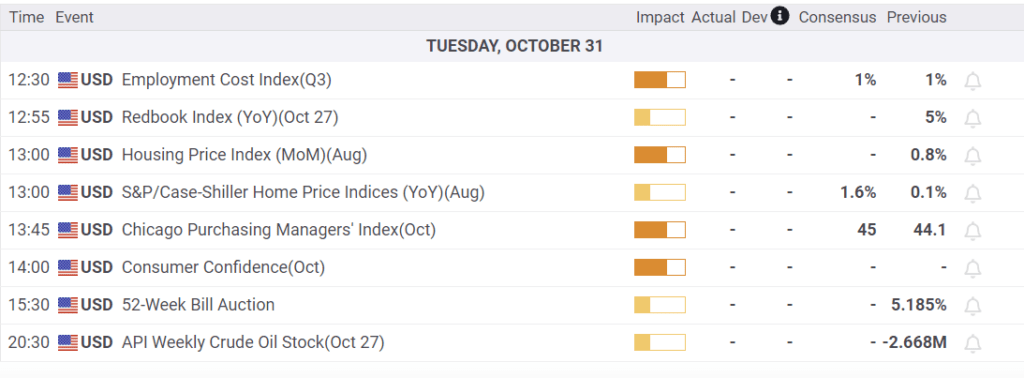

What To Watch Today

Economy

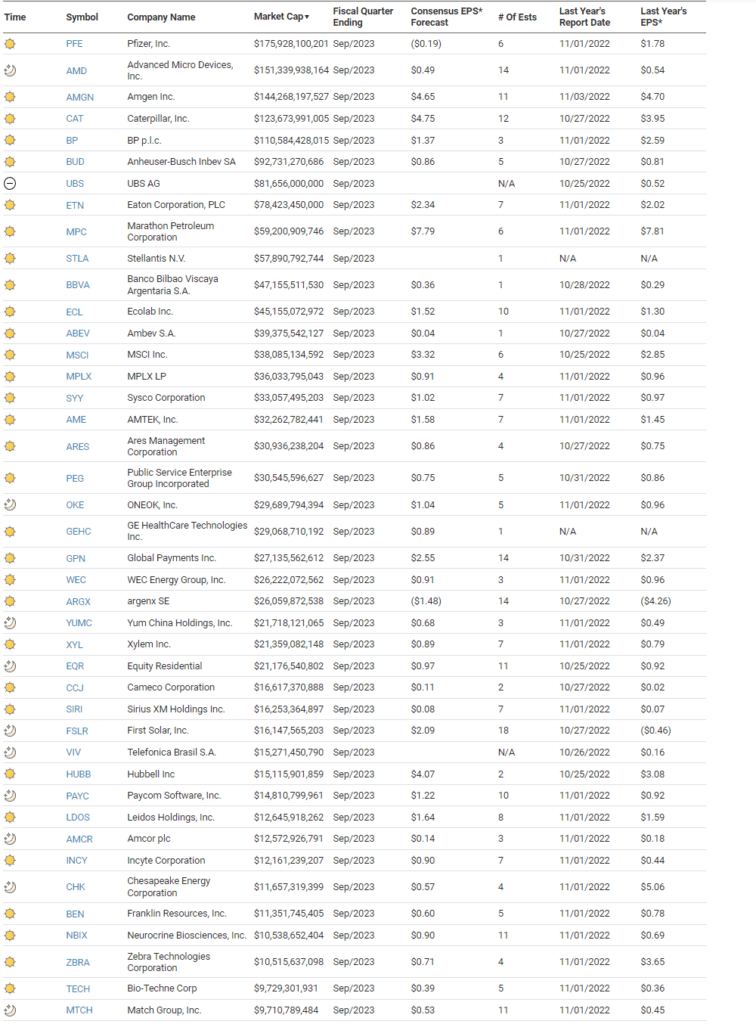

Earnings

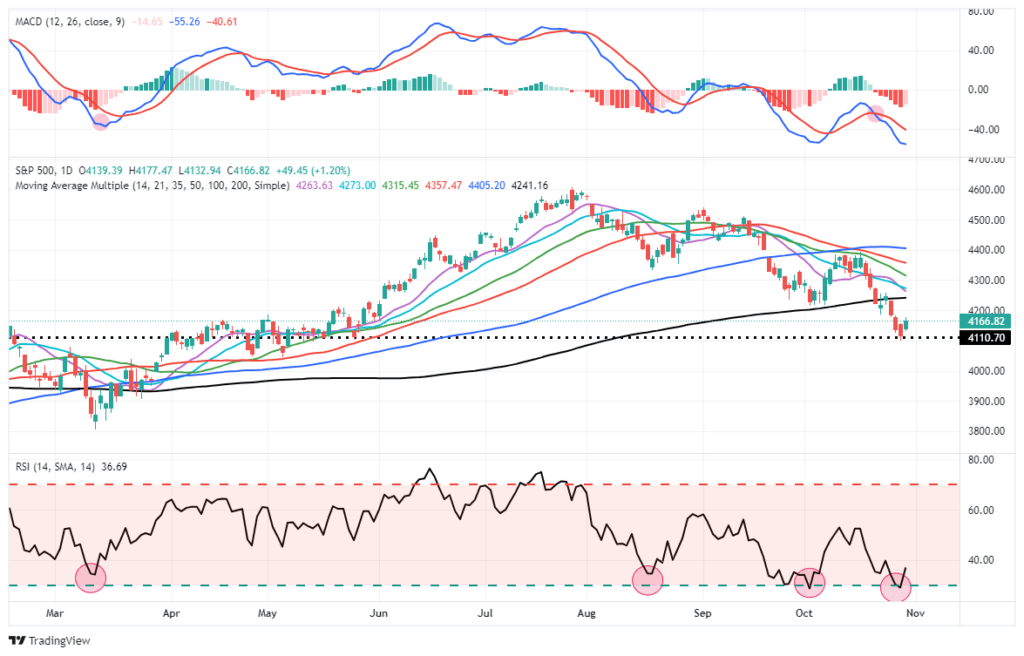

Market Trading Update

As noted in this past weekend’s #BullBearReport, the market was getting oversold on a more extreme basis technically. That oversold condition, combined with negative sentiment, is what is needed for a reflexive rally. We possibly saw the beginning of that rally yesterday, BUT we need confirmation with a follow-through rally that begins to break the negative price cycle of the last two weeks. With the FOMC announcement on Wednesday and the employment report on Friday, there is sufficient data to create volatility in the markets short-term. Continue to use this rally as an opportunity to rebalance risk and raise cash as needed. If the market can break back above the 200-DMA, then we may be in a position to allow the market to run into year-end. Remain cautious for now.

Treasury Refunding Coming On Wednesday

On Wednesday, the Treasury will announce their borrowing intentions for the quarter. Other than the watchful eye of bond traders, these quarterly announcements typically go unnoticed. We suspect this announcement will be different. Recent concerns about large deficits and the pressure debt issuance are putting on the bond markets, coupled with the recent correlation between stocks and bonds, means this announcement is likely to be well followed by many non-bond investors.

Like economic data, the bond market has expectations for what they think the Treasury will announce. Given the spotlight on bonds, we suspect deviations from expectations will be met with temporary but volatile price movement. To help form expectations, consider the following from Assistant Treasury Secretary Josh Frost. His comments are very logical. But is the Treasury willing to lock in 5% rates for the next thirty years? We suspect they will try to limit 10- and 30-year issuance to the best of their ability.

GM, Ford, and Stellantis Settled With The UAW

GM, following in Ford’s and Stellantis’s footsteps, came to an agreement with the UAW. While the deals differ, they all entail big pay raises for auto workers. It is estimated the union workers will now earn about $85k per year on average. The auto companies must either raise car prices, cut investments, or see their profits decline. Ford estimates the new contract will add $900 in costs to build a car. Equally concerning for the companies, their labor cost structure will rise further above their competition. Per the WSJ:

Today, the Detroit carmakers’ all-in hourly labor costs—a measure of how much they spend per worker on wages and benefits—is in the mid-$60s, compared with an estimated $45-$55 for Tesla and foreign automakers. By the end of the four-year contract, the Detroit companies’ costs would balloon to $87 to $90 per hour, according to a Wells Fargo estimate based on Ford’s pact.

To fray higher labor costs, Ford and GM are backing off EV investments. GM told investors they will not meet their goal of producing 400k EVs by mid-2024. Ford is delaying a $12 billion investment in battery plants and EV projects. We also suspect they will push for more robots to limit labor costs further.

GM and Ford’s shares trade at or below pre-pandemic levels.

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 5

2023/10/31