Monetary policy governs financial market liquidity which drives asset prices. Therefore, as the Fed continues to reduce liquidity to fight inflation, investors best have expectations for the Fed’s path ahead. Powell and other Fed members are open about what factors they are keying on to determine the Fed’s path in 2023. Per Jerome Powell- “Our decisions will depend on the totality of incoming data and their implications for the outlook for economic activity and inflation.”

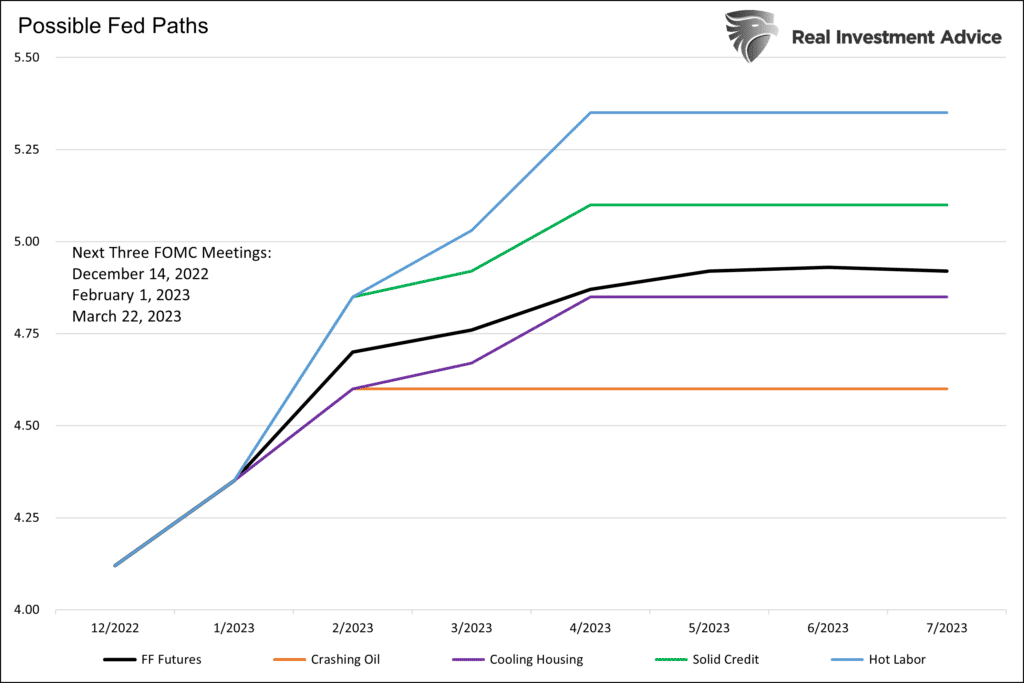

So if economic activity and inflation determine monetary actions, how should we think about upcoming economic data and, ultimately, the Fed’s path ahead? To help assess the numerous potential paths for Fed Funds, we share a quote from Bank of America’s Michael Hartnett: “The next 3 meetings… crashing oil says Fed goes 50/25/0bps Dec/Feb/Mar, cooling housing says 50/25/25bps, solid credit market says 50/50/25bps, hot labor market 50/50/50bps…” Hartnett makes a case for 75bps to 150bps of more rate hikes. The graph below shows the Fed’s potential path ranges from 4.60% to 5.35% based on the four scenarios. The black line reflects market expectations.

What To Watch Today

Economy

Earnings

Market Trading Update

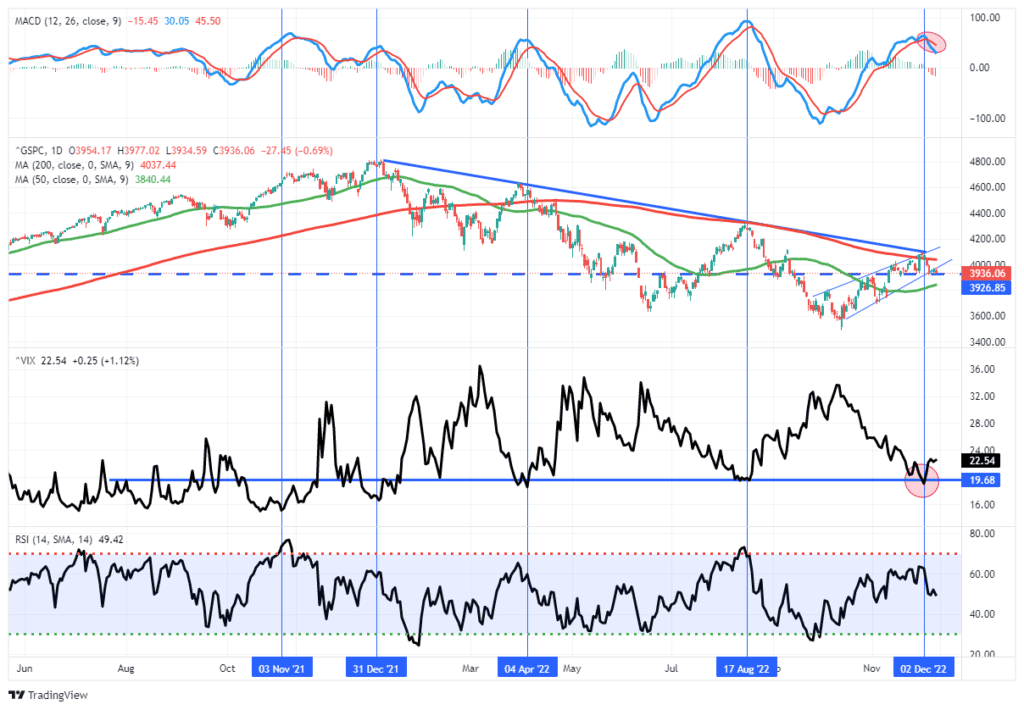

Not surprisingly, that hawkish language took the “wind out of the bull’s sails,” sending the market back below the 200-DMA. The market held support at the 100-DMA but broke the 3950 support level, which triggered selling late yesterday afternoon. That selling pushed the MACD “sell” signal lower, suggesting the market may struggle between now and this week’s FOMC meeting. Furthermore, due to wage growth, there is a risk of a hotter-than-expected CPI report tomorrow morning.

We remain risk-averse until we get a better opportunity to increase equity risk.

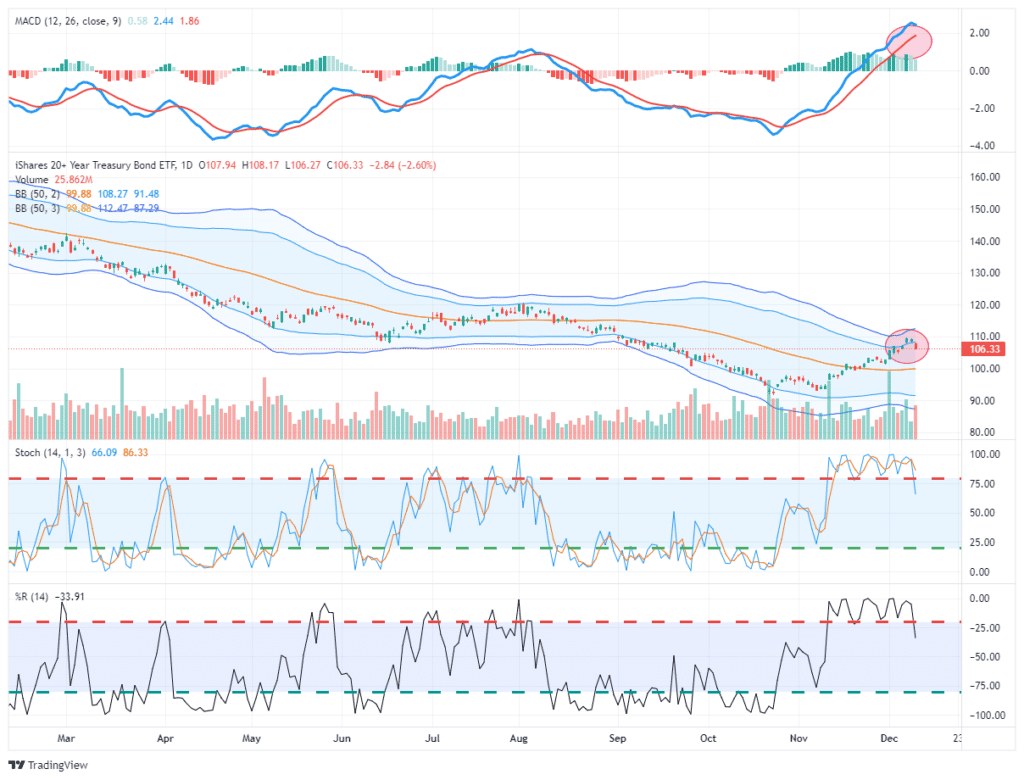

Also, as noted last Monday, Treasury Bonds had a huge move over the last couple of weeks and are now extremely overbought and extended. Most likely, this bond rally is due to portfolio rebalancing for year-end reporting. I expect a pullback in bond prices early next year to provide a better entry point to increase our bond duration in portfolios. Be patient for now.

The Week Ahead

Tuesday and Wednesday may likely determine the market’s trend through the end of the year. CPI on Tuesday is expected to rise .5% monthly and 7.3% yearly. That compares to .4% and 7.7% last month. After Friday’s PPI data, the obvious concern is a surprise to the upside. Such could easily result in a year-over-year inflation rate near last month’s. The Fed FOMC meeting on Wednesday will follow CPI. After Powell’s speech two weeks ago, which was perceived as dovish, we should be prepared for a more hawkish tone. In that vein, the Fed may use their dot plot forecasts to prepare markets for Fed Funds to be higher for longer in 2023.

The bond market may be volatile to start the week. In addition to CPI and the Fed, bond dealers will have to absorb Treasury auctions of 10-year notes and 30-year bonds. A day or two before auctions and on auction days, dealers tend to heavily impact prices as they hedge and distribute the new debt issuance.

Jobless claims and Retail Sales top off a busy Thursday. Retail sales will help the Fed assess whether or not their actions are slowing demand. We continue to look at weekly jobless claims for signs that the labor market is weakening. Thus far, any such signal is nascent.

Also important, Fed members will exit their blackout period and be available to speak publicly on Thursday and Friday.

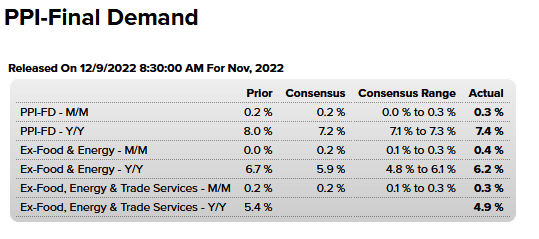

PPI

Our first look at November inflation via PPI shows inflation is running a little hotter than expectations but still trending lower on an annual basis. Monthly PPI and core PPI rose .3% compared to .2% last month. Year over year, PPI fell from 8% to 7.4%. The expectation was for a decline to 7.2%. As a point of reference, PPI peaked in March at 11.7%.

PPI tends to lead CPI and PCE by a month or two. Accordingly, Tuesday’s CPI estimates may be revised slightly higher. The most important thing to consider with inflation is the trend and the rate at which the trend is changing. The trend is clearly toward lower inflation. The rate of change, or how quickly inflation declines, will help determine when the Fed stops raising rates and potentially begins to lower them. The faster inflation falls toward Fed objectives, the quicker the Fed will take its foot off the brake. If CPI and PCE follow PPI and surprise to the upside, the markets may begin to price in a higher for longer Fed Funds rate. Such is likely bearish for stocks.

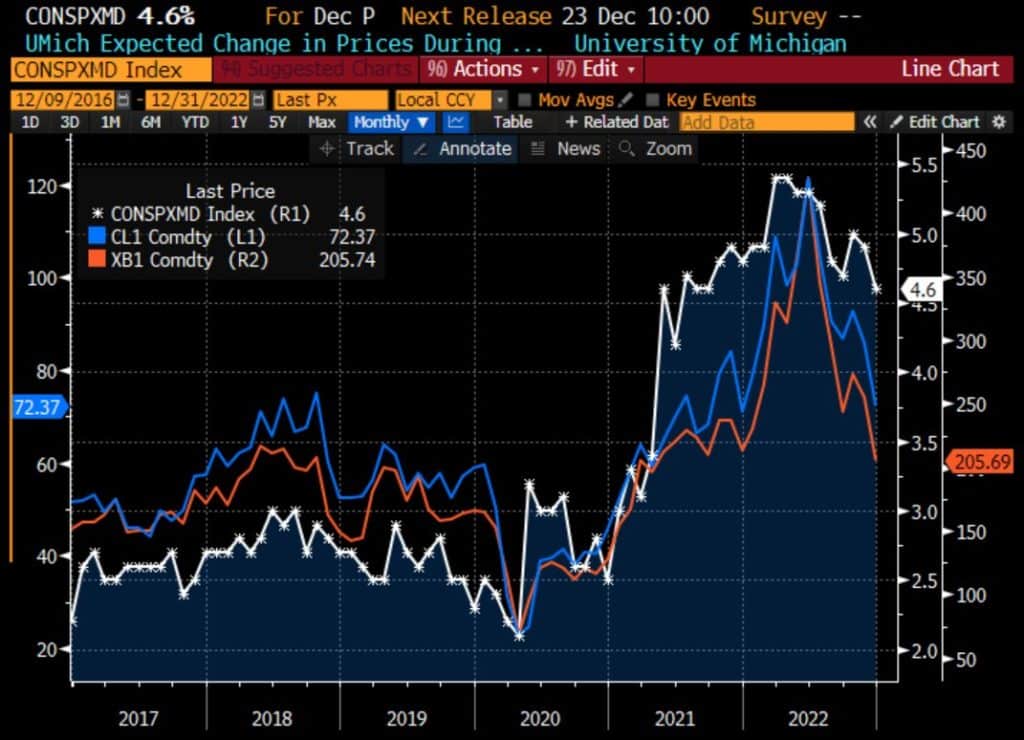

What Drives Inflation Expectations?

The University of Michigan consumer one-year inflation expectations fell to 4.6%, the lowest level in over a year. The Fed relies on inflation expectations to help guide policy. As such, what drives consumer expectations? The graph below comparing UM inflation expectations to crude oil (CL1) and gasoline (XB1) futures prices highlights that energy prices play a key role in forming consumer inflation expectations. Accordingly, this raises a problem for the Fed as they prefer to view inflation on a core basis, without the effects of food and energy prices.

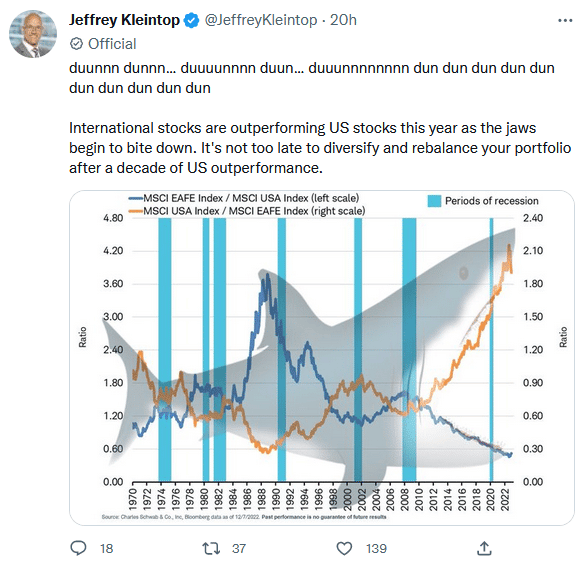

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.