Over the last week, some of the largest and most well-followed investors, also known as whales, turned bullish on bonds. The largest whale is famed hedge fund investor, billionaire, and philanthropist Stanley Druckenmiller. A week ago, Druckenmiller, speaking at the Robin Hood Foundation conference, said he was taking “massive leveraged positions” in two-year Treasury notes. He has become “really nervous” that we are on the brink of a hard economic landing. Druckenmiller believes the downturn will occur this quarter. His timing on the bond investments was impeccable. Or maybe investors took his cue and made similar bets, making his investment look good.

Bill Gross, a whale among bond traders, once ran the largest bond fund in the world at PIMCO. Per Fortune: ‘Bond King’ Bill Gross says it’s time to stop betting against bonds and get ready for an economic slowdown: “Recession in the fourth quarter.” Bill Ackman, a billionaire hedge fund whale like Druckenmiller, made headlines in August when he shorted bonds with warnings they could rise to as high as 6%. A couple of weeks ago, Ackman covered his shorts. The Israeli conflict with Hamas and economic concerns drove his actions. Regarding the economy, Ackman seems to be on the same page with the other whales. To wit, he states: “The economy is slowing faster than recent data suggests.” The graph below shows the recent decline in the ten-year UST yield.

What To Watch Today

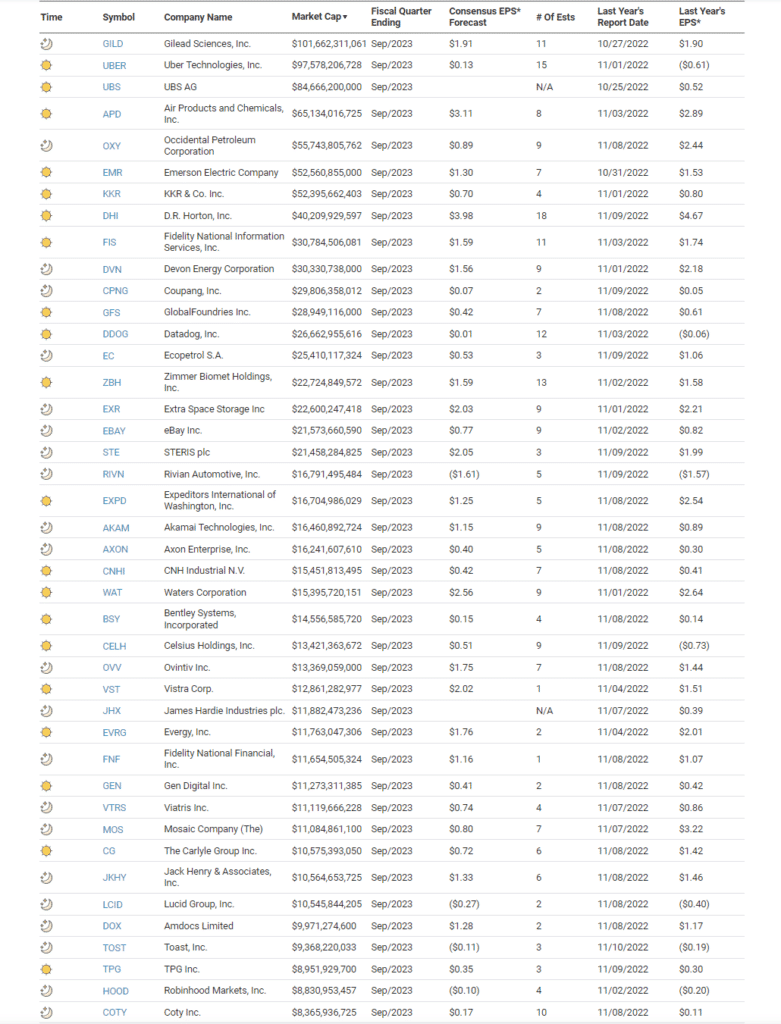

Earnings

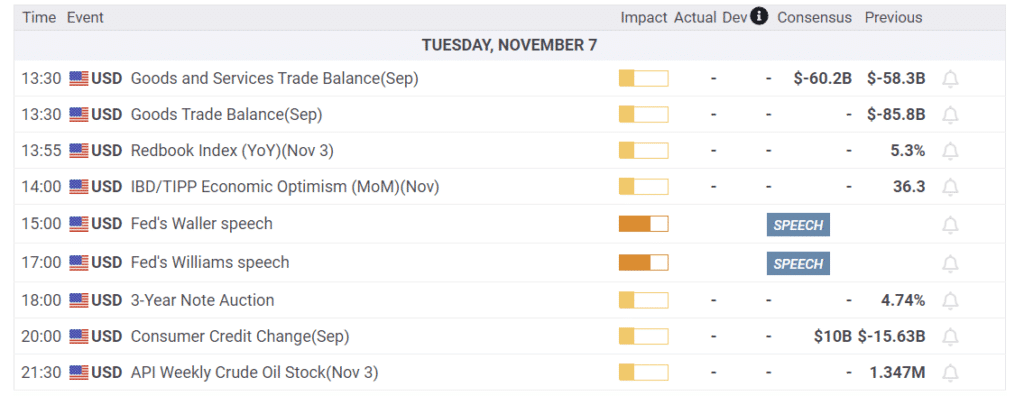

Economy

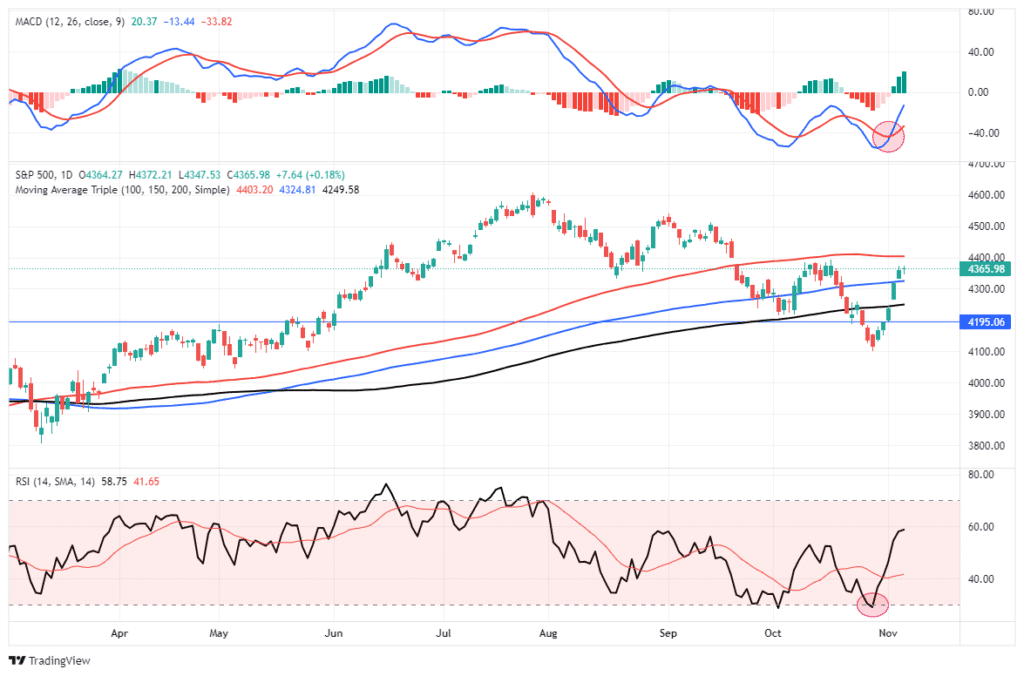

Market Trading Update

After a 6% gain last week for the Nasdaq and the S&P 500, we noted in yesterday morning’s commentary that some weakness and sloppy trading were likely. Given the sharp advance in both stocks and bonds, seeing some profit-taking from the “trapped longs” should not be surprising. While the market did end the day higher, we did spend some of the afternoon in negative territory. Bonds also gave up some of their recent gains. With earnings season beginning to wrap up and the majority of the “Magnificent 7” already reporting, the focus is going to start turning back to the economic calendar. There are two Fed speakers this afternoon, and we will get more inflation data soon.

For now, the rally has been solid. We have recommended using this rally to take profits and rebalance holdings as needed. Such was what we did yesterday. The market is usually weak going into the Thanksgiving holiday and strong afterward into the first week of December. Around mid-December, we will get a bit of pullback as mutual funds distribute gains and income, then the “window dressing, Santa Rally” into year-end. Once we reach 2024, the outlook becomes more “cloudy with a chance of meatballs.” Trade accordingly.

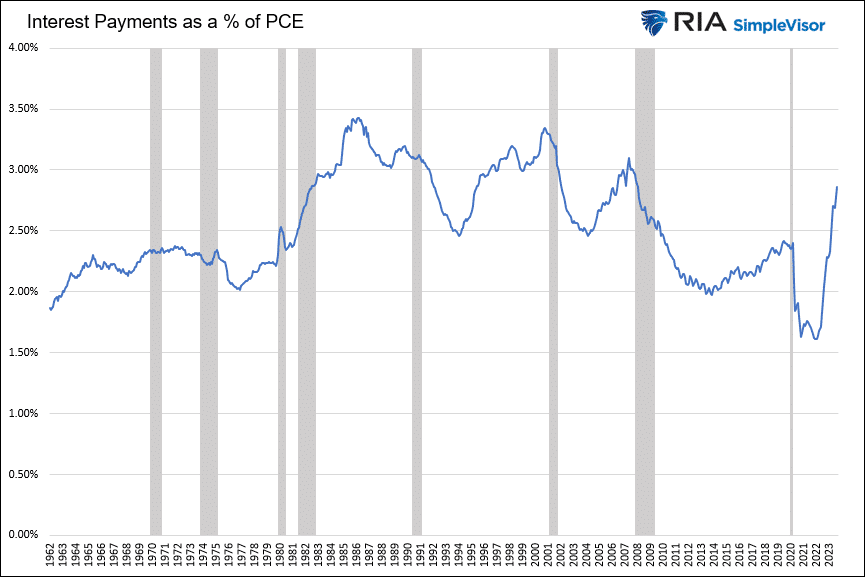

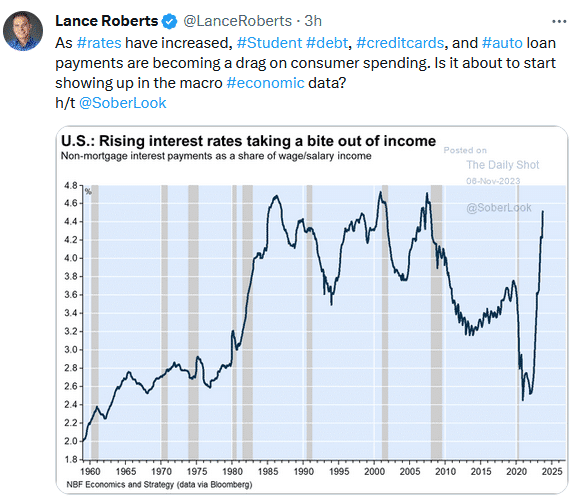

Personal Interest Payments Are Rising Rapidly

The following graph shows the ratio of personal interest payments to personal consumption expenditures (PCE). Prior to the 90s, personal debt was relatively small. As such, when interest rates rose, it was not a significant determinant of personal spending. Over the last thirty years, interest rates on consumer loans have had a more substantial impact on consumption and, therefore, the economy. The graph below shows that each peak in the ratio this century preceded a recession. Further, each peak was lower than the prior one. Such entails the threshold for higher interest rates is declining.

The current ratio is higher than the pre-pandemic peak and approaching that of 2008. The massive pandemic-related stimulus significantly boosted savings. Such allowed consumers to spend freely despite rising interest rates. We think the situation is temporary. With savings primarily depleted, higher interest costs will weigh on consumption as it has done for the last 30 years. Keep in mind that personal consumption accounts for two-thirds of GDP.

The Tweet of the day shows further evidence that personal interest payments are rising rapidly.

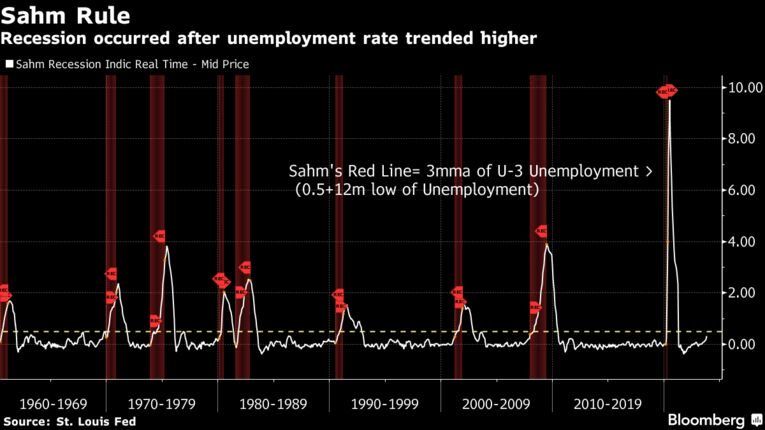

The Sahm Rule Recession Warning

There is an economic rule of thumb called the Sahm Rule, which has a 100% track record predicting recessions. The rule’s premise states that if the three-month moving average of the unemployment rate increases by 0.5% above the 12-month unemployment low, a recession is not only likely but has probably started already. The Bloomberg graph below shows the current Sahm measure alert has not been triggered. Last Friday, the BLS reported the unemployment rate rose to 3.9% from a low of 3.4% in April. While the difference is +0.5%, the Sahm rule uses the three-month moving average, which is 3.83%. A reading of 4% or higher in the next month’s unemployment rate would trigger the alert as would two consecutive months of 3.9%.

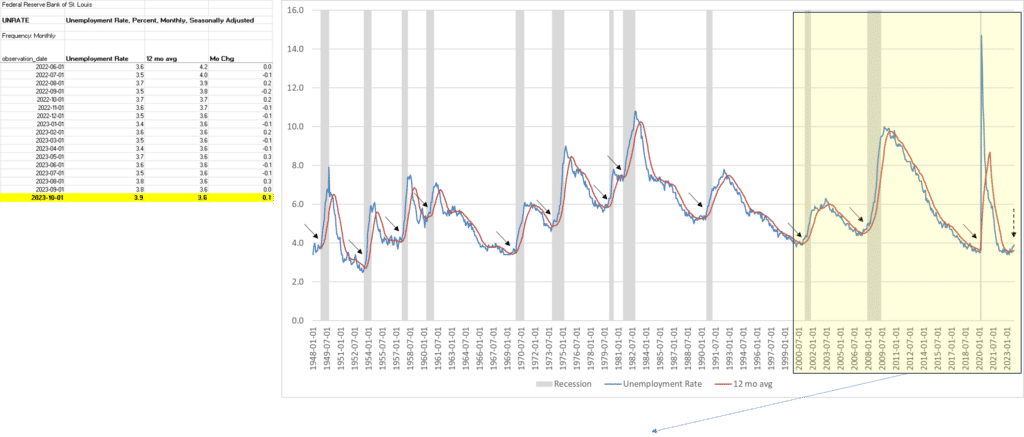

The second graph comment below comes from an astute client of ours. Per his notes:

Unemployment rate vs. 12-month rolling average. The arrows indicate when the unemployment rate crossed above the 12-month rolling average. Two things eventually happened: 1) The unemployment rate increased rapidly, and 2) a recession ensued. Recently, the same phenomenon happened whereby the unemployment rate crossed over the 12-month average.

As an aside, the NBER always backdates recessions after the fact. While it’s not apparent today, a year from now, when economic data has been revised, it should not be shocking to learn we are already in a recession or close to the start date of a recession.

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 5

2023/11/07