In 2021, used car prices often made headlines as one of the goods responsible for the spike in inflation. Two years ago, new car inventories were depleted at most dealers. With stimulus checks in hand and consumers needing a car, most people had no choice but to buy a used car. As a result, used vehicle retail sales hit $16.70 billion in 2021, which was about 25% higher than $12.3 billion in sales in 2019. With exceptional demand and a limited supply of used cars came higher prices. The BLS Used Vehicle price index rose 55% from the start of the pandemic to its peak in January 2022. The well-followed Manheim Used Vehicle Price Index rose similarly. So, with peak pricing seemingly behind us, how will CPI be affected?

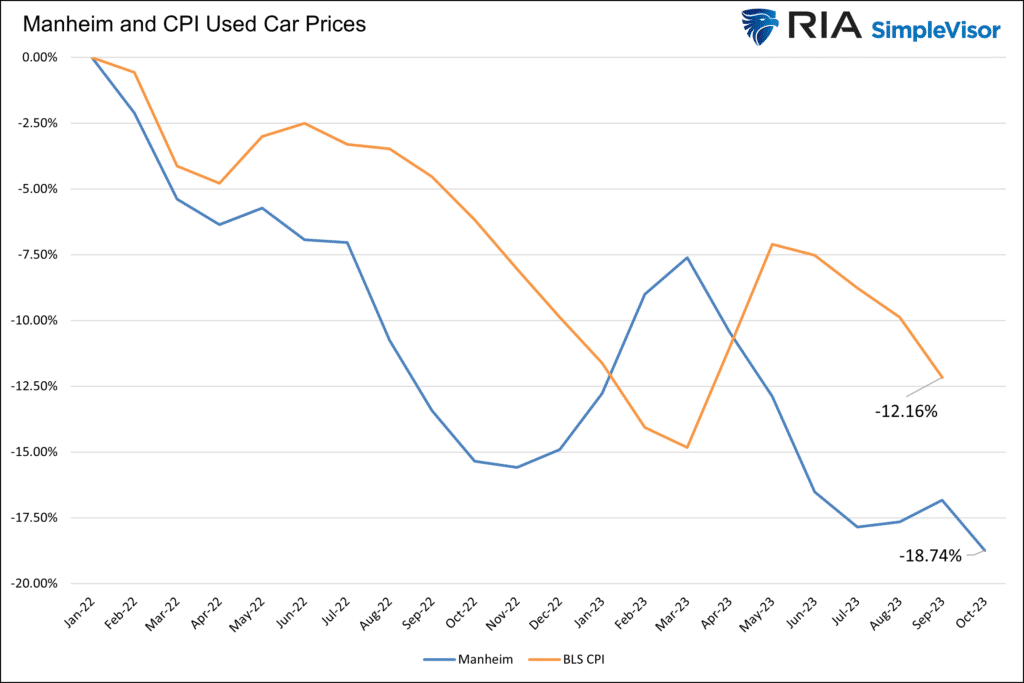

News and used car prices contribute 8% to CPI, with used cars being 3% of the 8%. Therefore, despite its small contribution to CPI, used cars boosted inflation by 1.6% in 2020 and 2021. That, however, is in the rearview mirror. Used car prices have been falling rapidly since peaking in January 2022. The graph below shows the Manheim Used Car Price Index is down almost 19% over the period, while the BLS is down 12%. These two indexes are well correlated. Further, the time lag between CPI and Manheim is minimal. We suspect that CPI will catch down to Manheim in the CPI report this month or, at the latest, next month.

What To Watch Today

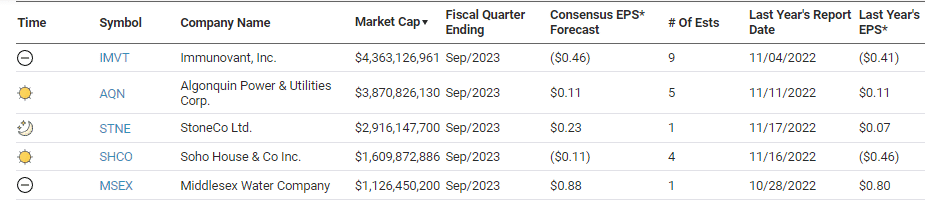

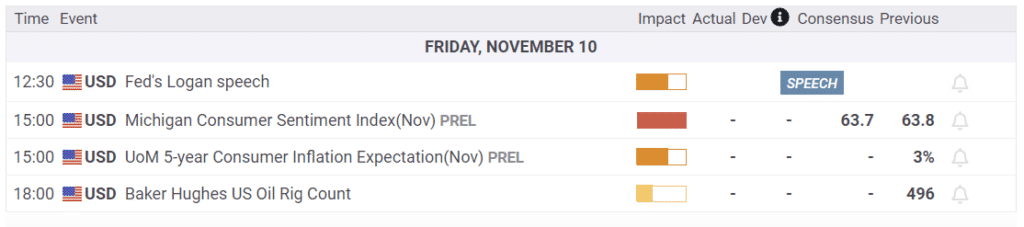

Earnings

Economy

Market Trading Update

As discussed in yesterday’s commentary, the market has gone “too fast, too furious,” and a pullback was needed. That happened yesterday as traders took profits following a ransomware attack on ICBC, which disrupted the 30-year bond auction yesterday.

“A ransomware attack on Industrial and Commercial Bank of China (ICBC) disrupted some trades in the U.S. Treasury market on Thursday, the Treasury Department said.

The Financial Times reported earlier on Thursday that the U.S. Securities Industry and Financial Markets Association (SIFMA) told members that ICBC had been hit by ransomware that disrupted the U.S. Treasury market by preventing it from settling trades on behalf of other market players.”

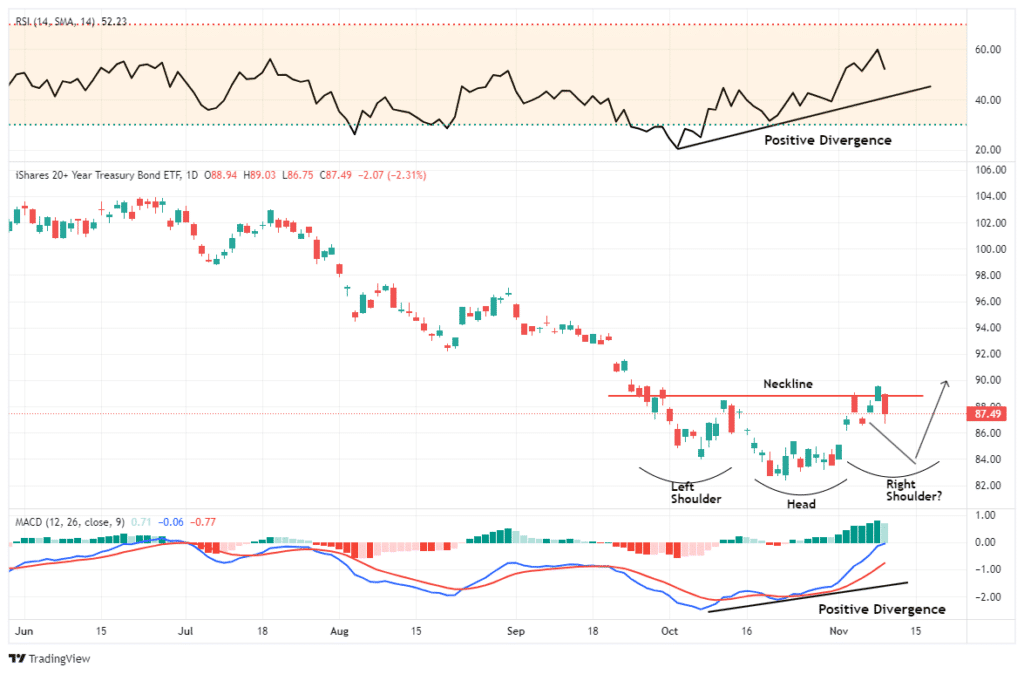

ICBC is China’s largest commercial lender, and after a sharp run-up in bond prices, the disruption sent traders into the bond market taking profits. This situation should resolve itself by next week, but the pullback in bond prices was not unexpected. As we discussed in the “Bond Bear Market,” bond prices are forming a potential “inverse head and shoulders” pattern, which is a bullish bottoming process. To wit:

“With the more “dovish” tone of the Fed’s commentary, combined with a much weaker-than-expected employment report last Friday, expectations for higher yields collapsed, sending bond prices higher. As shown, on a short-term basis, bond prices rallied sharply to the “neckline” of a potential “head and shoulders” low. That technical pattern, which is bullish for bond prices if it completes, is supported by a positive divergence in both the MACD “buy signal” and the Relative Strength Index (RSI).”

This pullback starts the process of forming the right shoulder, which needs to form a higher low and then rally to break the “neckline” to complete the formation. While this is a bullish development, it has not been completed yet, so patience is required.

Don’t Sleep On SLOOS

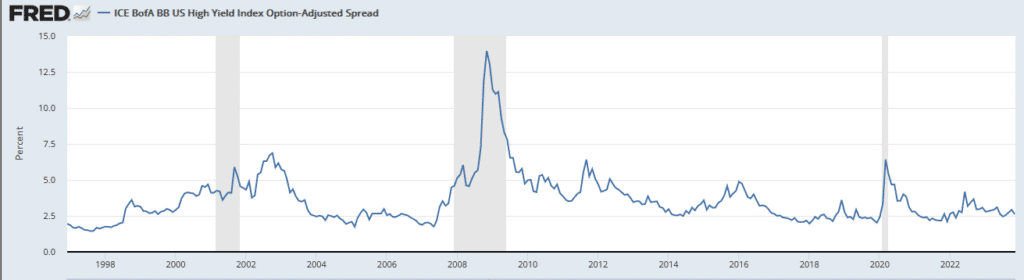

The Fed’s Senior Loan Officer Opinion Survey (SLOOS) tracks how banker lending standards are changing. Given our economy is highly driven by credit and, therefore, interest rates and the banking sector’s ability to lend, the SLOOS is a good leading economic indicator. Further, the SLOOS correlates well with high-yield bond defaults, as shown below in the “Trueinsights” graph. Despite tightening lending standards, the junk bond market does not seem concerned. The second graph shows the yield spread between BB-rated corporate bonds and U.S. Treasuries. The spread is near the lowest level since the Financial Crisis. Either this time is different, or junk bonds are due for a rude awakening!

Is Retail Bracing For A Slow Holiday Season?

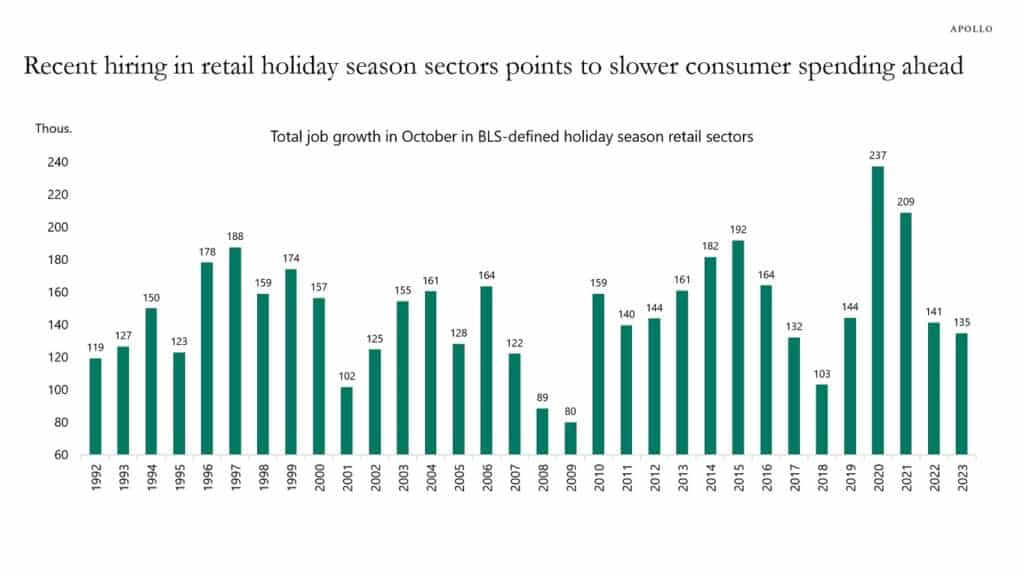

To help answer our question, we lean on Torsten Slok, Chief Economist at Apollo. Per a recent article of his:

Hiring for the holiday season is generally done in October, and adding up new jobs created in the BLS-defined holiday season retail sectors in the latest employment report shows that retailers expect a weaker holiday season, see chart below. This soft outlook is consistent with growing inventories at many retailers. The BLS defines holiday sectors as furniture, electronics, personal care, clothing, sporting goods, general merchandise stores, miscellaneous store retailers (e.g., florists, office supply stores, gift shops, and pet shops), and non-store retailers (e.g., online shopping and mail-order houses, vending machine operators, and direct store establishments).

As his graph shows, hiring in the retail holiday sector for October was the third worst since the recession of 2008.

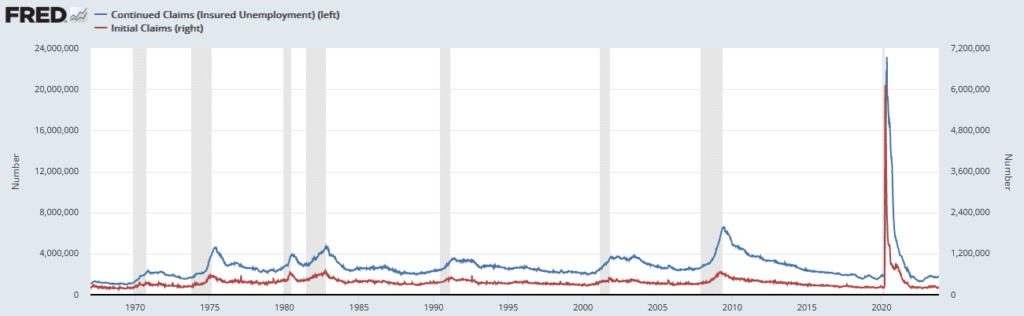

Jobless and Continuing Claims Update

Initial jobless continue to slowly increase but remain at historically low levels. 217k people filed for jobless claims this past week. For context, the recent high was in August at 232k, and it was briefly below 200k at the start of the year. More importantly, there are continuing jobless claims. We say importantly as they tend to be a good leading indicator of jobless claims and the entire labor market. Continuing claims data lag jobless claims by a week.

In yesterday’s report, continuing claims reached its highest level of the past three months, 1.834 million, up from 1.812 million the prior week. This is the 7th straight week of continuing claims have increased. Economists will likely not take the increase in continuing claims seriously until it rises above 2 million.

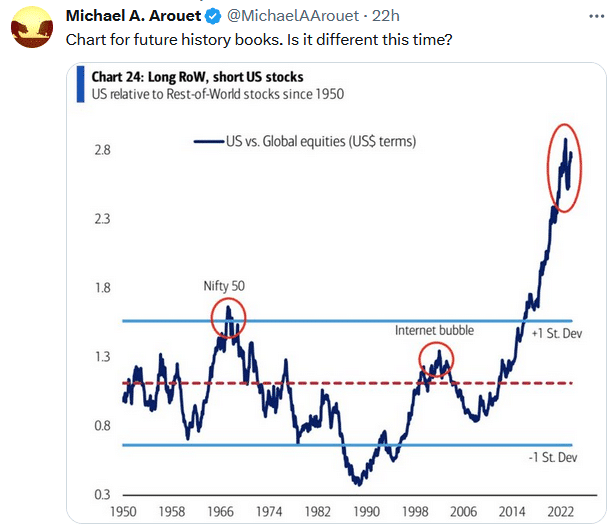

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 1

2023/11/10