By Lance Roberts | September 23, 2023

Inside This Week’s Bull Bear Report

- Fed Projections Are Useless

- How We Are Trading It

- Research Report – That 70s Show

- Youtube – Before The Bell

- Market Statistics

- Stock Screens

- Portfolio Trades This Week

Market Update & Review

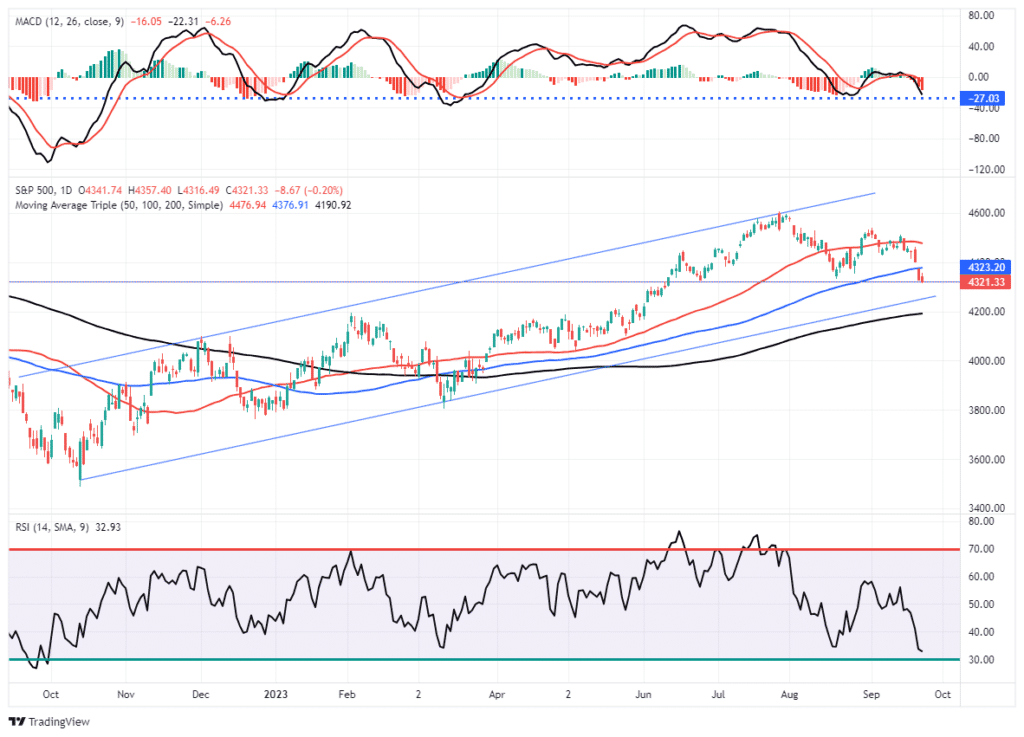

The market took a hit this week as the Fed projections of “higher for longer” killed the “rate cut hopes.” However, while there was much handwringing and teeth-gnashing over the decline, it was normal within any given year. As we noted in June:

“Notably, in any given year, bullish or bearish, a 5-10% correction is entirely normal and healthy. Such corrective actions are opportunities to increase portfolio equity risk.”

It took a bit longer than expected for the correction to begin, but in late July, the market peaked and has continued to correct through September. With the market still in a broader uptrend, the bullish backdrop remains, but there is a risk of a decline to 4200. However, the market is oversold on many levels, so a reflexive rally next week to the 50-DMA would be unsurprising.

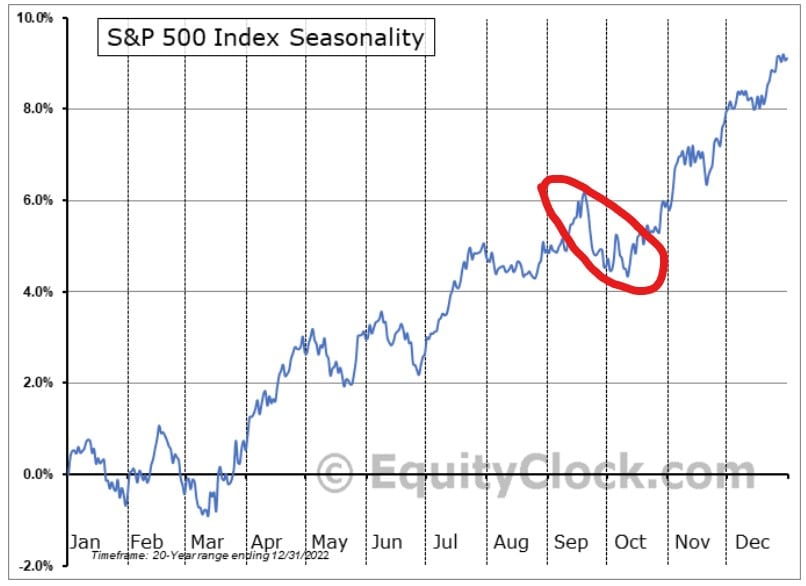

Not only is the current correction normal, but it is also well aligned with the seasonal tendencies of market returns, as we noted on Tuesday in “October Weakness.”

“While September has been a bit sloppy so far, will further weakness in October weigh on investor sentiment before the seasonally strong period begins? The S&P 500 index seasonality chart below shows weakness in the last two weeks of September and the first two weeks of October is common.”

Nonetheless, the weakness following the FOMC this weakness certainly raises concerns. However, a history review suggests that while the Fed is currently “talking a tough game,” reality tends to be very different. The reason is that the Fed projections are useless because they are always late and wrong. There is no reason to suspect this time will be different.

Need Help With Your Investing Strategy?

Are you looking for complete financial, insurance, and estate planning? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

World’s Worst Economic Forecasters

As noted, Wednesday’s Federal Reserve rate decision was not a surprise. The overall language of their statement barely changed, and the expectation of “higher for longer” remained. The potential of an additional rate hike later this year spooked the markets on Thursday.

However, keeping the possibility of an additional rate hike on the table was prudent as the markets would have perceived any other statement as “dovish” and that the Fed was done hiking rates. As Justin Lahart wrote for the WSJ:

“The Fed projecting one last rate increase is also a way of preventing investors from immediately turning to the next question: When will the Fed cut? The risk is that as soon as investors start doing that, rate expectations will come down sharply, and with them, long-term interest rates, providing the economy with a boost the Fed doesn’t want it to receive just yet.”

That is right. Since October last year, the market has been hoping for rate cuts and running up asset prices in advance. Of course, higher asset prices boost consumer confidence, potentially keeping inflationary pressures elevated. Keeping a rate hike on the table keeps the options for the Federal Reserve open.

As the WSJ noted:

“Fed Chair Jerome Powell said that officials didn’t need to decide yet whether to lift rates again after a historically rapid series of increases over the past 18 months and as they await evidence that a recent inflation slowdown can be sustained. As Jerome Powell stated, ‘Let’s see how the data comes in. They want to be convinced. They want to be careful not to jump to a conclusion.’”

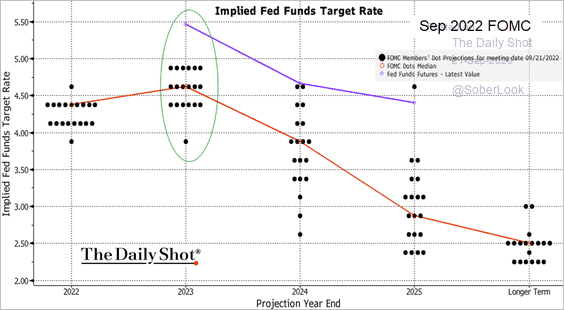

However, what seemed to spook the bond and stock markets was that Fed officials indicated they expect to keep rates higher for longer through 2024 than they anticipated earlier this year. Such quelled hopes of a return to monetary accommodations anytime soon and shifted the expectations for cuts forward.

This push forward of rates is based on the idea that the economy remains strong, creating a resurgence of inflation later this year.

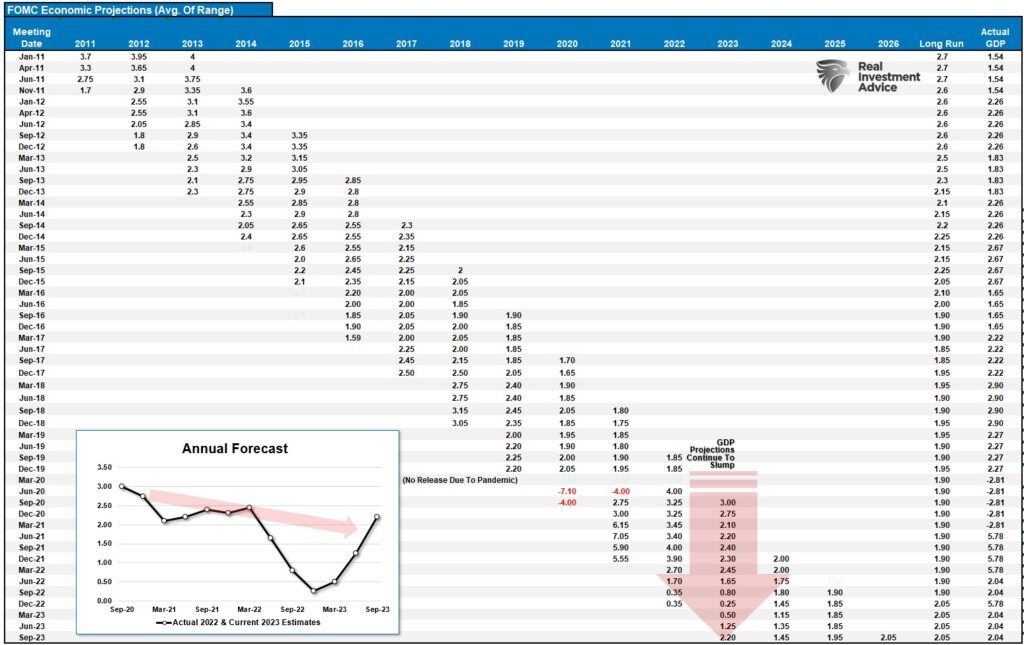

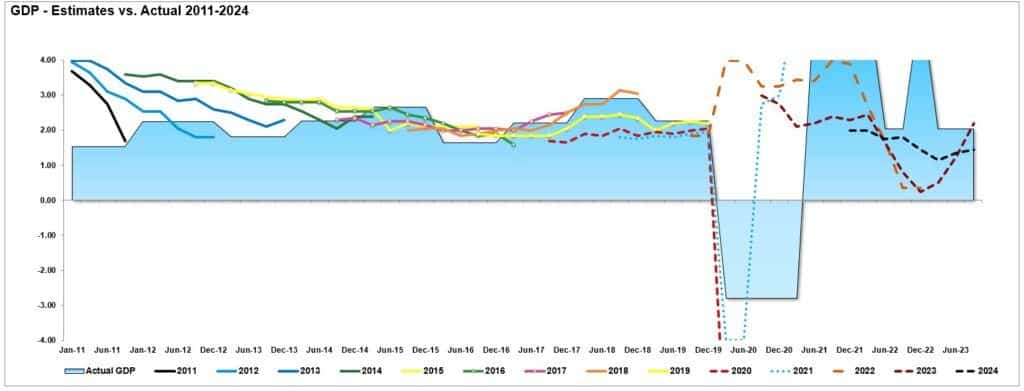

However, there is a problem with the Fed projections. They are historically the worst economic forecasters ever. We have tracked the median point of the Fed projections since 2011, and they have yet to be accurate. The table and chart show that Fed projections are always inherently overly optimistic.

As shown, in 2022, the Fed thought 2022 growth would be near 3%. That has been revised down to just 2.2% currently and will likely be lower by year-end, as we will explain momentarily.

Here is the graphical version of the Fed projections. Like Wall Street analysts with earnings estimates, the Fed’s projections are always initially overly optimistic and guided lower to reality.

While the Fed is pushing a “no pivot” stance, there is good reason to expect a pivot in 2024.

A 2008 Redux?

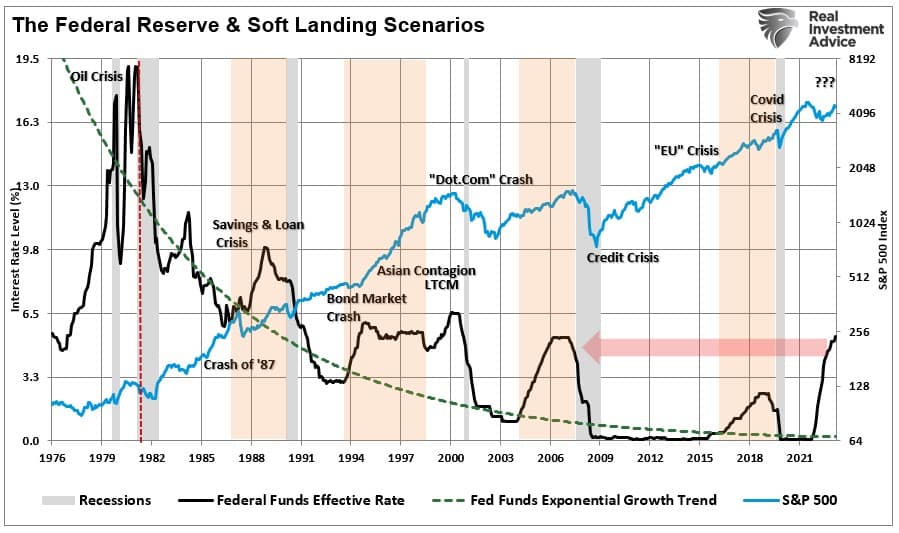

The Federal Reserve’s current policy rate is the highest since 2008. If you don’t remember what happened, then let me remind you.

In January 2008, the Fed was aggressively hiking interest rates amid a massive real estate bubble under the Chairmanship of Ben Bernanke. At that time, there was “no recession” in sight, “subprime mortgages were contained,” and it was a “Goldilocks economy.”

Eight months later, the market fell sharply, banks were on the brink of bankruptcy, and the economy was entrenched in a massive recession as Lehman Brothers filed for bankruptcy.

The Fed projections NEVER include the risk of a recession, and today, like then, it believed it could navigate a soft landing in the economy. They were wrong on multiple counts. As we showed previously, there are ZERO times in history when the Fed was hiking rates that outcomes were not bad to awful. After rates peaked and yield curves UN-inverted, recessions, bear markets, and crisis events occurred.

The Fed will likely be surprised again in the next few months as the lagging economic data they focus on gets revised sharply lower. One of the main reasons is a subject we covered in detail in “Economic Data Diverges.” To wit:

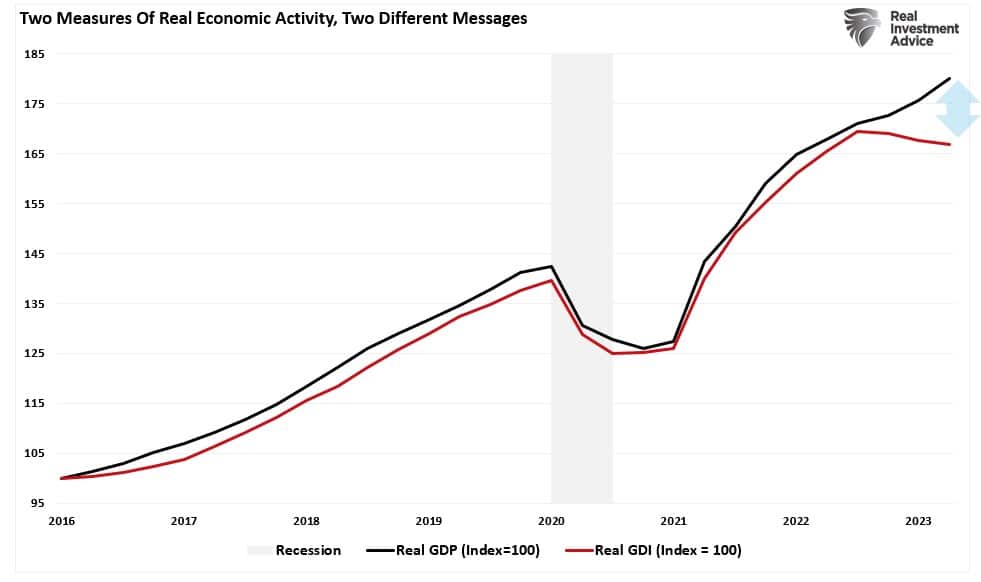

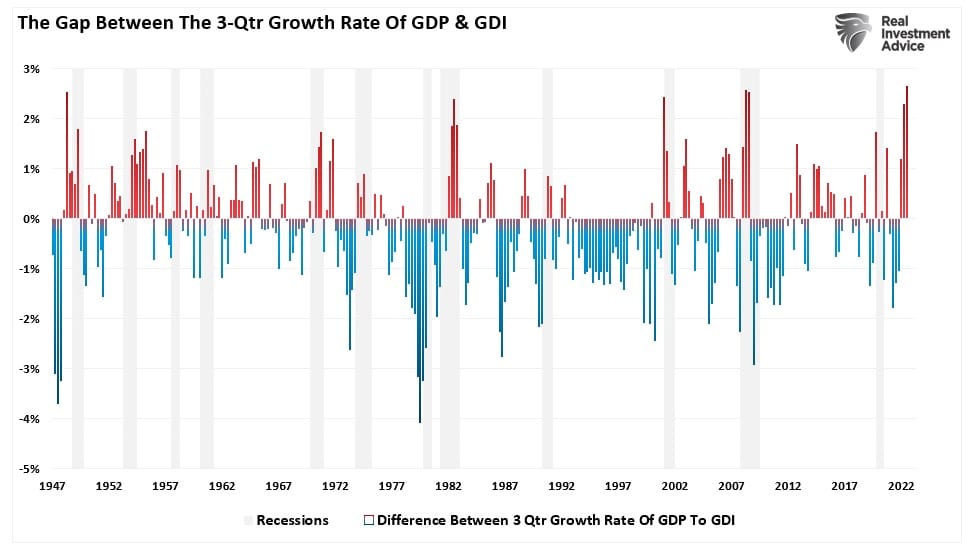

“Therefore, given that GDI measures the income side of the equation (derived from production), it is logical that GDI should track pretty closely to GDP over time. Furthermore, it should be logical that deviations between production and consumption should indicate a shift in the economic underpinnings.”

A Catch Down Is Coming

However, the deviation starting last year between those two measures is quite apparent and begs the question of whether this Is an anomaly or not.

The chart below looks at real GDP and GDI back to 1947 and measures the deviation between the 3-quarter growth rates of each. With only the expectation being in the late 70’s, a recession followed each time GDP deviated from GDI. In other words, the economic activity eventually catches down to the primary driver of consumption: production. Currently, the deviation of GDP from GDI is the largest on record.

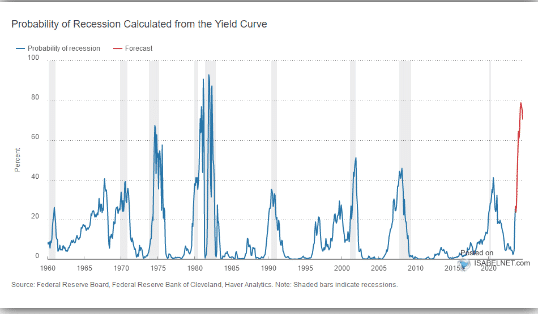

In past articles, we reviewed many indicators that typically preceded recessionary onsets. Falling tax receipts, inverted yield curves, student loan payments, leading economic indicators, and even our economic composite confirm that recessionary risks remain elevated. As shown, based solely on the inverted yield curve alone, the probability of a recession is at one of the highest levels since the 1980s.

Given the wide range of other confirming indicators previously discussed, there is a high probability that the Fed will cut rates in 2024 as GDP is revised to what GDI tells us about the economy.

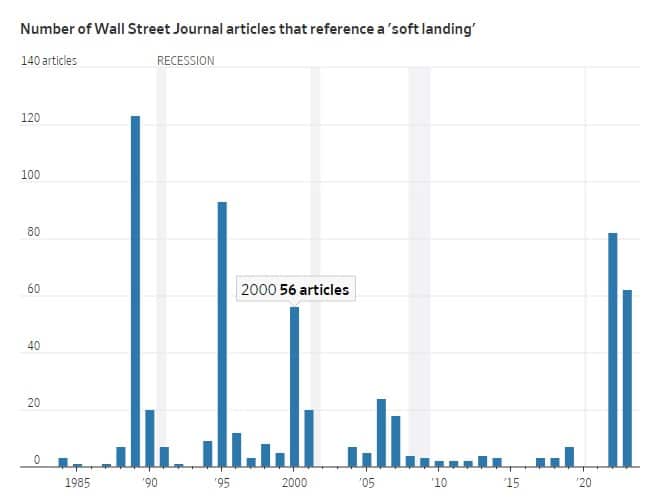

Soft Landings Are Extremely Elusive

While the current economic data suggests that the economy is doing fine, such is always the case just before the realization it’s not. So far, the markets have continued to place “hope” on the extremely elusive “soft landing” scenario. However, there are many risks to that view, as noted. As the WSJ said:

“Similarly, this summer’s combination of easing inflation and a cooling labor market has fueled optimism among economists and Federal Reserve officials that this elusive goal might be in reach. But soft landings are rare for a reason: They are tricky to pull off.“

The reason is that many factors have yet to reveal themselves. Such as:

- The Fed’s aggressive rate hiking campaign has a “lag effect” that will impact the economy in 2024.

- The restart of the student loan payments will extract spending from the economy.

- A potential Government shutdown could clip growth heading into the end of the year.

- The autoworkers strike could have an impact on growth.

- Higher interest rates weigh on consumption, which is nearly 70% of the economic equation.

Furthermore, from a purely contrarian point of view, the experts no longer consider a “recession” a risk.

As we quoted previously in 2022, when “everyone” was expecting a recession:

“When all experts agree, something else tends to happen.” – Bob Farrell.

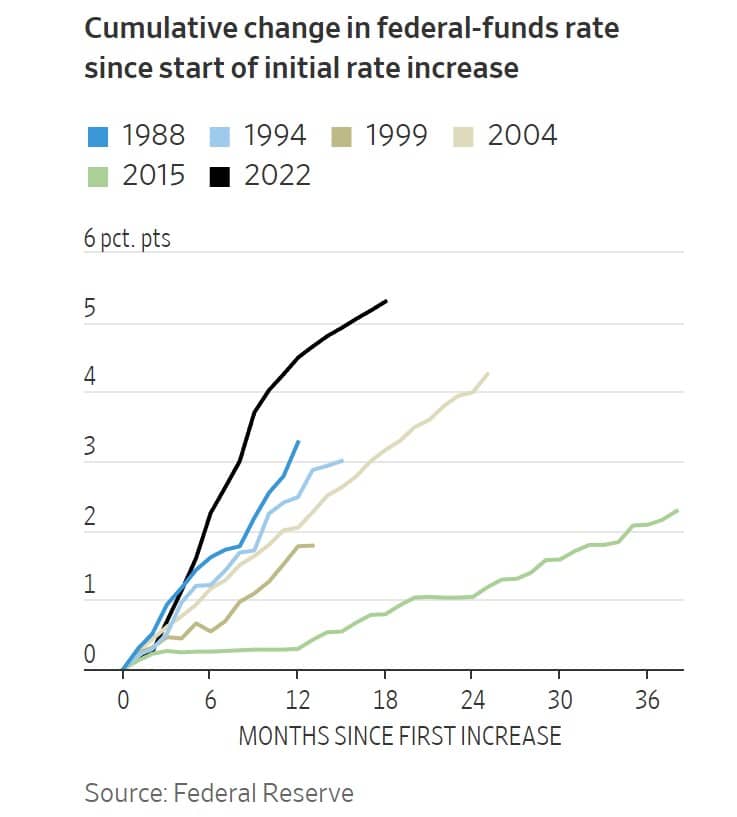

Historically, the Fed has always gone too far when hiking rates. Take a look at the chart below.

What this chart doesn’t tell you is the following:

- 1988 – Led to a recession in 1991

- 1994 – Led to a crash in the bond market.

- 1999 – Preceded the Dot.com crash and recession

- 2004 – Led to the Financial Crisis

- 2015 – Preceded the EuroZone crisis and the Fed’s Taper Tantrum

- 2022 – Recession in 2024?

Sure, this “time could be different.” The problem is that, historically, such has not been the case. While we must weigh the possibility that the Fed is correct in its more optimistic predictions, the probabilities still lie with its previous track record and the indicators.

How We Are Trading It

The Fed’s “no pivot” policy stance drives the markets short-term. Investors remain at the mercy of volatile markets with little direction on where capital can find safety. Gold has not hedged inflation. Bonds have not hedged risk, and equities remain under continuous pressure.

The setup remains more bearish than bullish, so we continue to monitor and adjust our positioning. As noted, there is a developing opportunity to own long-dated Treasury bonds, but you must give that thesis time to play out into 2024. However, as Greg Feirman recently penned:

“Personally, I think Powell is bluffing. He didn’t want to declare ‘Mission Accomplished,’ which would cause stocks and bonds to rally wildly, so he accompanied the pause with a lot of tough talk and hawkish projections. But I don’t think the Fed will follow through. I think they’re done raising rates and will wait and see what effect all the previous tightening has on the economy. This is also the correct course.

So what of it? Personally, I am looking to go ‘All In’ on long-term treasuries. TLT is testing its 52-week low of around $90 in the premarket – but I think it will hold. And I’ll use the selloff to add to my position.”

I agree with that statement and added to my position in TLT on Thursday.

There are few opportunities in the market where the upside potential of an investment is clear. It will take time for economic realities to collide with the Fed’s fantasy.

The Fed funds futures market has now priced in the Fed’s likely “terminal rate” on monetary policy going into 2024. We will likely use the next oversold rally in the market to raise cash, further reduce risk, and rebalance portfolios accordingly.

See you next week.

Research Report

Subscribe To “Before The Bell” For Daily Trading Updates

We have set up a separate channel JUST for our short daily market updates. Please subscribe to THIS CHANNEL to receive daily notifications before the market opens.

Click Here And Then Click The SUBSCRIBE Button

Subscribe To Our YouTube Channel To Get Notified Of All Our Videos

Bull Bear Report Market Statistics & Screens

SimpleVisor Top & Bottom Performers By Sector

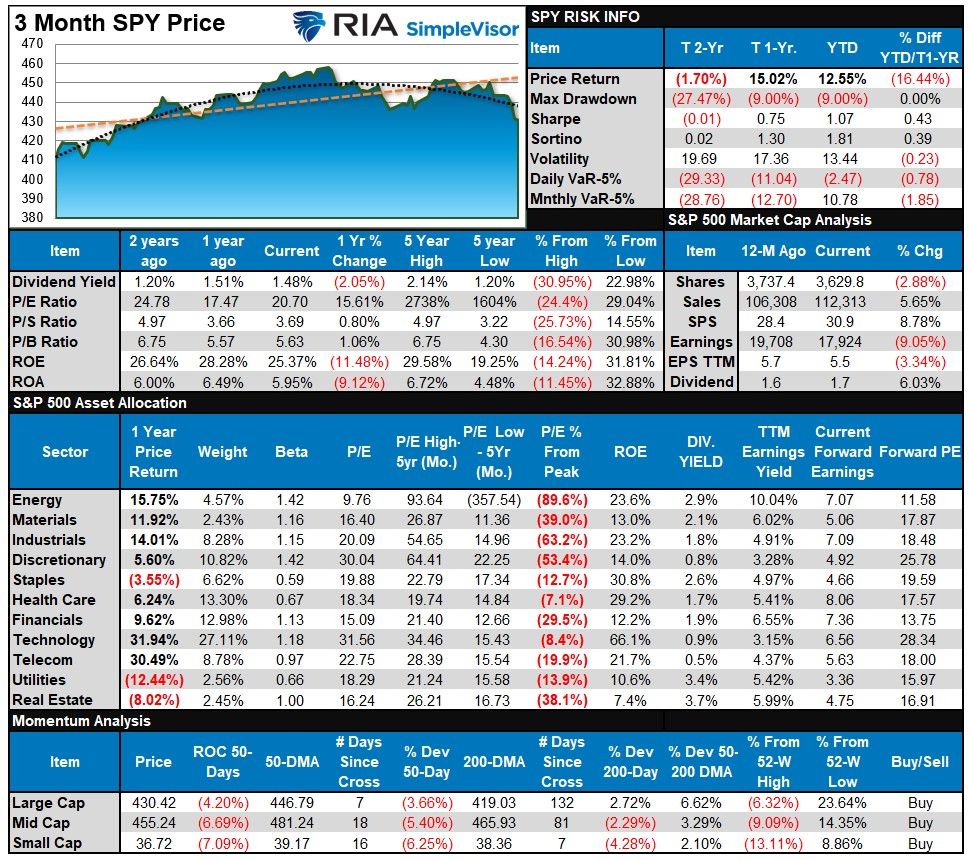

S&P 500 Weekly Tear Sheet

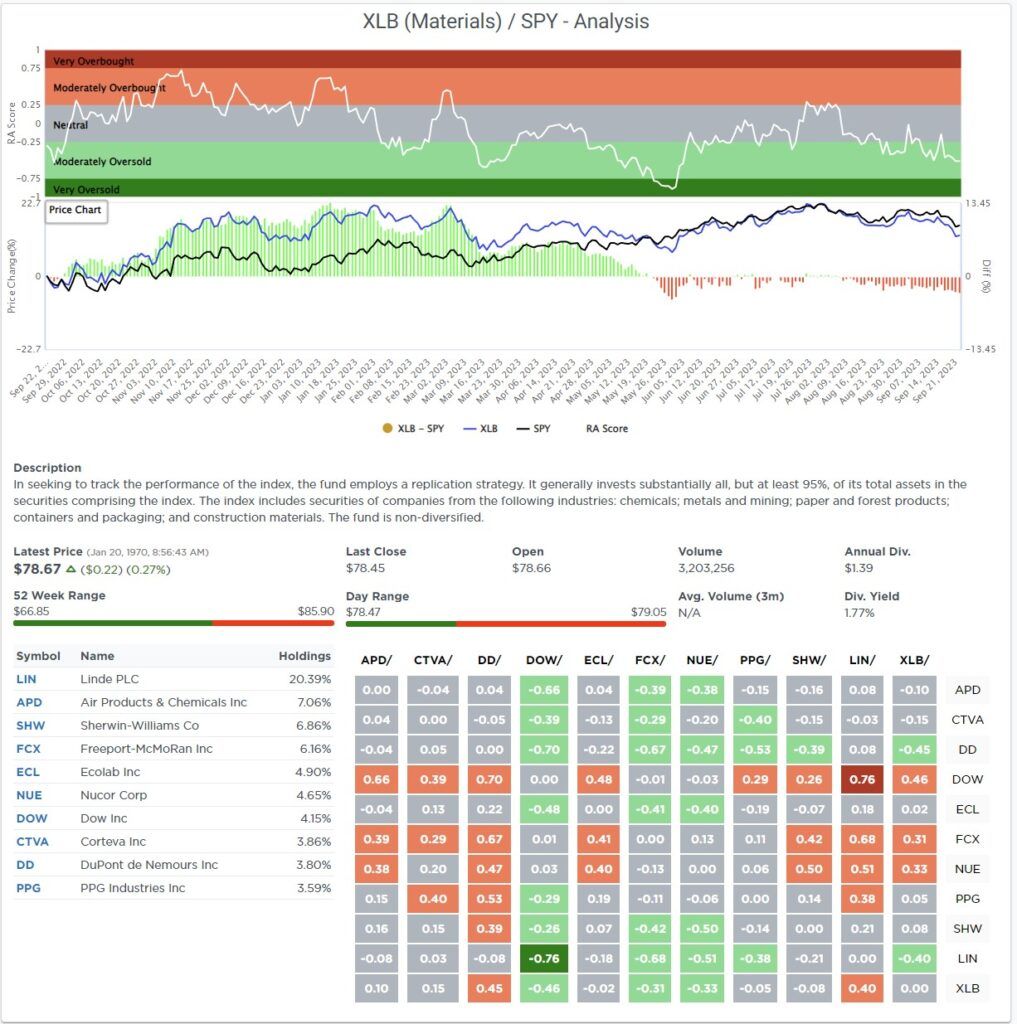

Relative Performance Analysis

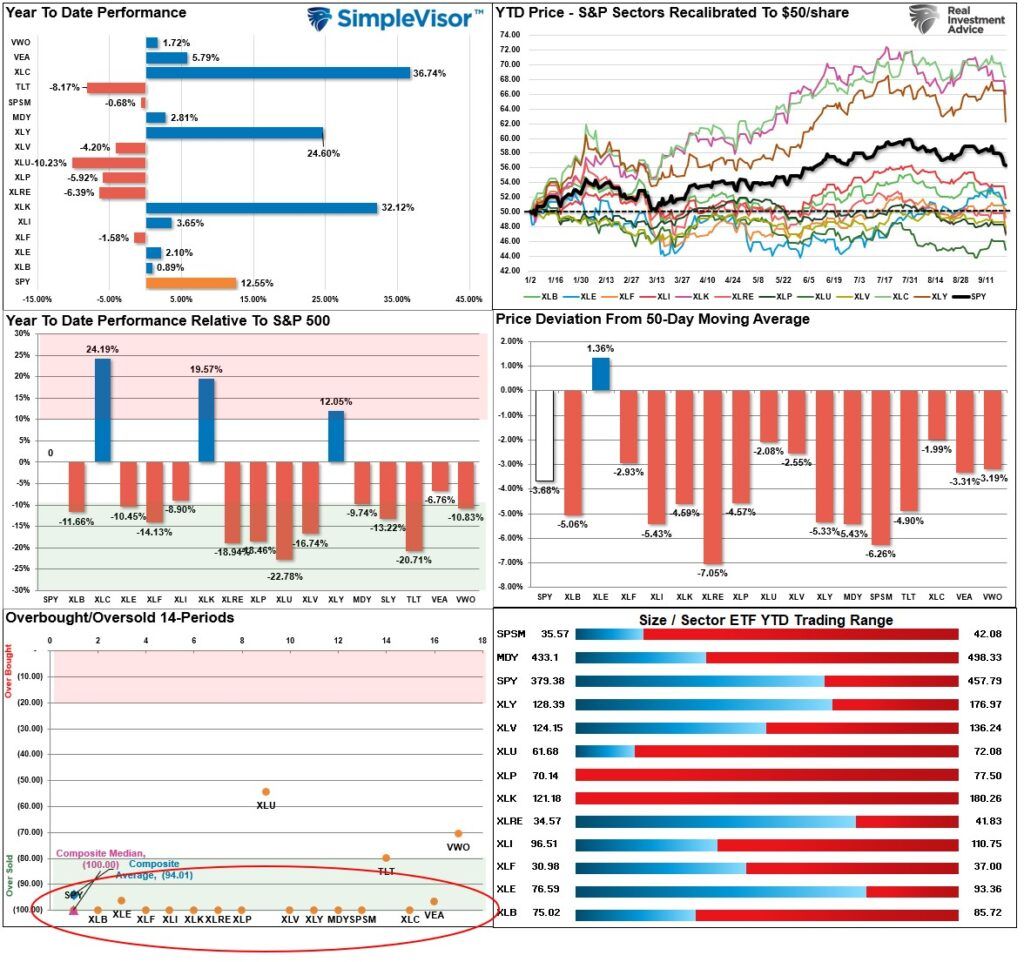

After the sell-off last week, most markets and sectors are now very oversold. Furthermore, the deviations of many of those markets and sectors below the 50-DMA suggest a decent counter-trend rally is likely starting this week. While we are likely not clear of the seasonally weak period as of yet, the downside from current levels is likely very limited. Look to use current weaknesses to add exposure to portfolios accordingly.

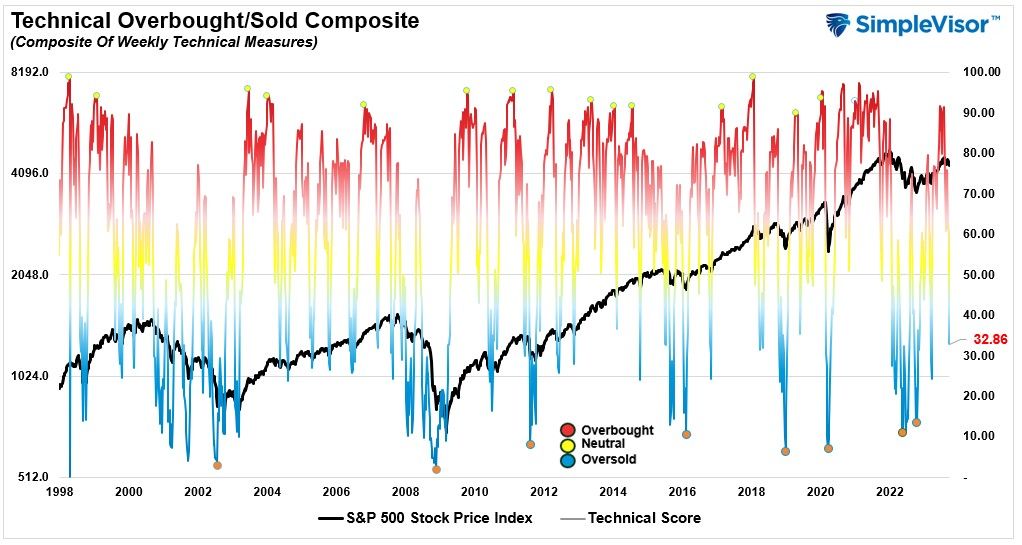

Technical Composite

The technical overbought/sold gauge comprises several price indicators (R.S.I., Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The market peaks when those readings are 80 or above, suggesting prudent profit-taking and risk management. The best buying opportunities exist when those readings are 20 or below.

The current reading is 32.86 out of a possible 100.

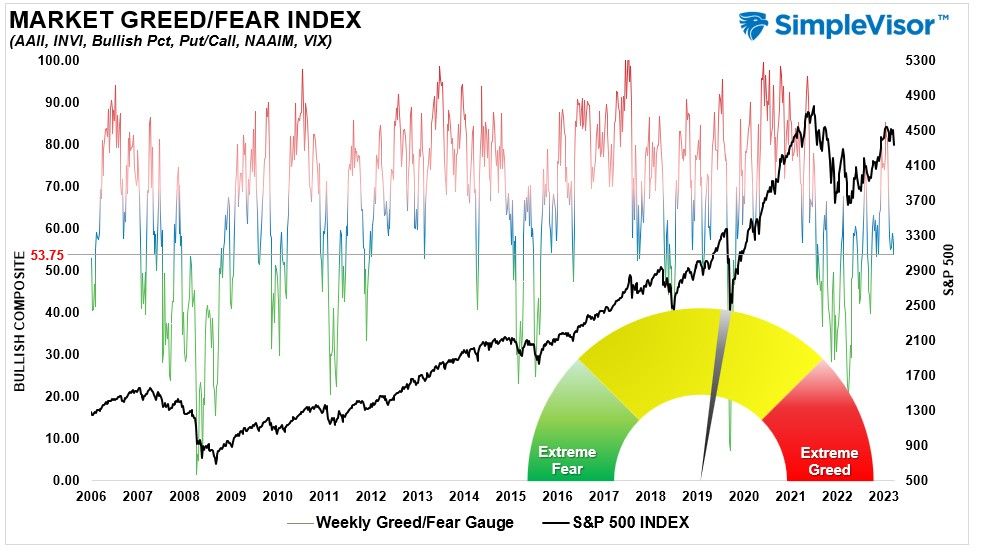

Portfolio Positioning “Fear / Greed” Gauge

The “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, the more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0 to 100. It is a rarity that it reaches levels above 90. The current reading is 53.75 out of a possible 100.

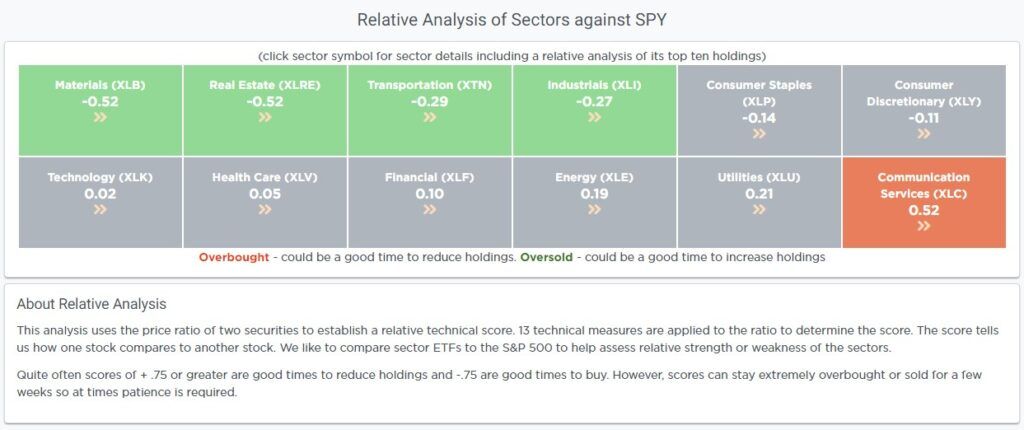

Relative Sector Analysis

Most Oversold Sector Analysis

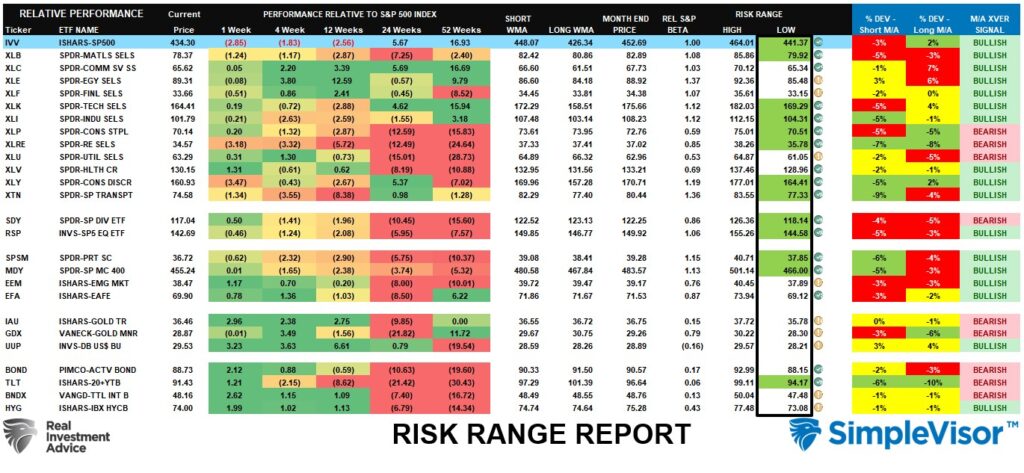

Sector Model Analysis & Risk Ranges

How To Read This Table

- The table compares the relative performance of each sector and market to the S&P 500 index.

- “MA XVER” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

- The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

- The table shows the price deviation above and below the weekly moving averages.

The sell-off this past week pushed many sectors and markets below their normal monthly trading ranges. These more oversold conditions will likely precede a reflexive rally starting this week. In particular, Financials, Technology, Industrials, Materials, Communications, and Transports are the highlighted sectors to watch for leadership. Small and Mid-capitalization stocks and Bonds are the major markets to watch for a rally.

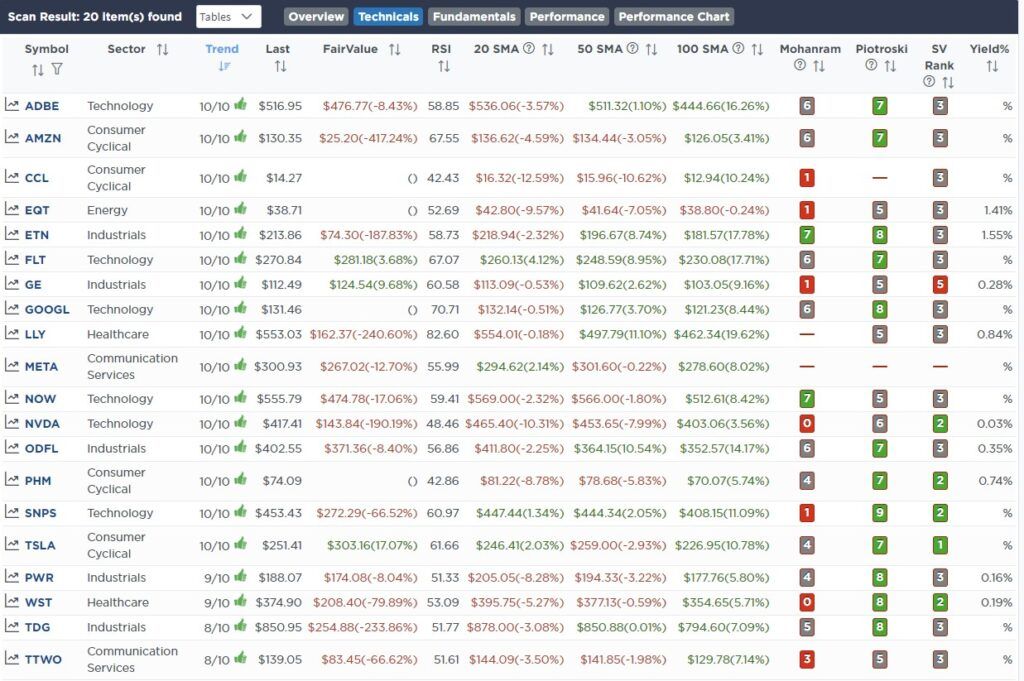

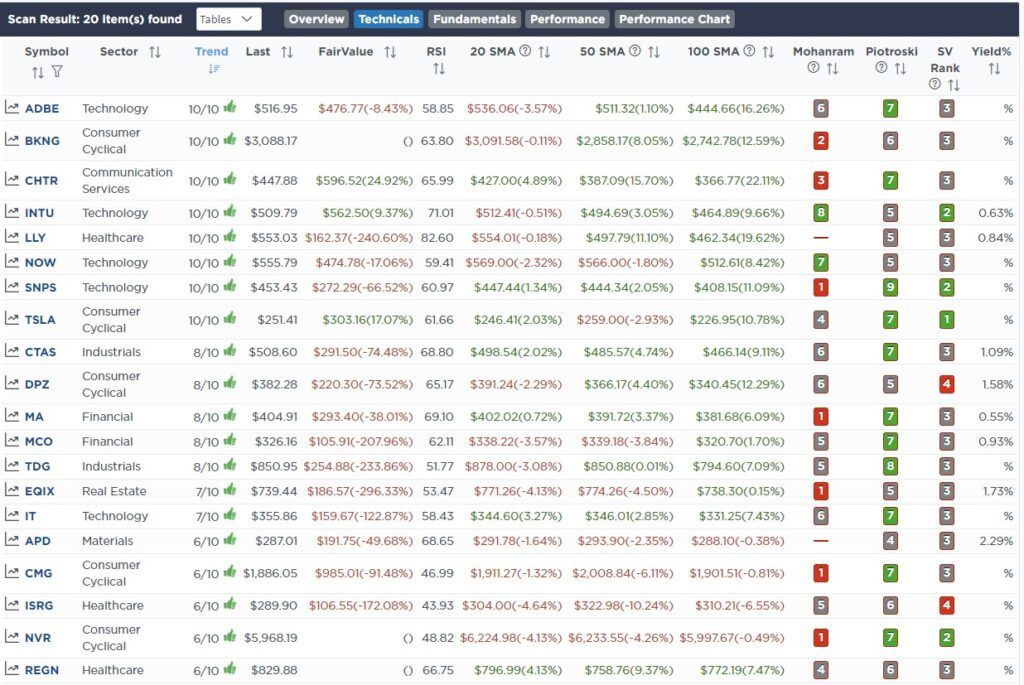

Weekly SimpleVisor Stock Screens

We provide three stock screens each week from SimpleVisor.

This week, we are searching for the Top 20:

- Relative Strength Stocks

- Momentum Stocks

- Fundamental & Technical Strength

(Click Images To Enlarge)

R.S.I. Screen

Momentum Screen

Fundamental & Technical Strength

SimpleVisor Portfolio Changes

We post all of our portfolio changes as they occur at SimpleVisor:

September 18th

“As we have discussed over the last several weeks, we continue using this corrective period in the market to rebalance portfolios for a potentially stronger year-end run. (See today’s blog, October Weakness Before The Year-End Run? for reasons why we think this may be the case.)

With that premise in place, we continue consolidating our holdings and moving our weightings more in line with the benchmark index.

We are exiting LEN and ITB. Homebuilder sentiment is turning over, and the trade is not working out as we expected. This also reduces our small and mid-cap holdings, which are lagging in performance.

Energy prices are very extended, as is the energy sector. We are rebalancing XOM and XLE back to model weights. This entails selling about 0.25% of each position for most accounts.

CMCSA has been consolidating for a while and sitting on a strong support uptrend. Further, the technical backdrop is getting ready to turn upward as well. We have been chomping at the bit to buy more and are taking advantage of the situation today.”

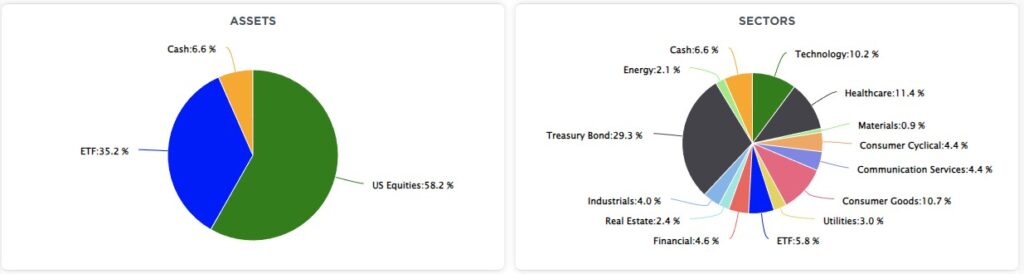

Equity Model

- Sell 100% of Lennar Homebuilders (LEN)

- Reduce Exxon Mobil (XOM) to a target portfolio weight of 2%.

- Add 1% of the portfolio to Comcast Communication (CMCSA) to increase its weighting to 2.5%.

ETF Model

- Sell 100% of the Homebuilder ETF (ITB)

- Reduce the iShares Energy Sector ETF (XLE) down to a target portfolio weight of 2%

- %d 1% of the portfolio to the iShares Communication Sector ETF (XLC), increasing weight to 7.5%

September 21st

“We previously owned Albemarle (ALB) due to its leading position in lithium production. We had bought and sold it numerous times previously for a good gain. We re-entered the position with a very small sizing (1% of the portfolio) as a starter position for a new holding. However, the materials sector remains under pressure, and the technical setup for ALB is failing. We are stopped out of the position today.

Small and mid-capitalization stocks continue to underperform so we are stopping out of the Russell 2000 Index ETF (IWM) in the ETF Model.”

Equity Model

- Sell 100% of Albemarle (ALB)

ETF Model

- Sell 100% of the Russell 2000 Index ETF (IWM)

Lance Roberts, C.I.O.

Have a great week!

Lance Roberts is a Chief Portfolio Strategist/Economist for RIA Advisors. He is also the host of “The Lance Roberts Podcast” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter, Linked-In and YouTube

Customer Relationship Summary (Form CRS)