We have done value scans on large and small-cap stocks in the past few months, so it is time to present a value screen on mid-cap stocks. Stocks in this scan have a market cap between $2 billion and $10 billion.

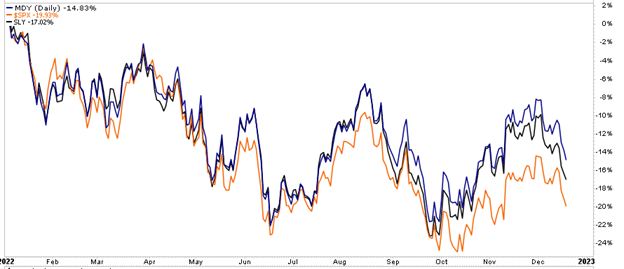

Mid-cap stocks tend to offer more growth than large-cap stocks and less price volatility than small-cap stocks. The graph below shows that mid-cap stocks (MDY) have outperformed small (SLY) and large-cap (SPX) stocks year to date.

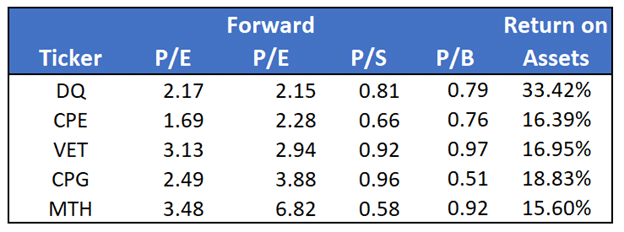

Screening Criteria

We considered the following factors when screening:

- P/S <1

- P/B <1

- P/E <10

- Forward P/E <15

- PEG Ratio <1

- Return on Assets >15%

- Market Cap Between $2 and $10 billion

Company Summaries

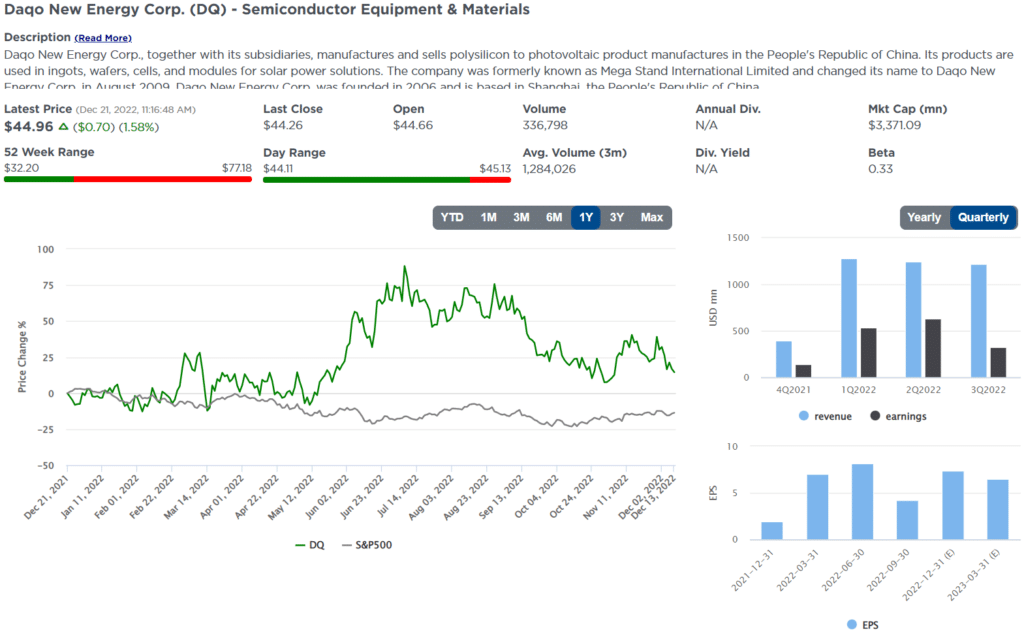

Daqo New Energy Corp. (DQ)

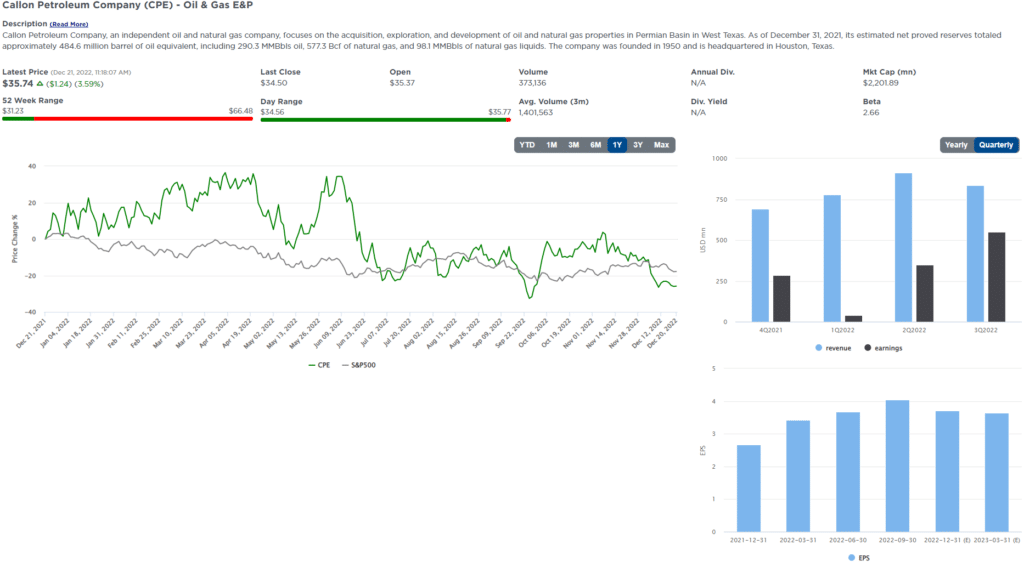

Callon Petroleum Company (CPE)

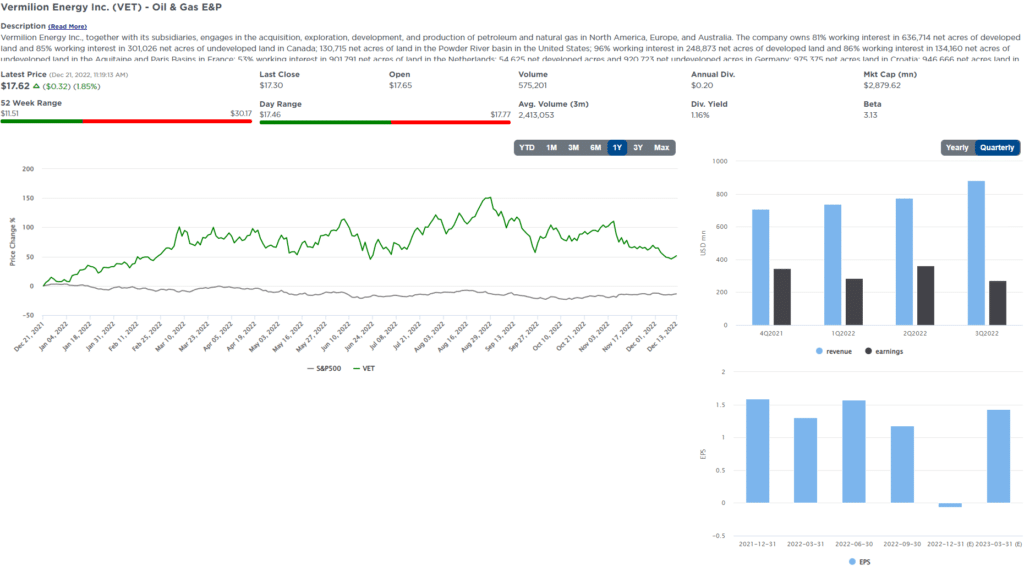

Vermilion Energy Inc. (VET)

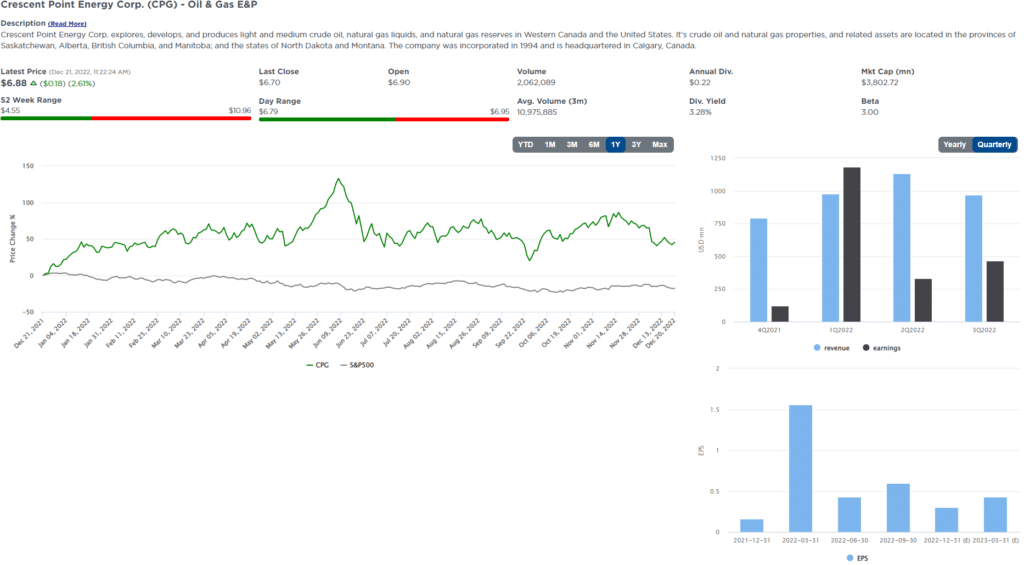

Crescent Point Energy Corp. (CPG)

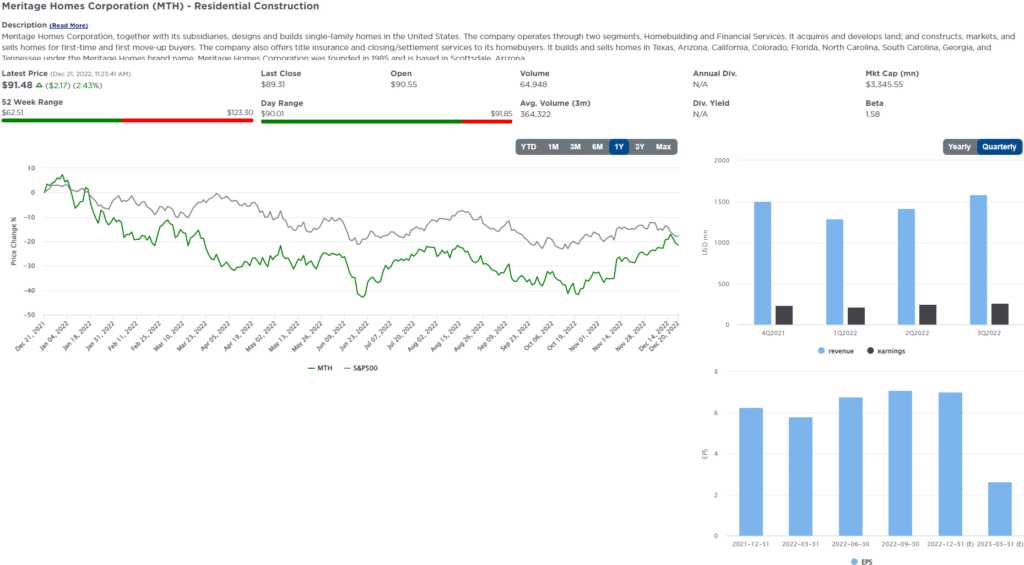

Meritage Homes Corporation (MTH)

Five for Friday

Five for Friday uses stock screens to produce five stocks that we expect will outperform if a particular investment theme plays out in the future. Investment themes may be relevant to the current or expected market, industry and/or economic trends. Investment themes may not always represent our current forecast.

Disclosure

This report is not a recommendation to buy or sell the named securities. We intend to elicit ideas about stocks meeting specific criteria and investment themes. Please read our disclosures carefully and do your own research before investing.

Michael Lebowitz, CFA is an Investment Analyst and Portfolio Manager for RIA Advisors. specializing in macroeconomic research, valuations, asset allocation, and risk management. RIA Contributing Editor and Research Director. CFA is an Investment Analyst and Portfolio Manager; Co-founder of 720 Global Research.

Follow Michael on Twitter or go to 720global.com for more research and analysis.

Customer Relationship Summary (Form CRS)