We recently published Part Two of a series comparing inflation in the 1970s to today. Part Two discusses the price wage spiral that helped fuel higher prices in the 1970s. To wit- “In the 1970s, workers demanded higher wages to offset the rising cost of living. Simultaneously, business owners, having to pay higher salaries, responded by increasing prices. The cycle resulted in a self-reinforcing loop, which further amplified inflationary pressures.”

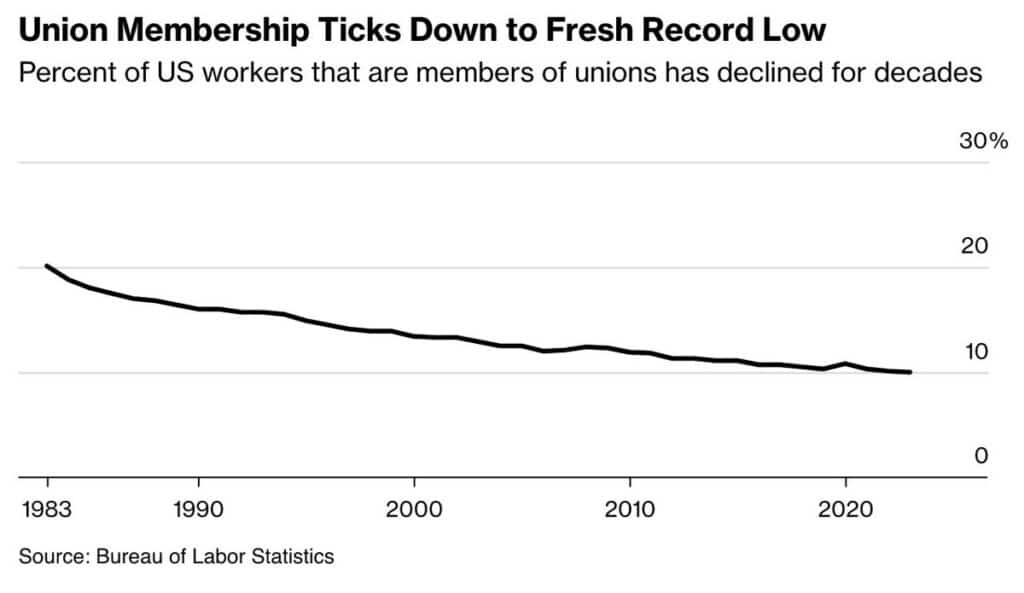

Throughout 2022, Jerome Powell publically fretted about the potential for a price wage spiral. Furthermore, we are sure recent negotiations with the automakers, Hollywood writers and actors, FedEx, and others only fueled concerns of a price wage spiral. However, the 1970s and today are different. Regarding a price wage spiral, we must consider that in the 1970s, unions were much stronger, and one out of every five workers were union members. While still a concern, the graph below from Bloomberg shows that union membership has trended lower consistently since. It now stands at only 10% of workers, limiting the potential for unions to drive wages for the entire workforce higher.

What To Watch Today

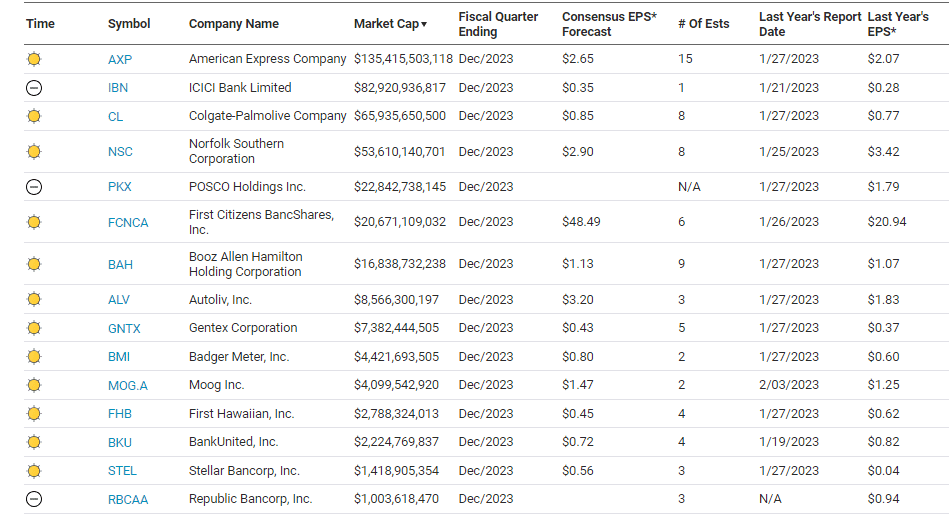

Earnings

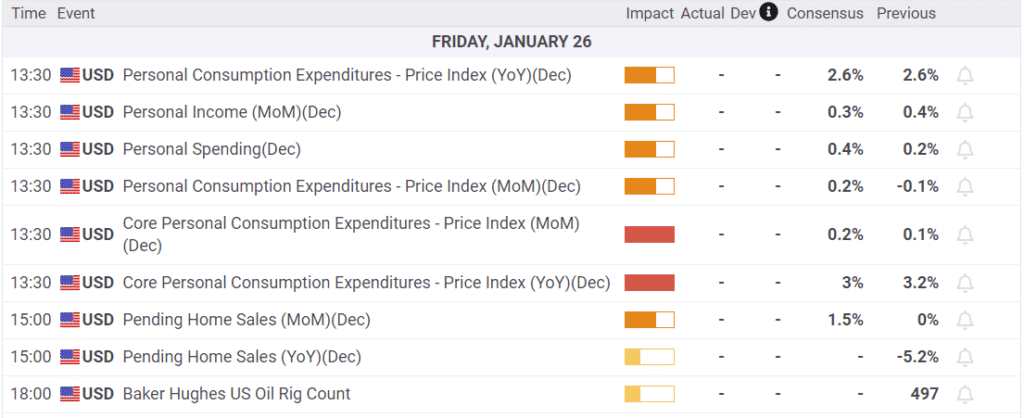

Economy

Investing Summit: Last Chance To Get Tickets – Event Is Tomorrow

January 27th, we are hosting a live event featuring Greg Valliere to discuss investing in the 2024 presidential election. What will a new president mean for the markets, the risks, and where to invest through it all? Greg will be joined by Lance Roberts, Michael Lebowitz, and Adam Taggart for morning presentations covering everything you need to know for the New Year.

Register now. There are 10 seats available for tomorrow morning. The session is a LIVE EVENT, and no recordings will be provided.

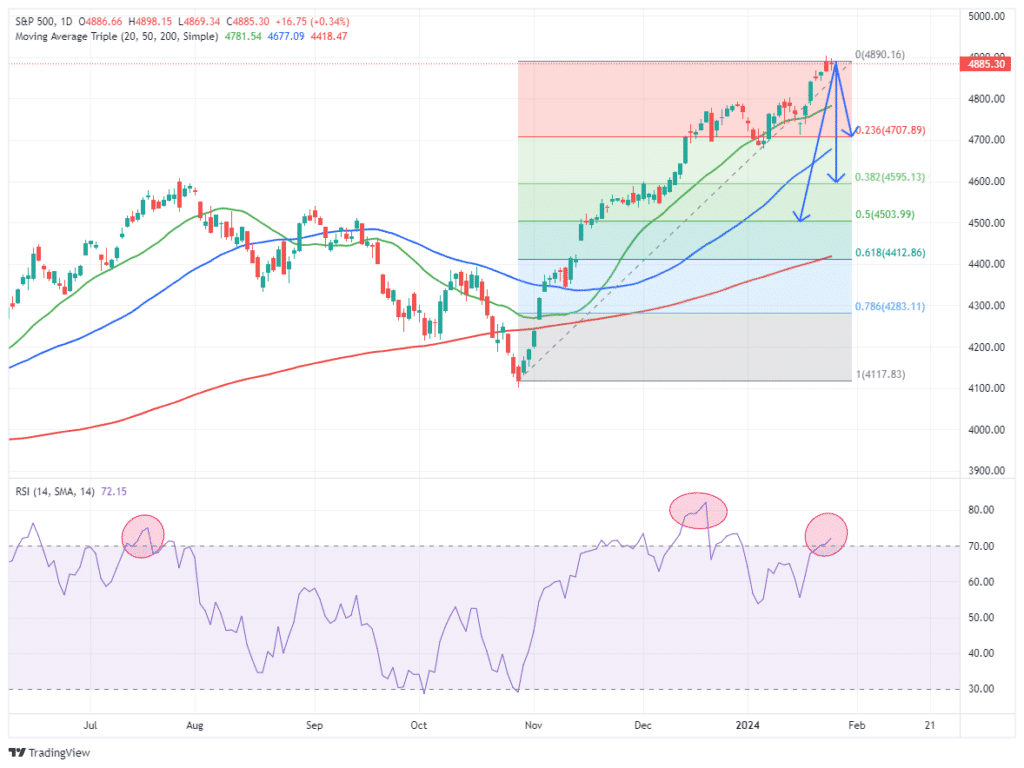

Market Trading Update

The current buying stampede is getting very long by historical standards. As is the case with all things, the market will reverse at some point to alleviate the imbalance between buyers and sellers. Using some basic Fibonacci retracement levels, three key supports are below current price levels.

The first is the 23.6% retracement, coinciding with the 50-DMA. This is the most logical support level for a short-term correction to reduce overbought conditions. If more selling pressure comes to bear, then the 38.2% retracement, which was also the break out of the short-term consolidation heading into December, should provide support. The 50% retracement is the least likely at the current time. However, it will most likely be tested during a deeper correction back to the 200-DMA this summer.

There is no guarantee, of course, that the market will begin a corrective process anytime soon. However, February and March tend to be the weaker months of the strong seasonal period, so a correction during that period would be unsurprising. Maintain equity exposure for now, but taking profits and rebalancing risks will not hurt at these more elevated levels.

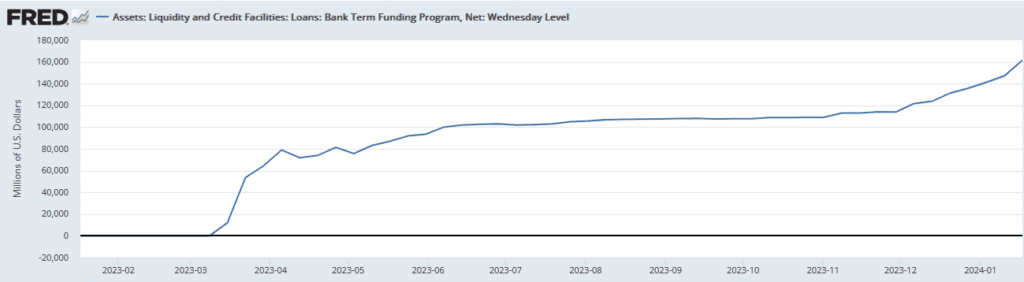

Fed Regional Bank Bailout Ends

In a somewhat surprising move, the Fed said its Bank Term Funding Program (BTFP), which started a year ago in response to the regional banking crisis, will end on March 11. Further, the Fed will immediately raise the interest rate on the program. In Bank Rescue Package Becomes A Profit Center, we wrote the following:

The program’s borrowing rate is now lower than the rate at which they can reinvest those funds at the Federal Reserve. Simply, the Fed is providing banks a risk-free arbitrage.

The gravy train is over for banks ramping up borrowing in the BTFP and using the funds to profit. More importantly, we must consider if the regional banks that the BTFP bailed out will have enough liquidity to operate. To help ensure banks have liquidity, the Fed is trying to remove the stigma of using its discount window borrowing platform. Until today, the program was seen as a last-ditch effort for troubled banks. In fact, showing up on the list of discount note borrowers often meant the bank was in trouble. Consequently, the financial markets would pressure a participating bank’s stock price lower and borrowing costs higher. To confront this problem, the Fed is considering forcing every bank to use the window at least once a year. Therefore, such action would disguise who is using the window to fulfill the Fed’s wishes and who is desperate.

Got Tech?

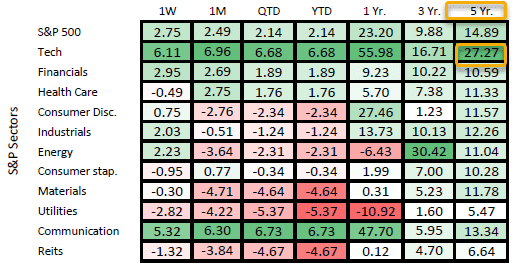

Only one sector (out of the 11) has outperformed the S&P 500 over the last five years. Not only that, it has nearly doubled the five-year performance of the S&P 500. In the previous 1 and 3-year periods, only 3 and 4 sectors, respectively, have beaten the S&P 500. Both instances include the tech sector. Now, let’s hone in on 2024 to date. Tech and communication are the only two sectors beating the market. In fact, despite the S&P 500 being up 2.14%, six sectors are down on the year. Like the high valuations in the tech sector or not, it is the market leader and should hold a sizeable place in a diversified portfolio until it gives up its leadership role.

Tweet of the Day

“Want to have better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

Post Views: 5

2024/01/26