By Lance Roberts | October 21, 2023

Inside This Week’s Bull Bear Report

- Surging Deficits

- How We Are Trading It

- Research Report – The Fed’s Waterloo

- Youtube – Before The Bell

- Market Statistics

- Stock Screens

- Portfolio Trades This Week

Powell Spooks The Market

In yesterday’s Daily Market Commentary, we discussed Powell’s recent statements, which caused the stock and bond markets to fall. To wit:

“Initially, the message from Powell was dovish, confirming what other Fed speakers had said all week. To wit:

‘Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy.‘

However, his hawkish comments spooked the stock and bond markets, suggesting that the inflation risk remains near term until the economy slows.

‘Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy. In any case, inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.‘”

Notably, none of this is “new” news, but traders reacted negatively to the comments. As discussed previously, the Fed needs to keep the prospect of one more rate hike dangling over the market.

“The Fed projecting one last rate increase is also a way of preventing investors from immediately turning to the next question: When will the Fed cut? The risk is that as soon as investors start doing that, rate expectations will come down sharply, and with them, long-term interest rates, providing the economy with a boost the Fed doesn’t want it to receive just yet.“

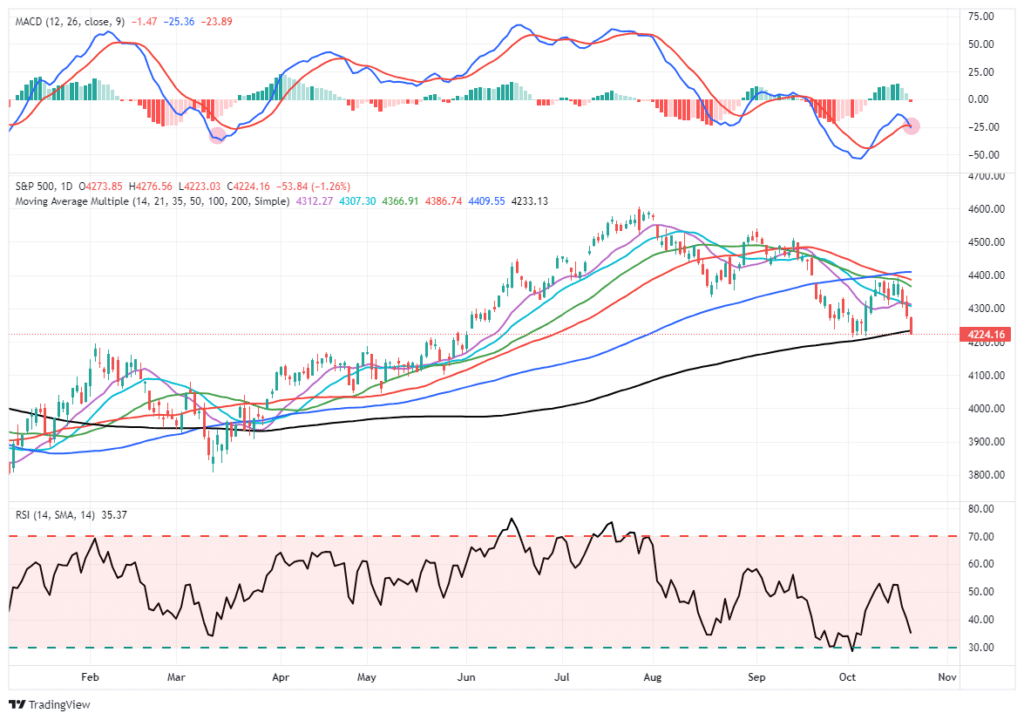

Despite the barrage of speakers this past week suggesting that rate hikes are done, the market focused on the “one more hike” as a reason to unwind equity and bond positioning. As rates rose toward 5%, stocks fell toward support, a potential outcome discussed last week.

“The break of the 20-DMA sets up a potential for a test of 4200. The 200-DMA is important support that should hold heading into next week.”

With Friday’s slide, the market settled on top of the 200-DMA and minor support going back to June. The market must rally on Monday to keep the current trading range intact. A confirmed break of the 200-DMA will suggest near-term downside risk.

Continue to manage risk for now, but be careful making significant changes on an OpEx day. Most likely, much of the noise will filter out by early next week.

Need Help With Your Investing Strategy?

Are you looking for complete financial, insurance, and estate planning? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

Surging Deficits – The Bear’s New Meme

As interest rates rose over the last few months, a new meme for bond bears emerged. With the Fed now most likely done hiking rates, as discussed yesterday, the narrative has changed to increasing debts and deficits.

“The Treasury will have to issue almost $10 trillion in debt over the next 12 months at interest rates of around 5%. Annual interest costs on just this portion of the federal debt—less than one-third of the total debt—will be about $500 billion.

Higher interest rates mean heavier borrowing costs for consumers, businesses, and the Treasury alike. But if the Fed relents on its campaign of interest rate hikes, then inflation will get worse. For inflation and interest rates to both come down, the cause of both problems must be reduced: government deficit spending.

Until that happens, higher interest rates are here to stay.” – Heritage Foundation

The increase in debt, particularly following the recent debt ceiling rise and government shutdown theatrics, has garnered much attention. It even led to Fitch’s downgrade of the U.S. debt rating. The downgrade sent 10-year Treasury bond yields above 4%, causing concern about America’s deteriorating financial condition. The bear’s premise is that radical steps must be taken to curb surging deficits.

Such certainly seems like a logical conclusion. Many “bond bears” suggest that rates must rise as surging deficits lead to more debt issuance. The theory is that at some point, buyers will require a higher yield to buy more debt from the U.S. Such is perfectly logical in a normally functioning bond market where the only players are the individual and institutional bond market players.

All of this occurs in the context of substantial fiscal deficits that show no signs of significant moderation, for reasons that include Congressional dysfunction and the considerable bills associated with past promises and ongoing transitions in response to critical challenges such as climate change. Consequently, the balance of risks suggests more significant fiscal pressures than originally anticipated. This uncertainty also extends to longer-term supply and demand dynamics.

Despite rising interest rates, there is genuine doubt about who will readily absorb the additional supply of government debt associated with surging deficits. The Fed, which was the most reliable buyer for over a decade with a seemingly limitless printing press and little price sensitivity, is now selling bonds, reversing its quantitative easing programs since the financial crisis with quantitative tightening.” – Mohammed El-Erian.

As long as “all else is equal,” rates should rise in such an environment.

All Else Is Not Equal

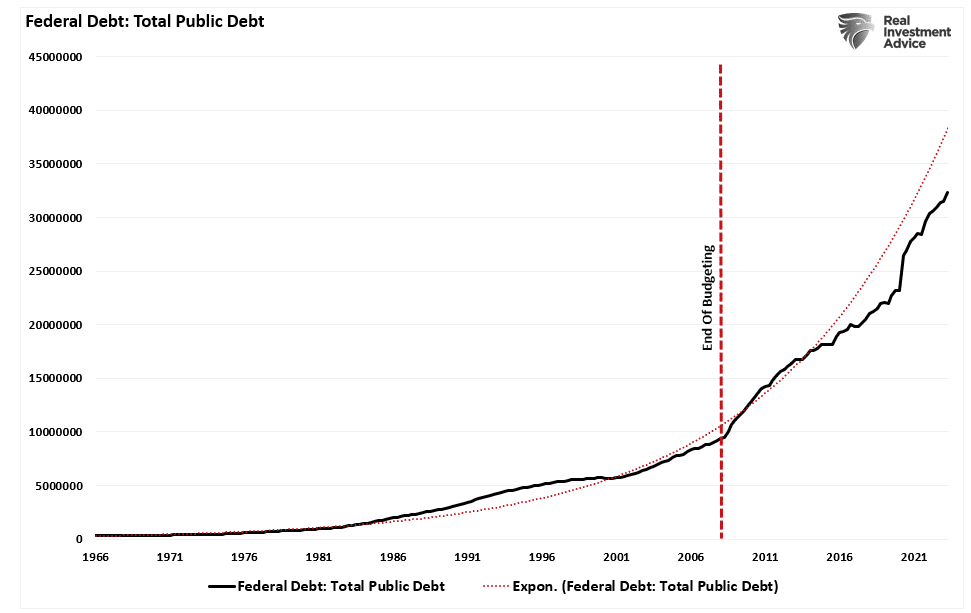

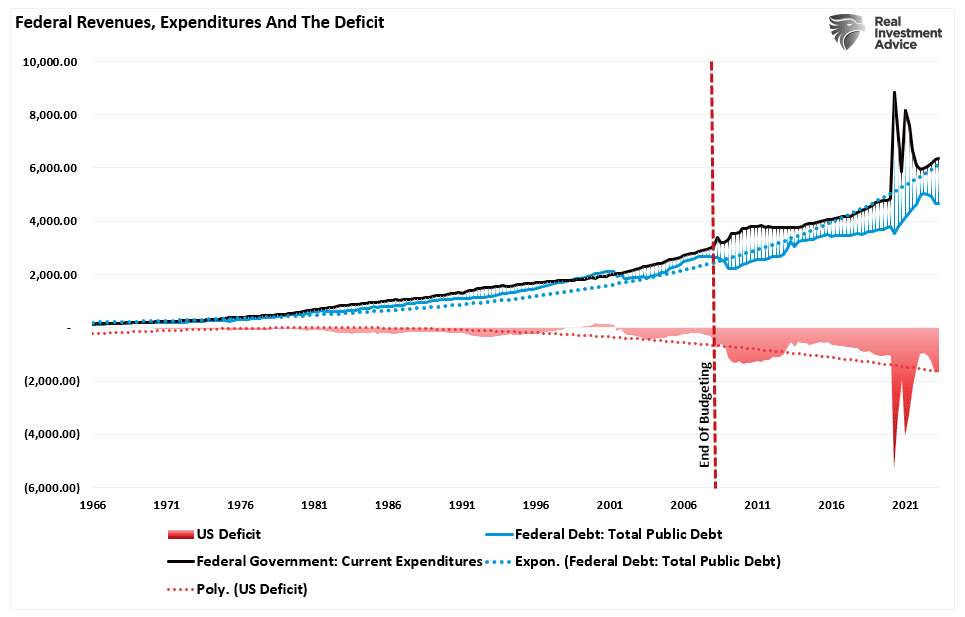

Since 2008, the Government has continued to operate without a budget. Rather than passing a budget each year, a “Continuing Resolution” is passed to fund spending. The problem with using “Continuing Resolutions” is that it uses the previous spending levels and increases that spending by 8%. Such is why, since 2008, debt growth has seemingly accelerated along with surging deficits.

Therefore, given the increases in spending, revenue collections are lagging, leading to increased debt issuance and a trending deficit.

It is worth noting that before 2008, revenues were greater than the running growth trend of public debt. However, post-2008, such has not been the case. Subsequently, the surging deficit continues to accelerate.

As noted above, higher interest rates should be expected in a world where all else is equal.

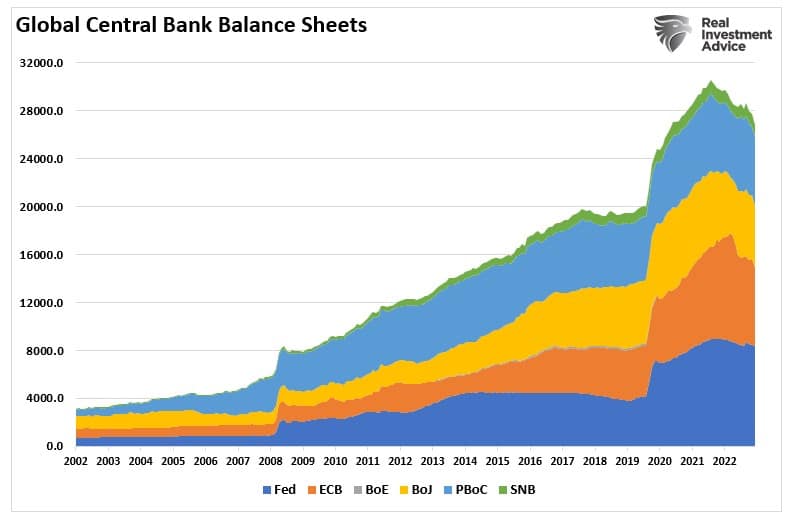

However, all else is not equal in a global economy where government debt yields are controlled by Central Banks colluding with Governments to maintain economic growth, control inflation, and avoid financial crises. Such is evident in the chart below. Since 2008, Central Banks globally have been buyers of global debt.

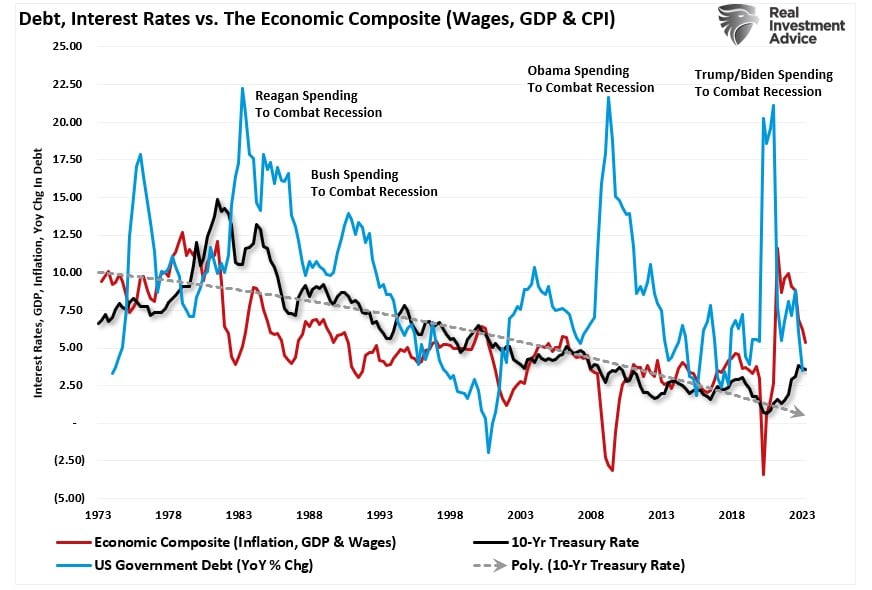

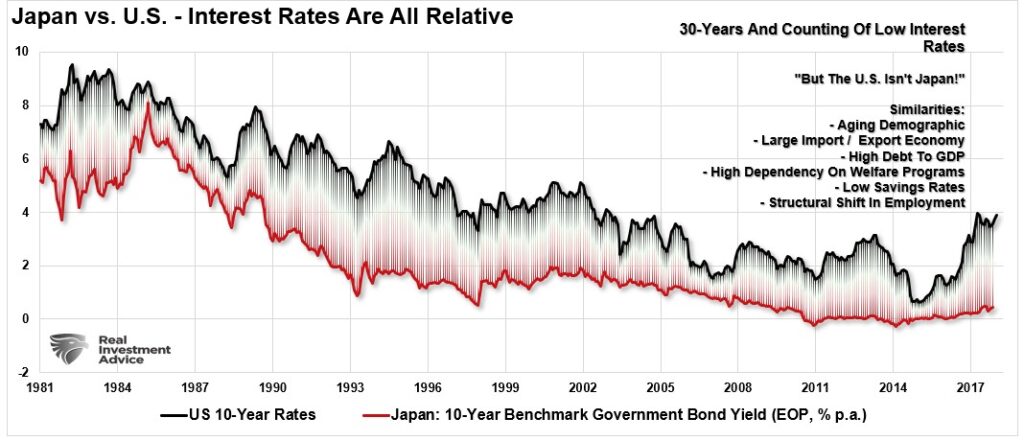

Why have Central Banks engaged in such a massive bond-buying program? To provide liquidity to combat the deflationary forces of debt and keep global economies out of recession. As shown, since 1980, each time the economy was dealt a recessionary blow, the Government responded by increasing debt. However, more debt resulted in a continued decline in inflation, wages, economic growth, and interest rates.

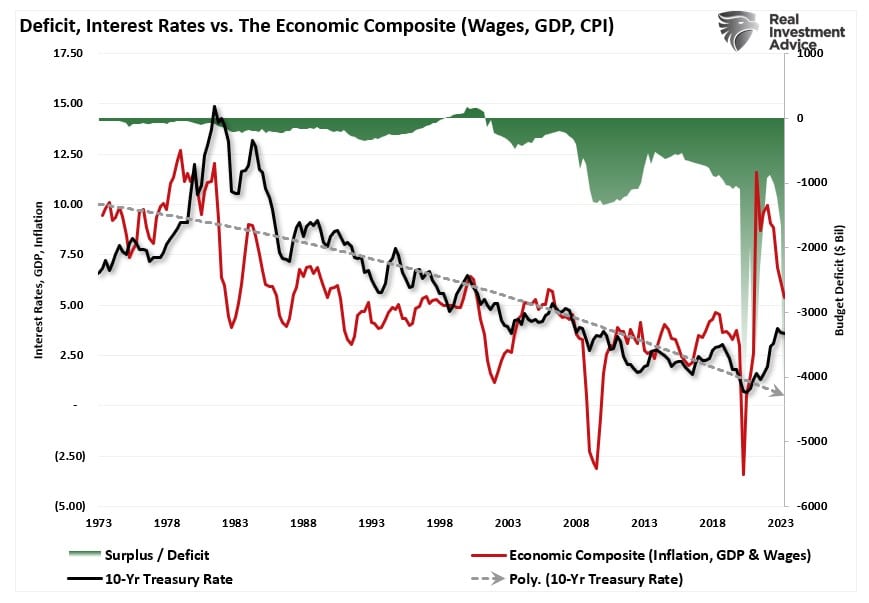

The analysis becomes clearer when viewing the economic composite against the deficit.

The expectation, currently, is that “this time is different.” More debt and surging deficits will lead to higher interest rates. However, since 1980, such has not been the case. (The exception was in 2020, when sending checks to households and shuttering the economy, creating an inflation spike.)

While the bears ignored falling interest rates and surging deficits over the last 40 years, they suggest now there is “no precedent” for our current situation.

There Is No Precedent?

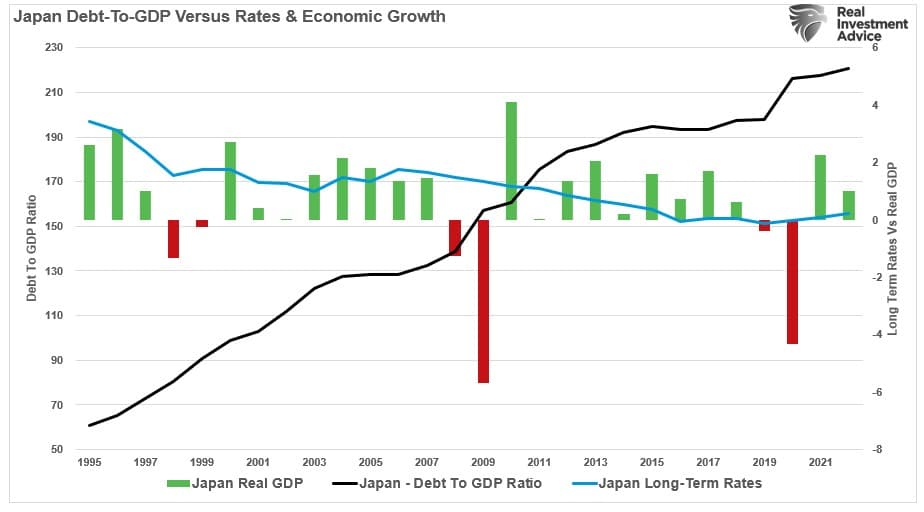

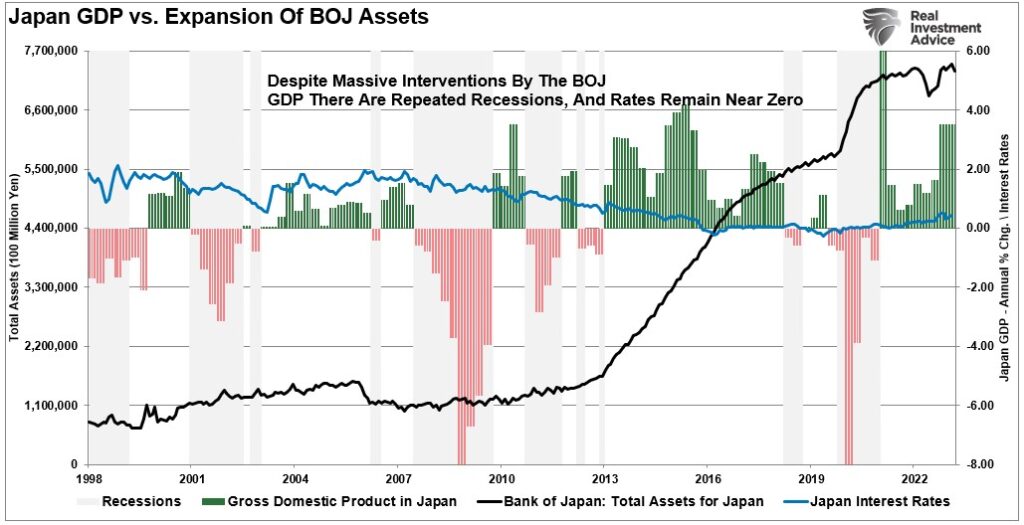

You don’t have to look much further than Japan. Since 2008, Japan has run a massive “quantitative easing” program. That program, on a relative basis, is 3-times more extensive than in the U.S. Not surprisingly, economic prosperity is only marginally higher since the turn of the century. Nonetheless, suppose the bear’s thesis that “no one will buy our debt” is valid. In that case, Japan should be plagued by significantly higher interest rates and inflation, given a debt-GDP ratio of more than 210%.

Surprisingly, there is no evidence of such. Maybe the situation would be markedly different if the Bank of Japan (BOJ) didn’t own most ETF, corporate, and government debt markets. However, such is also why Japan continues to be plagued by rolling recessions, low inflation, and low interest rates. (Japan’s 10-year Treasury rate fell into negative territory for the second time recently.)

We know that interest rates in the U.S. and globally are telling us economic growth will remain weak in the future. While the recent surge in U.S. interest rates resulted from massive one-time liquidity injections, the similarities between the U.S. and Japan remain a stark reminder of where interest rates will ultimately be.

The bear’s premise that “no one will buy our debt” is deeply flawed. In the short term, heavy shorting of bonds and futures are moving the market. Eventually, when a financial or economic crisis assets itself, the Federal Reserve will reassert its force on the markets. This isn’t a good thing, as noted by my colleague Doug Kass:

“The fact is that financial engineering does not help an economy, it probably hurts it. If it helped, after mega-doses of the stuff in every imaginable form, the Japanese economy would be humming. But the Japanese economy is doing the opposite. Japan tried to substitute monetary policy for sound fiscal and economic policy. And the result is terrible.”

Japan is a microcosm of what the U.S. will face in the coming years, and the Federal Reserve will have to intervene.

The Fed Will Intervene

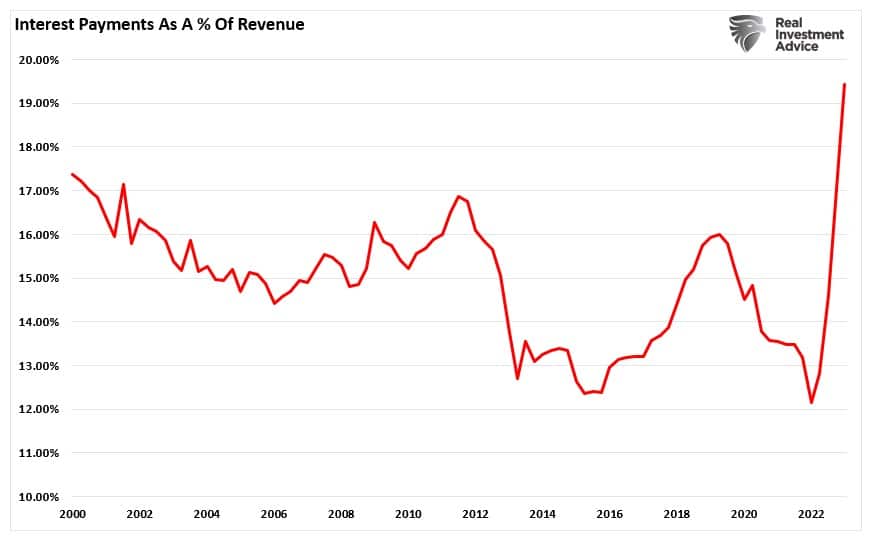

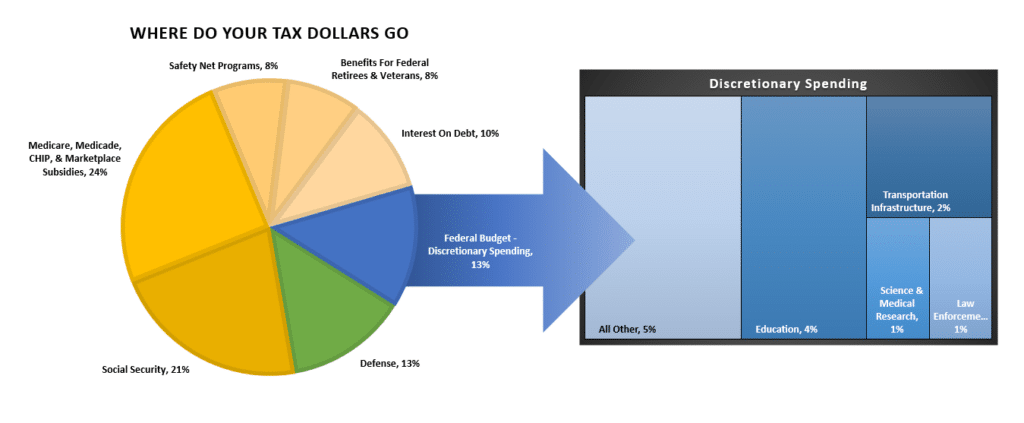

I agree with the bear’s view that higher interest rates are becoming a more significant chunk of the budget. The interest on the existing debt currently absorbs nearly 1/5th of your collected tax revenues. As a result, more debt will need to be issued to fund Government spending, which will continue to support surging deficits.

To better understand that impact, we can use the 2023 data from the Center On Budget Policy to understand the totality of our current spending better.

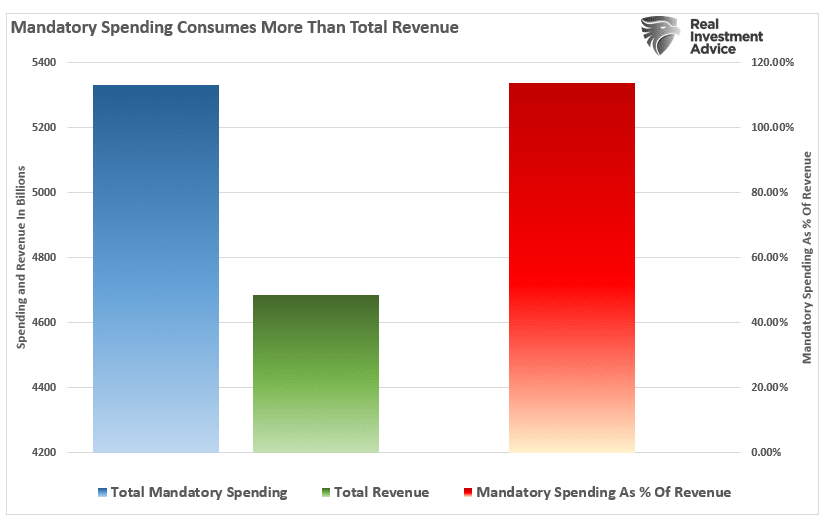

As of the latest annual data, through the end of Q2-2023, the Government spent $6.3 Trillion, of which $5.3 Trillion went to mandatory expenses. In other words, it currently requires 113% of every $1 of revenue to pay for social welfare and interest on the debt. Everything else must come from debt issuance.

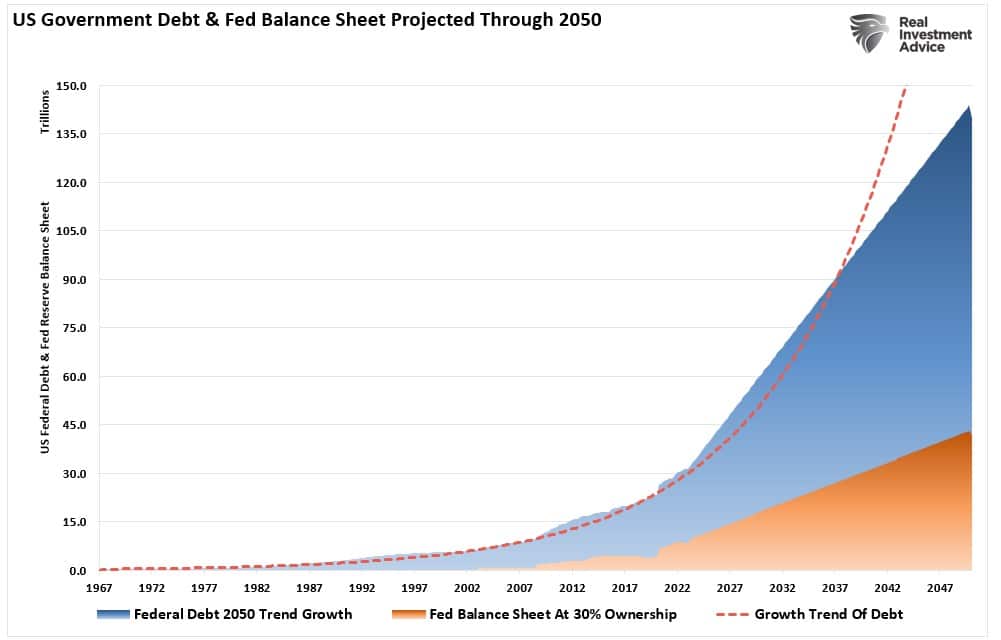

The biggest problem with the “rates must go higher” thesis is the inability of the economy to sustain higher rates due to mounting debt issuance and rising deficits. The Congressional Budget Office recently updated its debt trajectory over the next 30 years. The chart below models that analysis using the growth trend of debt but also factors in the need for the Federal Reserve to monetize nearly 30% of that issuance.

At the current growth rate, the Federal debt load will climb from $32 trillion to roughly $140 trillion by 2050. Concurrently, assuming the Fed continues monetizing 30% of debt issuance, its balance sheet will swell to more than $40 trillion.

Let that sink in for a minute.

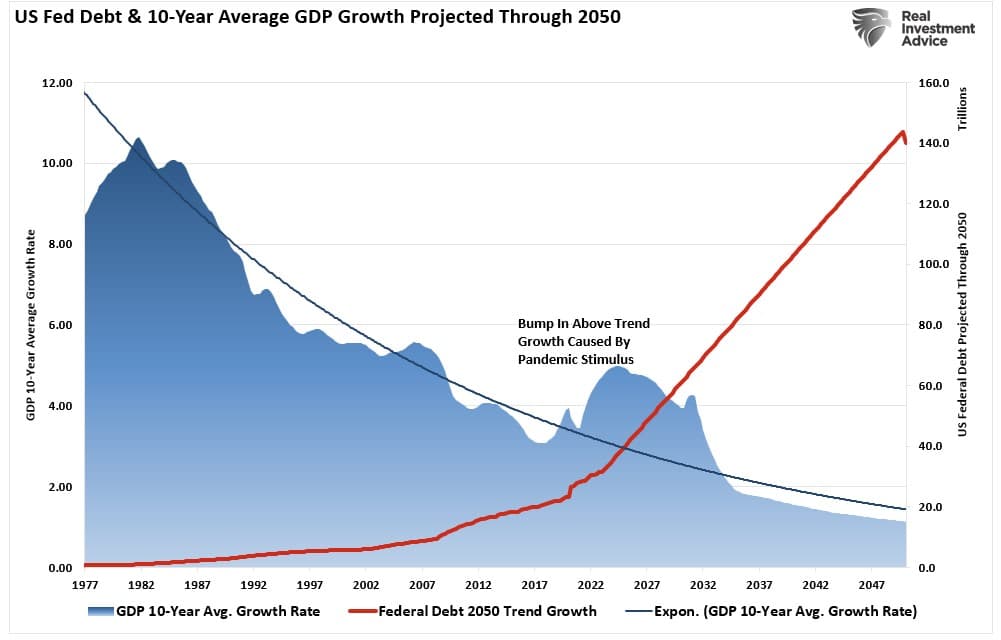

What should not surprise you is that non-productive debt does not create economic growth. Since 1977, the 10-year average GDP growth rate has steadily declined as debt increased. Thus, using the historical growth trend of GDP, the increase in debt will lead to slower economic growth rates in the future.

Conclusion

Therefore, as surging deficits continue, Central Banks will be forced to suppress interest rates to keep borrowing costs down to sustain weak economic growth rates. The problem with the assumption that rates MUST go higher is three-fold:

- All interest rates are relative. The assumption that rates in the U.S. are about to spike higher is likely wrong. Higher yields in U.S. debt attract flows of capital from countries with low to negative yields, which pushes rates lower in the U.S. Given the current push by Central Banks globally to suppress interest rates to keep nascent economic growth going, an eventual zero-yield on U.S. debt is not unrealistic.

- The coming budget deficit balloon. Given Washington’s lack of fiscal policy controls and promises of continued largesse, the budget deficit is set to swell well above $2 Trillion in coming years. This will require more government bond issuance to fund future expenditures, which will be magnified during the next recessionary spat as tax revenue falls.

- Central Banks will continue to buy bonds to maintain the current status quo but will become more aggressive buyers during the next recession. The next QE program by the Fed to offset the next economic downturn will likely be $4 Trillion or more, pushing the 10-year yield toward zero.

Again, if you need a road map of how this ends with lower rates, look at Japan.

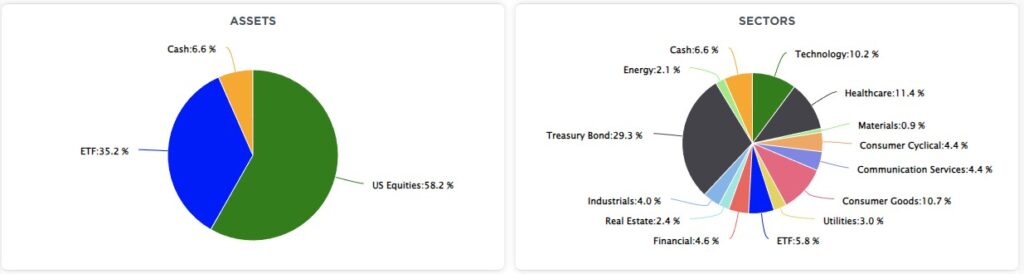

How We Are Trading It

So far, despite weak rally attempts, the summer weakness that started in July remains. The market is oversold, and the recent selling pressure across all assets is nearing exhaustion. If you are worried about what is happening overseas or with the Fed and the economy, use rallies to reduce risk at better price levels.

At the end of the month, the markets will again have to digest commentary from Jerome Powell at the next FOMC meeting. However, its message will remain the same. The market will also have much to digest in next week’s earnings as a large chunk of the S&P 500 index reports results. In November, the window for stock buybacks will reopen, providing some short-term upside catalysts. Therefore, if you want to reduce risk, do so as the market rallies.

As we noted last week, periods like this are never fun, but the market never goes straight up or down. However, the psychological strain during periods of market weakness leads to a host of behavioral mistakes that lead to longer-term underperformance. This period will pass, and the next bullish cycle will begin. Sometimes, turning off the television can help reduce the emotional toll of headline news.

See you next week.

Research Report

Subscribe To “Before The Bell” For Daily Trading Updates

We have set up a separate channel JUST for our short daily market updates. Please subscribe to THIS CHANNEL to receive daily notifications before the market opens.

Click Here And Then Click The SUBSCRIBE Button

Subscribe To Our YouTube Channel To Get Notified Of All Our Videos

Bull Bear Report Market Statistics & Screens

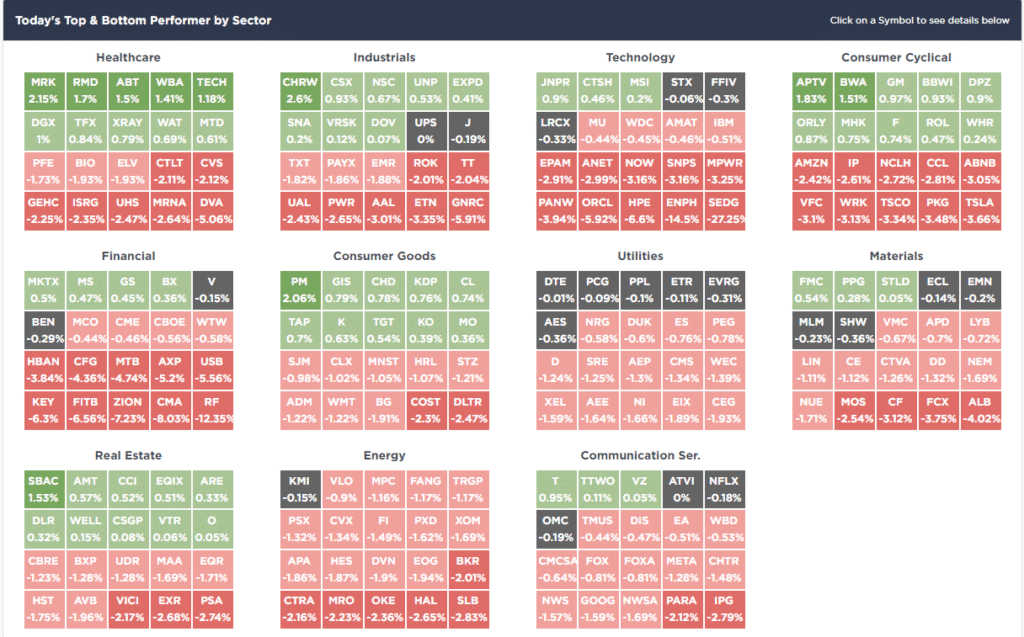

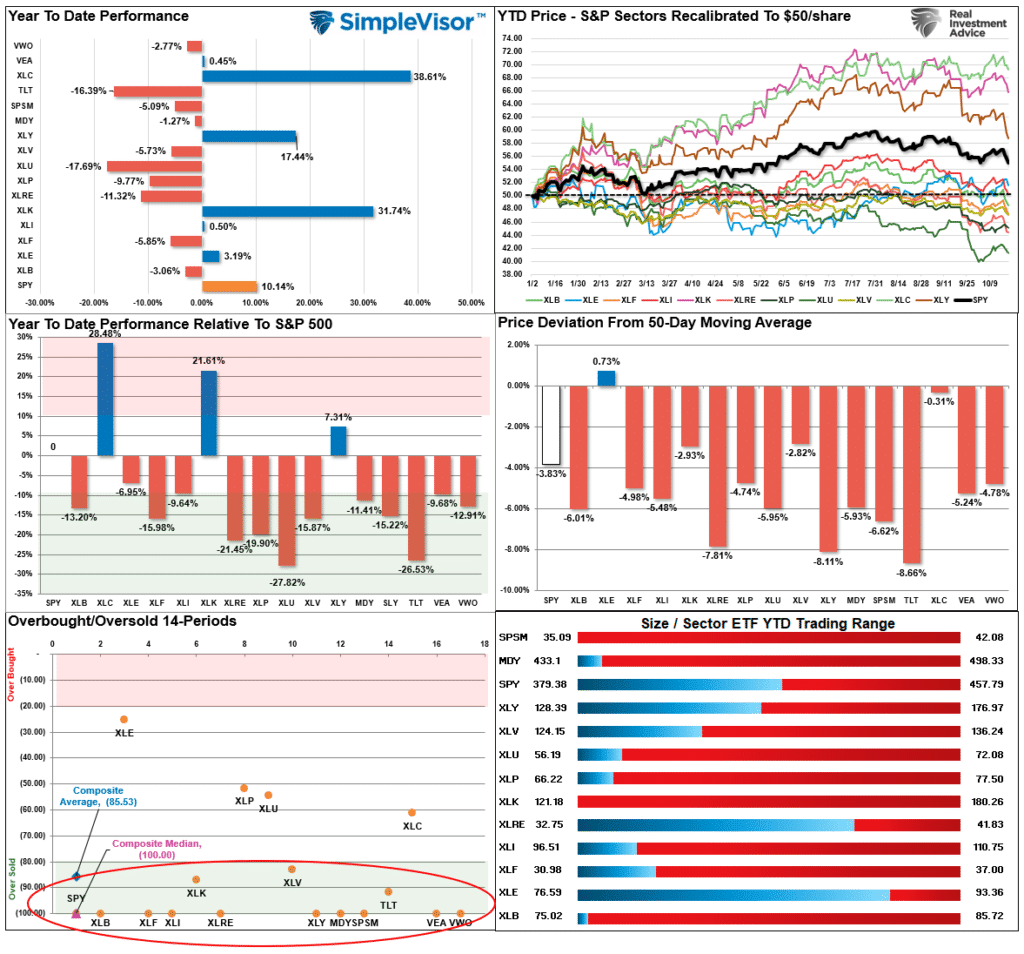

SimpleVisor Top & Bottom Performers By Sector

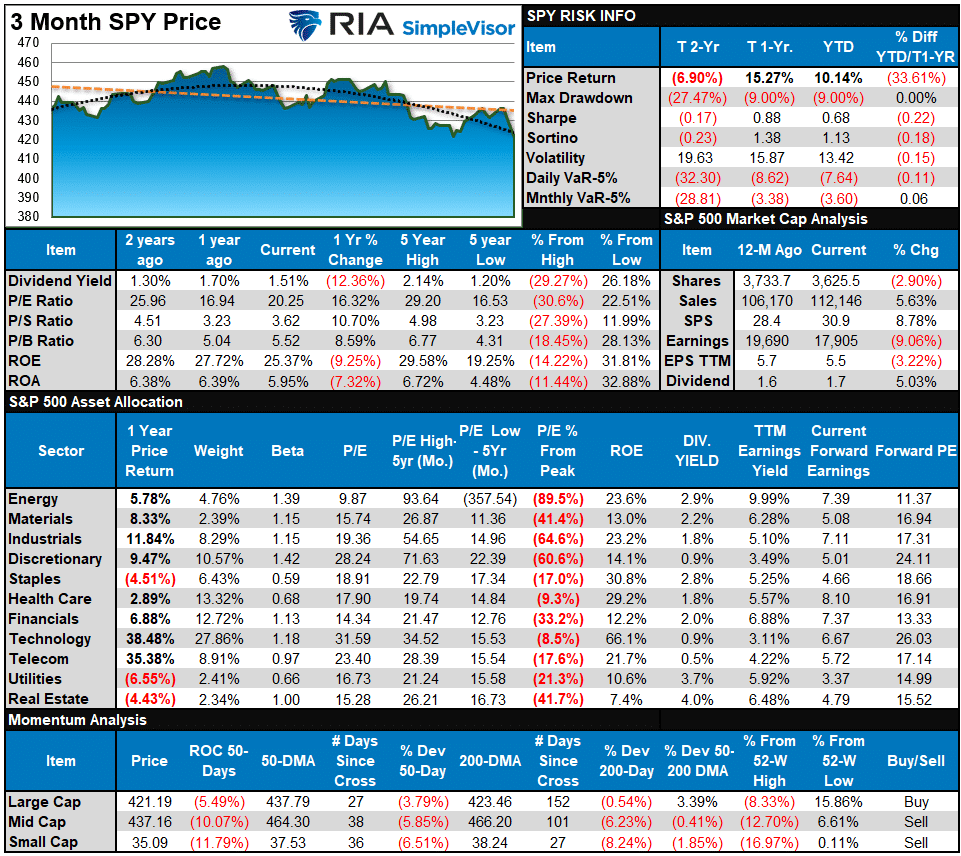

S&P 500 Weekly Tear Sheet

Relative Performance Analysis

With only the exception of Energy, which has found buyers due to the Israel conflict, the market sold off decently last week. On a very short-term basis, the markets are oversold and should rally next week. However, given the weakness on Friday, we could see some additional selling pressure on Monday. One thing to note is the deep deviation of the vast majority of sectors below their respective 50-day moving averages. Such deviations are unsustainable and suggest a counter-trend rally is likely.

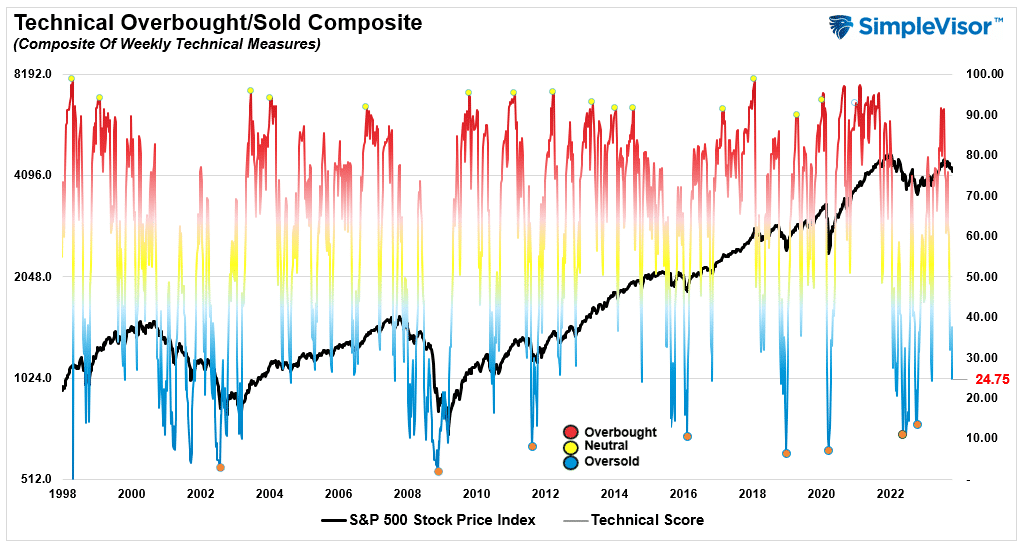

Technical Composite

The technical overbought/sold gauge comprises several price indicators (R.S.I., Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The market peaks when those readings are 80 or above, suggesting prudent profit-taking and risk management. The best buying opportunities exist when those readings are 20 or below.

The current reading is 24.75 out of a possible 100.

Portfolio Positioning “Fear / Greed” Gauge

The “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, the more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0 to 100. It is a rarity that it reaches levels above 90. The current reading is 46.22 out of a possible 100.

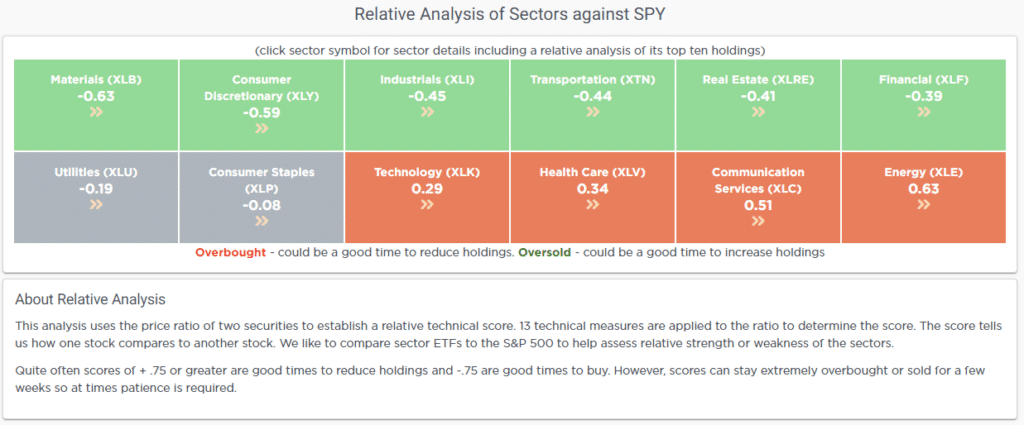

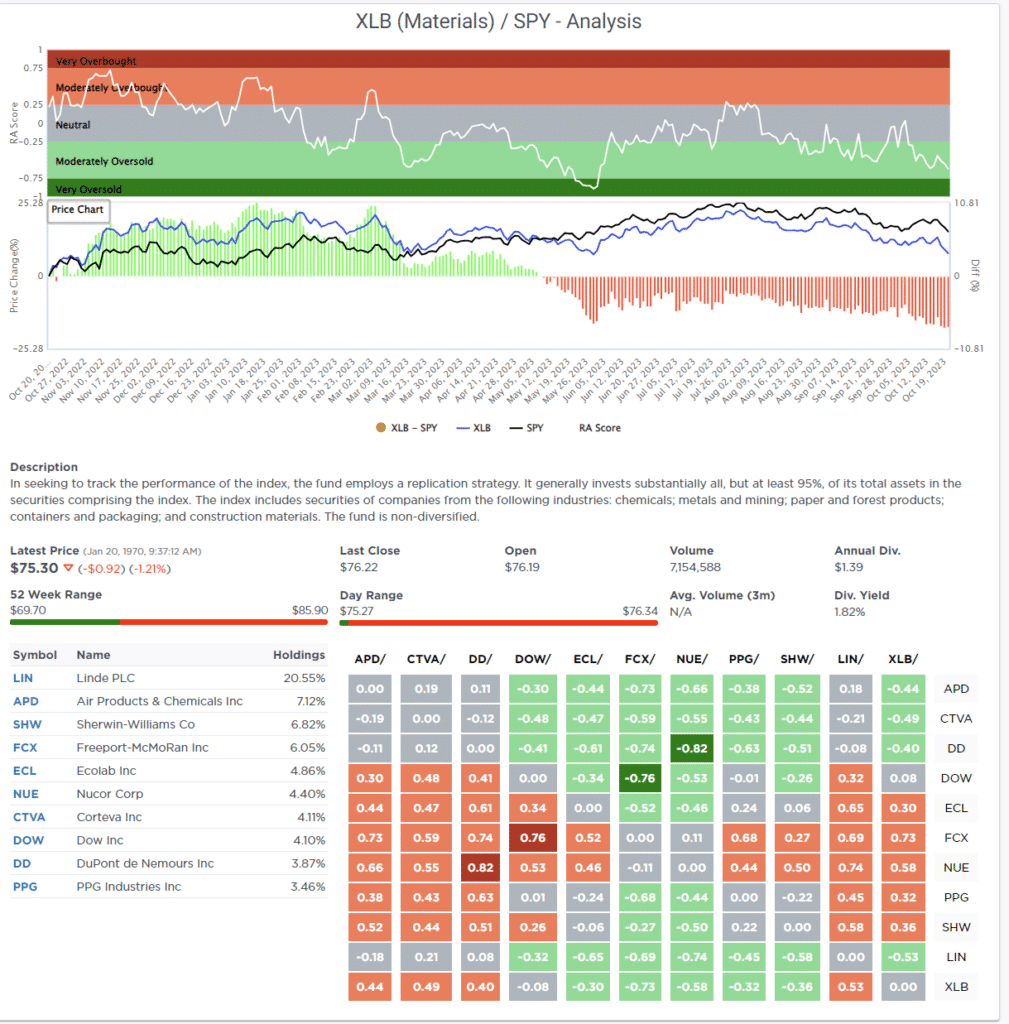

Relative Sector Analysis

Most Oversold Sector Analysis

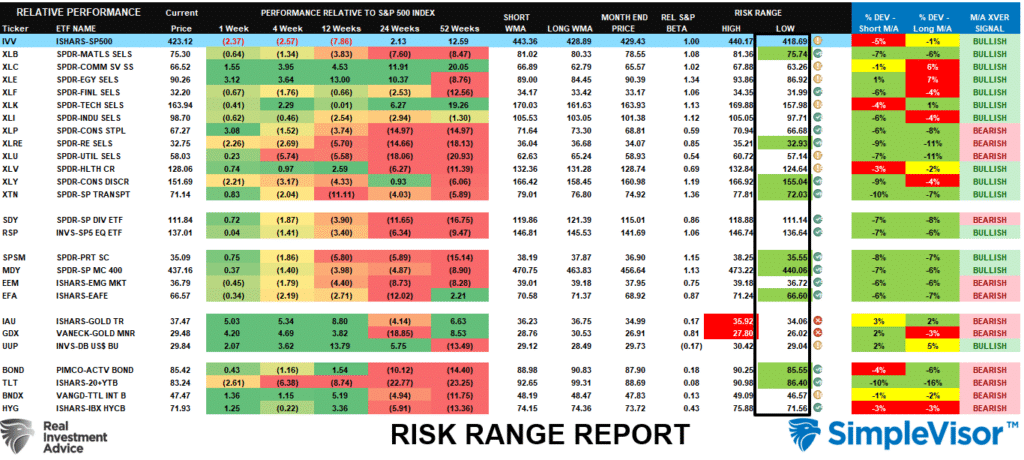

Sector Model Analysis & Risk Ranges

How To Read This Table

- The table compares the relative performance of each sector and market to the S&P 500 index.

- “MA XVER” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

- The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

- The table shows the price deviation above and below the weekly moving averages.

The Israel conflict has sent Gold and Gold Miners into more extreme overbought conditions. Consider taking profits, particularly if there is a break in the hostilities. Conversely, Materials, Real Estate, Discretionary, and Transportation, and Bonds are deeply oversold and should see buying near-term, particularly as we head into year-end and portfolio managers need to rebalance holdings.

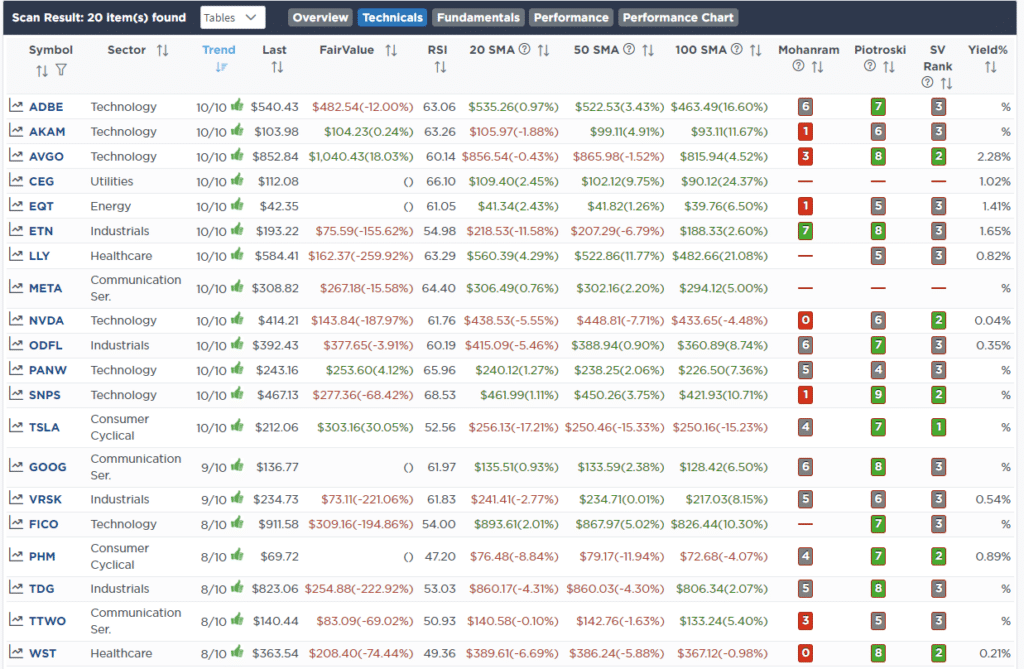

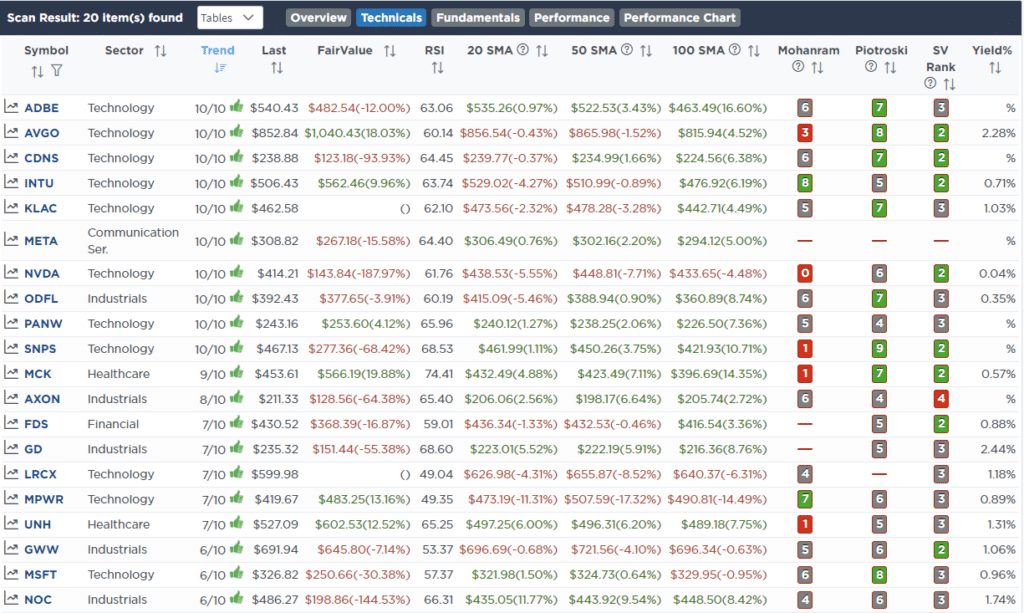

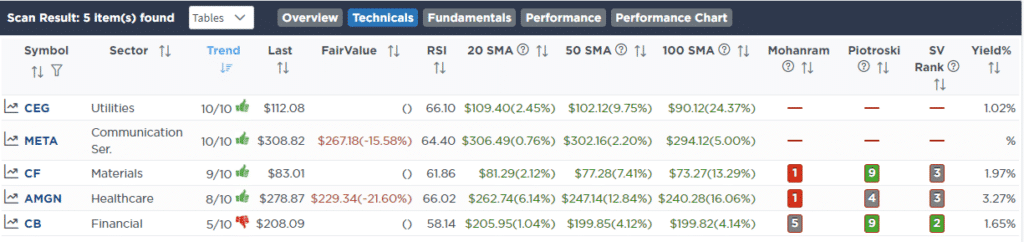

Weekly SimpleVisor Stock Screens

We provide three stock screens each week from SimpleVisor.

This week, we are searching for the Top 20:

- Relative Strength Stocks

- Momentum Stocks

- Fundamental & Technical Strength

(Click Images To Enlarge)

R.S.I. Screen

Momentum Screen

Fundamental & Technical Strength

SimpleVisor Portfolio Changes

We post all of our portfolio changes as they occur at SimpleVisor:

No Trades This Week

Lance Roberts, C.I.O.

Have a great week!

Lance Roberts is a Chief Portfolio Strategist/Economist for RIA Advisors. He is also the host of “The Lance Roberts Podcast” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter, Linked-In and YouTube

Customer Relationship Summary (Form CRS)