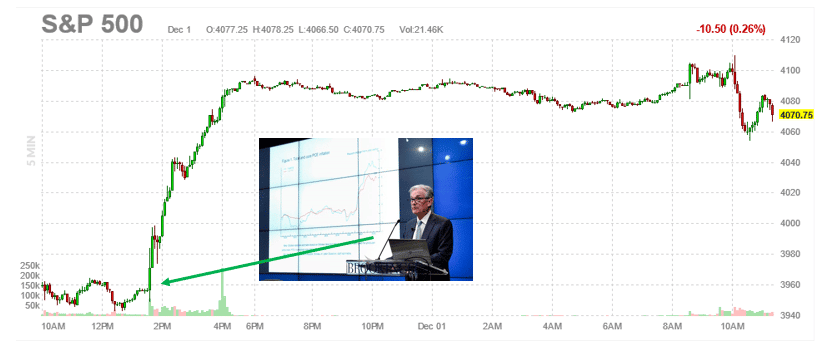

Stocks shot higher on Wednesday after Chair Powell’s speech. Looking for good news, the bulls heard the Fed is moderating its policy stance. Further, it appears the Fed is now concerned about over-tightening. Powell’s comments were very similar to previous comments of many Fed speakers. Wall Street Journal reporter Nick Timiraos followed Jerome Powell’s “bullish” speech with words of caution.

Nick Timiraos makes two critical points. For starters, he quotes Powell. “Officials seek to reduce inflation by slowing the economy through tighter financial conditions—such as higher borrowing costs, lower stock prices, and a stronger dollar—which typically curb demand.” Timiraos follows up on Twitter- “Powell may not have intended to ease financial conditions, but his comments about avoiding unnecessary weakness overshadowed his concerns about labor-market imbalances.” The stock and bond market rallies are not conducive to fighting inflation and likely not the result Powell wants. This has potentially bearish implications for how Powell addresses reporters after the December 14th Fed meeting.

Second, Powell blames early retirements and deaths due to covid and reduced immigration for making the job market tighter than normal. As a result, Timiraos tweets that rates may stay higher for longer and the “(Fed’s) ability and room to ease is less than before since inflation will return quickly in an undersupplied labor market.” Translation- it may take longer for the Fed to ease, and the rate of easing may not be as aggressive as in the past.

What To Watch Today

Economy

- 8:30 a.m. ET: Change in Nonfarm Payrolls, November (200,000 expected, 216,000 prior)

- 8:30 a.m. ET: Unemployment Rate, November (3.7% expected, 3.7% prior)

- 8:30 a.m. ET: Average Hourly Earnings, month-over-month, November (0.3% expected, 0.4% prior)

- 8:30 a.m. ET: Average Hourly Earnings, year-over-year, November (4.6% expected, 4.7% prior)

- 8:30 a.m. ET: Average Weekly Hours All Employees, November (34.5 expected, 34.5 prior)

- 8:30 a.m. ET: Labor Force Participation Rate, November (62.3% expected, 62.3% prior)

- 8:30 a.m. ET: Underemployment Rate, November (60.8% prior)

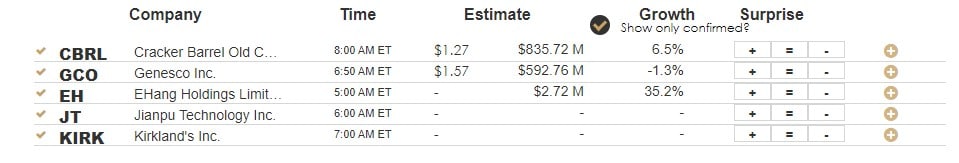

Earnings

Market Trading Update

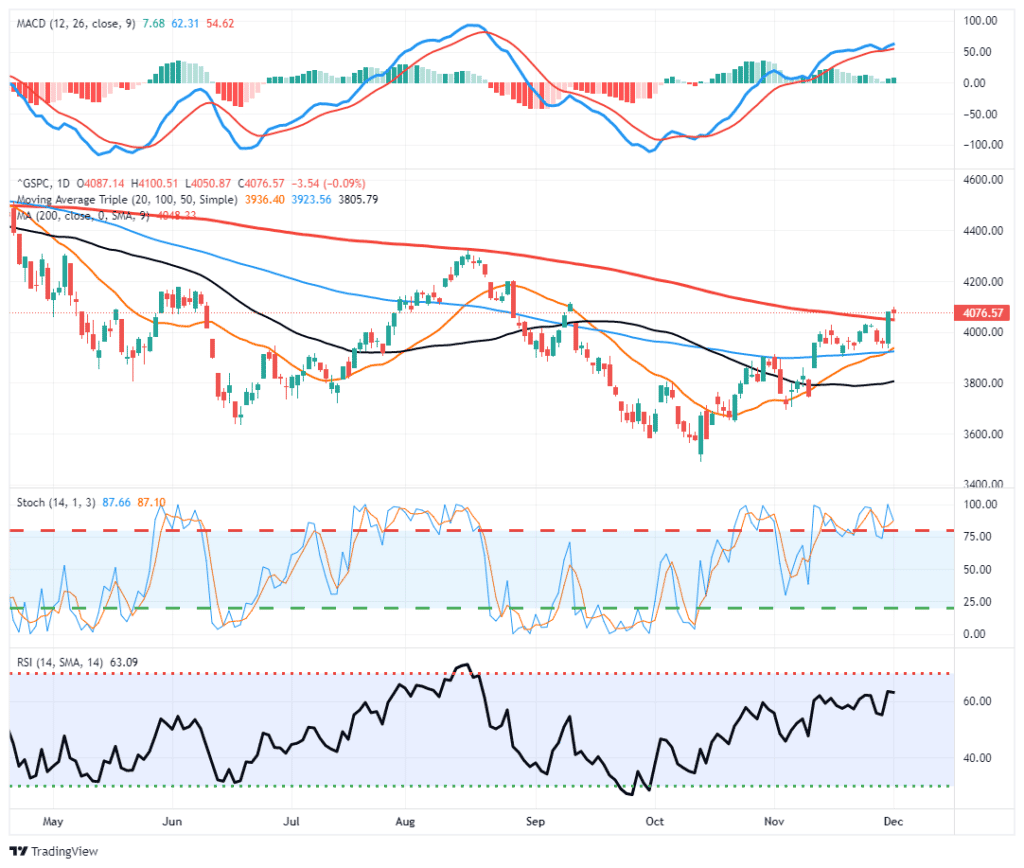

Following Wednesday’s 3.1% surge, the market flirted around breakeven yesterday with a rotation out of yesterday’s big gainers. The big winner yesterday was long-duration bonds, with the 10-year Treasury Yield falling by 4.7% to 3.53%. That yield is down sharply from the 4.25% reading just over a month ago, suggesting investors are starting to realize the risk of a recession is increasing.

Not much changed from yesterday’s market action. The MACD buy signal remains intact, suggesting the bullish rally still has room to run. The bullish upward trend keeps the trading range bound fairly tightly above the 20-dma. On a more bullish note, the 20-dma has crossed above the 100-dma, AND the 50-dma has started to turn higher. However, we have seen these bullish improvements previously, only to ultimately be disappointed. Therefore, we suggest trading this rally cautiously and taking profits as needed.

Misleading Economic Data

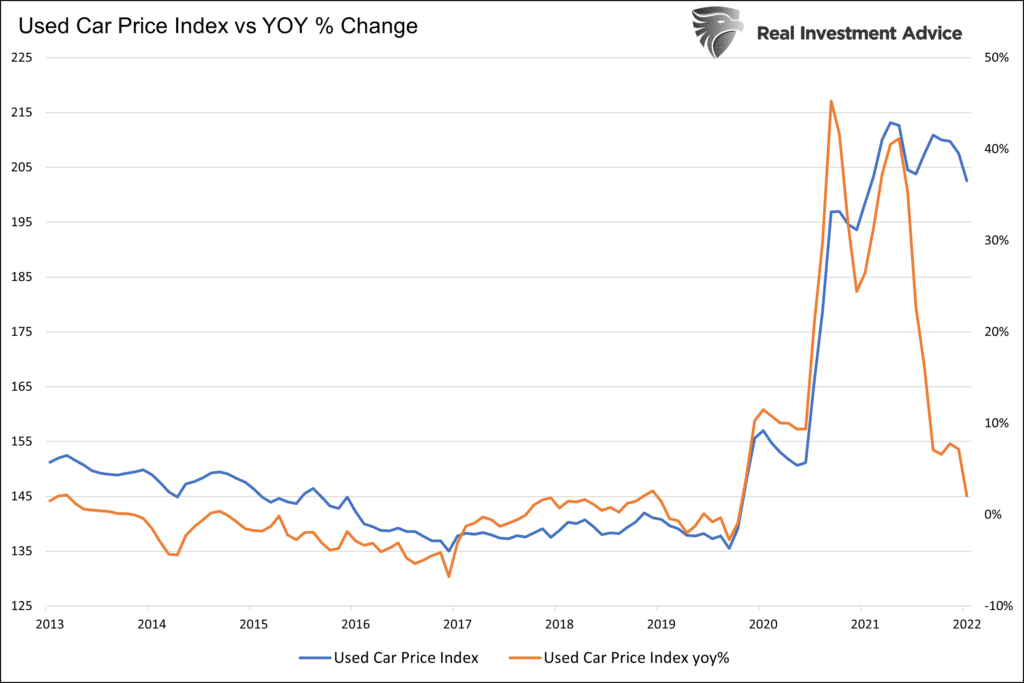

Math and data presentation can make measuring economic normalization very difficult. The culprit is the excessive fiscal and monetary actions in 2020 and 2021 and the economic data anomalies they created. We look at used car prices to help appreciate the problems investors are encountering.

If you only look at the orange line showing the year-over-year change in used car prices, you may proclaim that prices of used cars have normalized. Such a statement, however, would be grossly misleading. The blue line shows the used car price index is still well above the trend of the last ten years. While used car prices are not adding to inflation anymore, they are still almost 50% above where they would have been in a more normal economic cycle. Simply, a significant price correction is required to normalize car prices back to their long-term average.

Are Rates High Enough For Powell

Continuing with Powell’s speech is another comment he made about interest rates.

For starters, we need to raise interest rates to a level that is sufficiently restrictive to return inflation to 2 percent. There is considerable uncertainty about what rate will be sufficient, although there is no doubt that we have made substantial progress, raising our target range for the federal funds rate by 3.75 percentage points since March. As our last postmeeting statement indicates, we anticipate that ongoing increases will be appropriate. It seems to me likely that the ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting and Summary of Economic Projections.

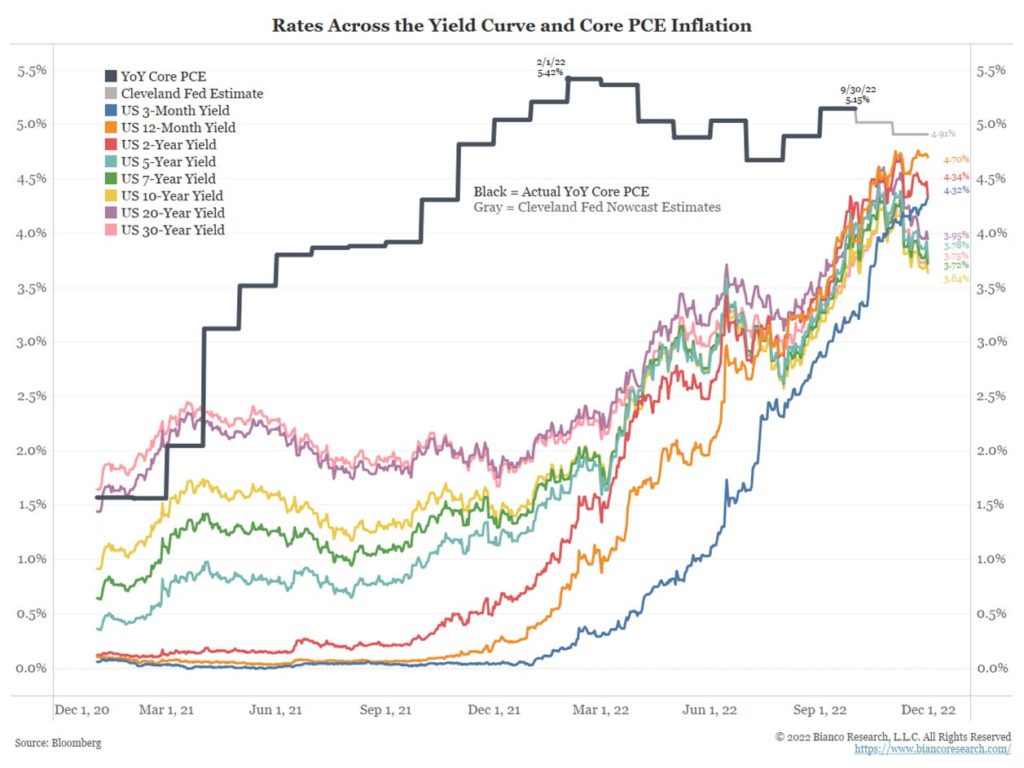

What is sufficiently restrictive? In the past, Powell has alluded to real rates (rates less inflation) that are significantly positive. Does that mean interest rates are .5% or 1% or more above PCE? We do not know. But, as Jim Bianco points out below, real rates are still negative and will likely stay negative for at least two more months. The question facing the Fed is how much they have to raise rates and how much inflation will fall in the coming months. The next few months of inflation data will be critical to assessing when the Fed will stop hiking rates.

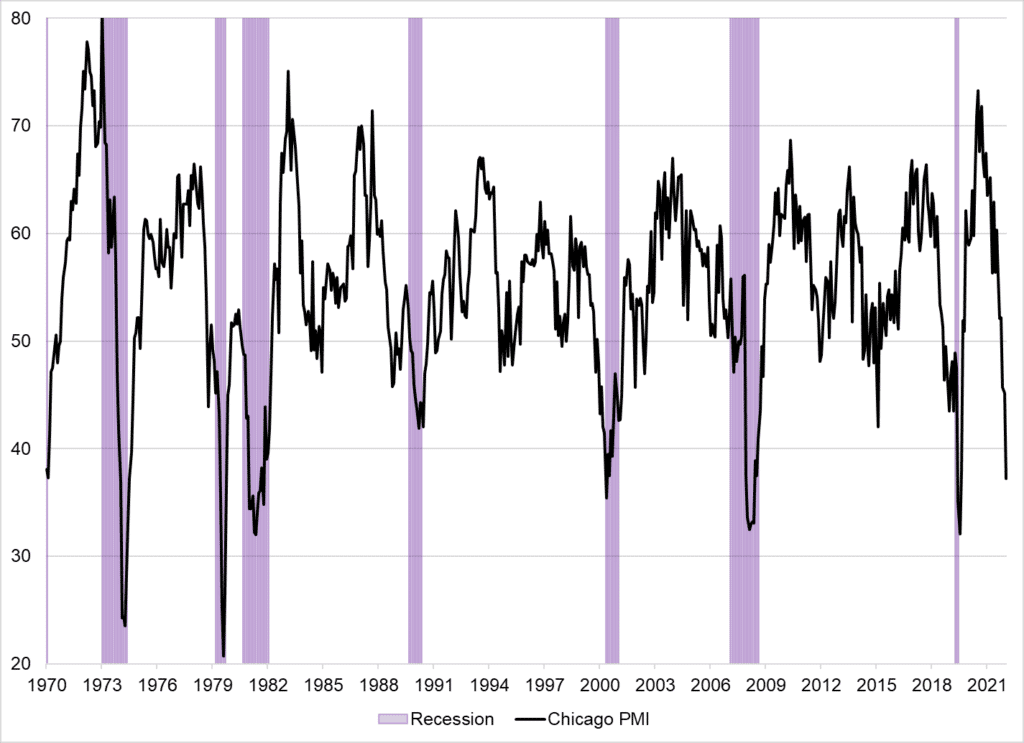

Eight for Eight on Recession Calls

In Tuesday’s commentary, we state: Since 1965, the 10yr-3m curve has inverted eight times, and a recession followed in all cases. The graph below shows that the Chicago PMI also has a perfect track record of predicting recessions. The last time the Chicago PMI index dipped below 40, as it did yesterday, a recession began in short order. Once again, we must ask, is time different?

Tweet of the Day

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.